What 10 Years of Investing in Mutual Funds Taught Me (The Good, The Bad & The Boring)

A decade-long journey with SIPs, mistakes, and quiet wins

It started with ₹2,000 a month.

That’s all I could set aside when I bought my first mutual fund. I didn’t know much—just that it was better than letting my money sit in a savings account. I’d read a blog, saw the words "power of compounding," and thought, Why not?

Now, over 10 years later, I’ve got a bit more to say.

This isn’t a success story with crores made overnight. It’s slower, messier—and way more real. If you’re thinking about mutual funds or just starting out, here’s what the past decade taught me.

1. SIPs Are Boring. And That’s the Point.

I’ve been doing SIPs (Systematic Investment Plans) almost every month since I started. It’s kind of like brushing your teeth—nothing exciting, but you feel weird when you skip it.

At first, I’d check my portfolio every few days. “Has it gone up? Down? Is this working?”

Then life happened. Work got busier. I forgot about the market. But I kept the SIPs going in the background.

That boring consistency is the only reason my money grew.

2. The Best Returns Came From Doing... Nothing

I tried timing the market once. Big mistake.

In 2016, I pulled out of a midcap fund because “things looked uncertain.” The fund went on to rally 40% the next year. I re-entered—late, of course—and missed the gains.

After that, I stopped playing fund manager. I picked a few solid funds and left them alone. That’s when the magic actually happened.

Turns out, the less I interfered, the better things got.

3. Don’t Chase “Top-Performing” Funds

I used to scroll through those “Top 10 Mutual Funds to Invest in This Year” lists. I’d get tempted, switch funds, try to catch the wave.

What I learned: Past performance is a terrible predictor.

A star fund one year can flop the next. Chasing returns is like chasing a bus after it’s already left.

Now, I stick to consistent performers with a long track record and low expense ratio. Nothing flashy. Just steady.

4. Direct Plans > Regular Plans

This one took me a while to learn.

For years, I was investing through a distributor. Then I found out about direct plans—same fund, lower cost, higher returns over time.

Switching to direct plans gave my returns a quiet boost. Nothing dramatic, but over 10 years, that 0.5–1% difference adds up.

5. Tax Impacts Everything

When I sold some units to fund a trip, I got slapped with capital gains tax. I hadn’t factored it in.

Now I’m more careful. I keep an eye on holding periods (1 year for equity, 3 years for debt) and use indexation benefits where possible.

It’s not fun stuff, but taxes matter. Especially when you’re looking to withdraw.

6. It’s Not Just About Returns

One of my funds underperformed for a couple of years. I thought about switching, but held on. Later, it bounced back.

I’ve realized that peace of mind matters more than squeezing out a few extra percent. If a fund helps you sleep at night, it’s doing its job.

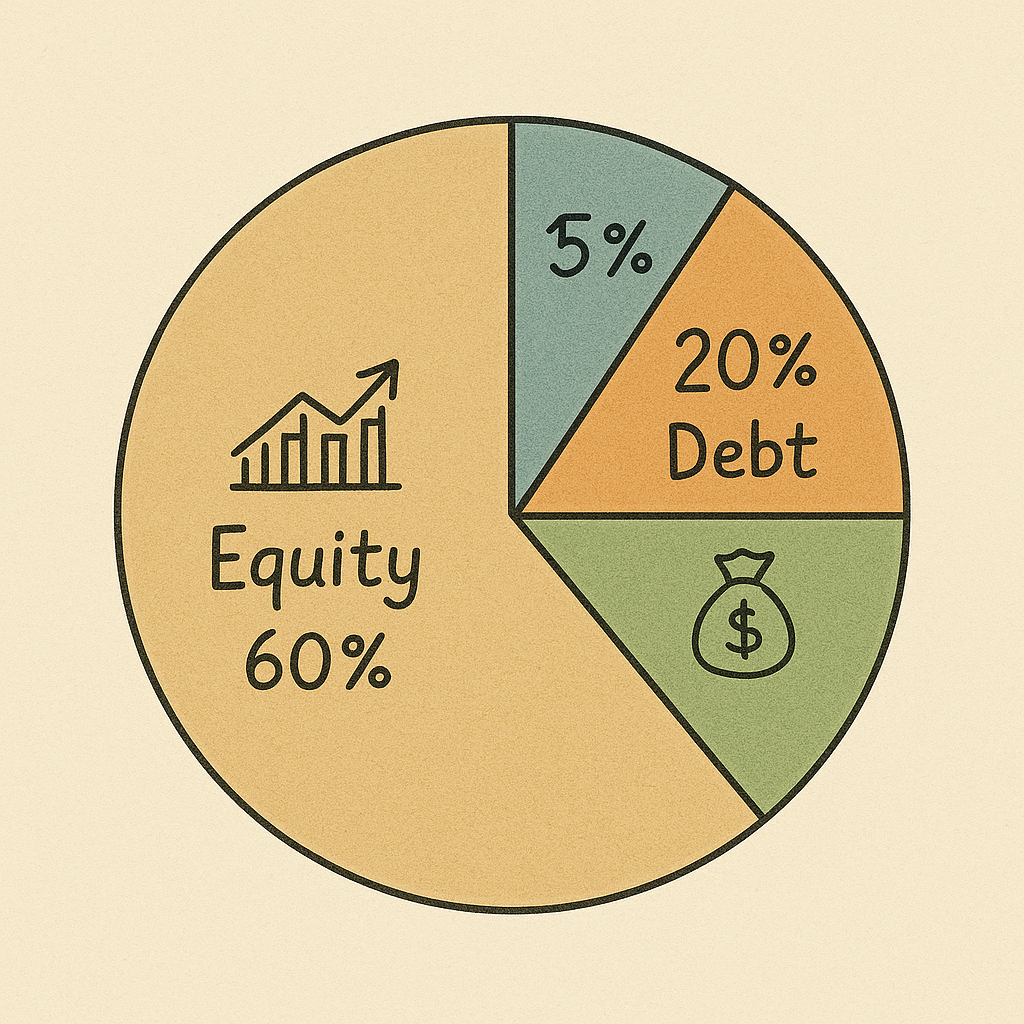

My Portfolio Today

Here’s a rough breakdown of where I’m invested now:

- 60% in equity funds (large-cap, flexi-cap, and index)

- 20% in debt funds (for stability)

- 10% in international funds (for diversification)

- 10% in liquid/emergency funds

Nothing exotic. Just simple stuff that I understand.

Final Thoughts

I’m not a financial advisor. I’ve made mistakes, missed opportunities, and learned slowly. But here’s what I know for sure:

- Start early—even small SIPs grow

- Stay consistent—ignore the noise

- Keep it simple—don’t overthink it

- Review, but don’t obsess

If you’re new to mutual funds, you don’t need to be an expert. Just get started, stay curious, and give your money the time to work.

It won’t make you rich overnight. But over 10 years?

You’ll be surprised at how far you’ve come.

P.S. If you’ve been investing for a while too, I’d love to hear your experience. What did you learn the hard way?