Best Discount Broker in India: Top Picks for 2024

Unlock essential trading and investment strategies tailored for Indian retail investors. Ready to elevate your skills? Discover actionable tips and insights now.

Introduction

Brokerage fees play a crucial role in determining your overall trading profits. Even a difference of a few rupees per trade can significantly impact an investor's returns over time—especially for frequent traders. For example, if an active trader makes 100 trades per month, a brokerage difference of ₹10 per trade results in ₹1,000 extra every month, which adds up over the course of a year.

Choosing the best discount broker in India is essential to maximize investment returns. Discount brokers like Zerodha, Upstox, and Angel One have disrupted the market by offering attractive, low-cost trading platforms. Zerodha, for instance, pioneered the flat ₹20/trade fee model, enabling retail investors to minimize costs. Upstox, on the other hand, frequently offers zero brokerage on equity delivery as a promotional incentive, appealing to cost-conscious beginners.

The landscape has become increasingly complex with so many discount brokers now providing a variety of features such as robust mobile apps, advanced analytics, and educational resources. While Zerodha’s Kite delivers a streamlined, user-friendly interface, Fyers is popular among technical analysts for its comprehensive charting tools. These subtle distinctions make broker selection more nuanced, as traders must weigh technology, customer support, and pricing models suited to their specific needs.

This guide aims to simplify the broker selection process by breaking down the top discount brokers in India for 2024. You’ll find side-by-side comparisons of key offerings, helping you identify the right fit based on trading style and objectives. By reviewing concrete scenarios and real broker features, readers will be equipped to make an informed, cost-effective trading decision.

Discount Brokers in India: What, Why & Who

What Are Discount Brokers and Why Are They Trending?

Discount brokers have disrupted the Indian financial landscape by providing cost-effective solutions for traders and investors. Unlike traditional full-service brokers who offer a wide range of advisory and research services at higher costs, discount brokers focus on essential online trading capabilities at significantly lower fees.

For instance, platforms like Zerodha, 5paisa, and Upstox have become immensely popular for charging as little as Rs. 20 per executed order or even zero brokerage on equity delivery trades. Their robust mobile and web trading interfaces have made investing more accessible for India's growing digital-savvy audience.

The appeal lies in affordability and technology. Accessing markets no longer requires heavy upfront investments—beginners can start with minimal capital, while experienced traders benefit from blazing-fast, intuitive order execution without extra fees eating into profits.

Why Discount Broker Comparison Matters

Choosing the right discount broker can dramatically impact a trader’s or investor’s experience. Comparative analysis is crucial because not all brokers are created equal—fees, trading platforms, research tools, and support levels can differ widely.

For example, while Zerodha is praised for its Kite platform and zero delivery charges, Upstox is often chosen for its intuitive interface and margin trading facilities. A broker like 5paisa stands out for its varied product offerings beyond equities. Such unique attributes mean that what works for an experienced derivatives trader may not suit a first-time investor seeking a friendly, low-risk entry point.

By thoroughly comparing discount brokers, Indian investors can identify the best fit for their trading patterns and financial goals, ensuring both cost efficiency and a seamless experience.

Who Stands to Benefit?

The democratization of trading through discount brokers has opened doors for all sorts of market participants in India. Those venturing into stocks for the first time benefit from low commissions and clear, transparent fee structures—enabling trial and learning without significant cost risk.

Intermediate and active traders who crave faster execution and reduced trading costs find these platforms especially appealing. With brokers like Zerodha handling millions of daily transactions, even high-frequency participants enjoy consistent platform reliability.

Crucially, the rise of digital-first brokers means that transparent, easy-to-navigate platforms are now standard—making markets more approachable to retail investors, millennials, and anyone who values convenience as much as savings.

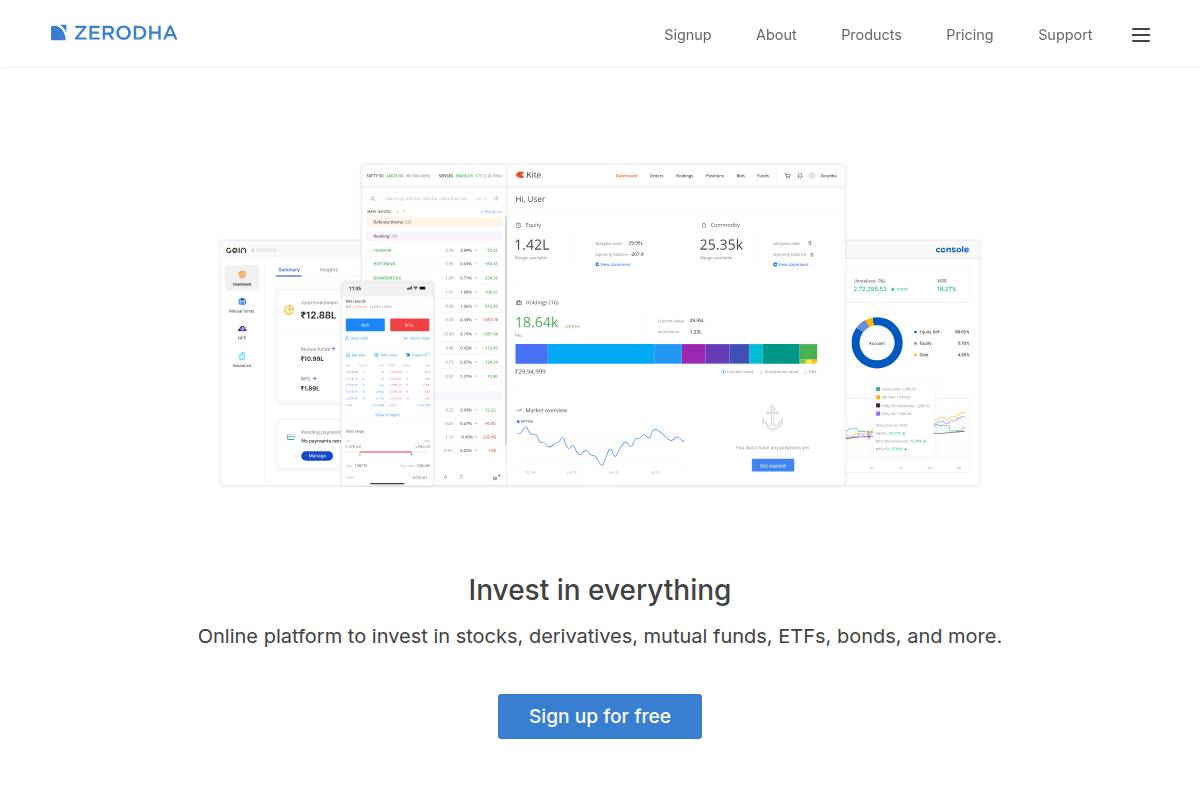

Zerodha

Zerodha

Overview

Zerodha stands as India’s largest discount brokerage, appealing to both beginners taking their first steps in trading and seasoned investors deploying advanced strategies. Since its launch in 2010, Zerodha has built trust within the Indian market for its transparent and no-nonsense fee structure.

By consistently prioritizing platform reliability, Zerodha grew to serve over 10 million active clients by 2023. Its straightforward approach is cited by many industry reviews as a welcome change from the complex pricing that defined legacy brokers before 2010 in India.

Technical Requirements

Trading with Zerodha is designed for modern investors who value mobility and flexibility. The platform requires a stable internet connection, and users can trade seamlessly using either a smartphone via the Kite app or their desktop through the web platform.

This cross-device accessibility is especially practical for users who commute or wish to monitor trades on different devices, matching the expectations of today’s retail investor.

Competitive Positioning

Zerodha dominates the Indian brokerage landscape with a blend of ease of use and broad reach. Unlike traditional brokers who might charge variable commissions, Zerodha’s flat-fee structure is often cited as a major differentiator by both customers and analysts.

For example, platforms like Upstox or Angel One offer competitive pricing, but Zerodha’s simplicity and long-standing reputation frequently put it at the top of customer satisfaction surveys, making it a staple for traders in the Indian market.

Getting Started

Opening a Zerodha account is a fully digital process, letting users sign up with just their PAN card, Aadhaar, and bank details. The digital Know Your Customer (KYC) process means most applications are processed within a single business day.

- Register online by entering your personal and banking details.

- Complete KYC by uploading digital copies of required documents.

- Verify your identity via Aadhaar-linked OTP for swift approval.

This quick onboarding allows even first-time investors to enter the market with minimal friction.

Key Features

Zerodha’s key features target key pain points for both occasional and daily traders. Its pricing, trading tools, and community resources set it apart:

- Flat ₹20 per executed order for intraday and F&O trades, eliminating surprises in brokerage costs.

- Free equity delivery trades, encouraging long-term investment without additional charges.

- Intuitive Kite trading interface with advanced charting tools and seamless navigation.

- Varsity, a learning platform integrated into Zerodha, offers structured modules on stock markets, futures, and options—helping thousands of new investors get started.

- API access and tool integrations with platforms like Streak and Sensibull, enabling automated strategies and options analysis for advanced users, as reported by OpenQRS.

Pros

- Low, flat, and transparent fees appealing to cost-conscious traders.

- Kite interface is praised for its clutter-free design and quick accessibility.

- Extensive educational resources like Varsity make complex investment concepts more accessible.

- Order execution speeds are favorable, even during busy market hours per user feedback on TradingQ&A.

Cons

- No personalized stock advisory—users must conduct their own research or turn to third-party services.

- Occasional server load and temporary slowdowns reported during peak market volatility, as seen during March 2020’s high trading volumes.

Pricing

- Equity Delivery: Free, supporting buy-and-hold investors without recurring costs.

- Intraday & F&O: Flat ₹20 per order, regardless of trade size, reducing unpredictability in trading costs.

User Sentiment

Most users highlight the simplicity, low fees, and robust reliability of Zerodha. The Kite trading app consistently garners high ratings on Google Play and the App Store for its clean interface and smooth execution.

Community forums such as TradingQ&A reflect a generally positive consensus but also document user concerns during periods of high volatility, especially when contacting customer support can take longer than usual. Users particularly note the value received from the Varsity educational modules in building knowledge from scratch.

Zerodha: Online brokerage platform for stock trading & investing

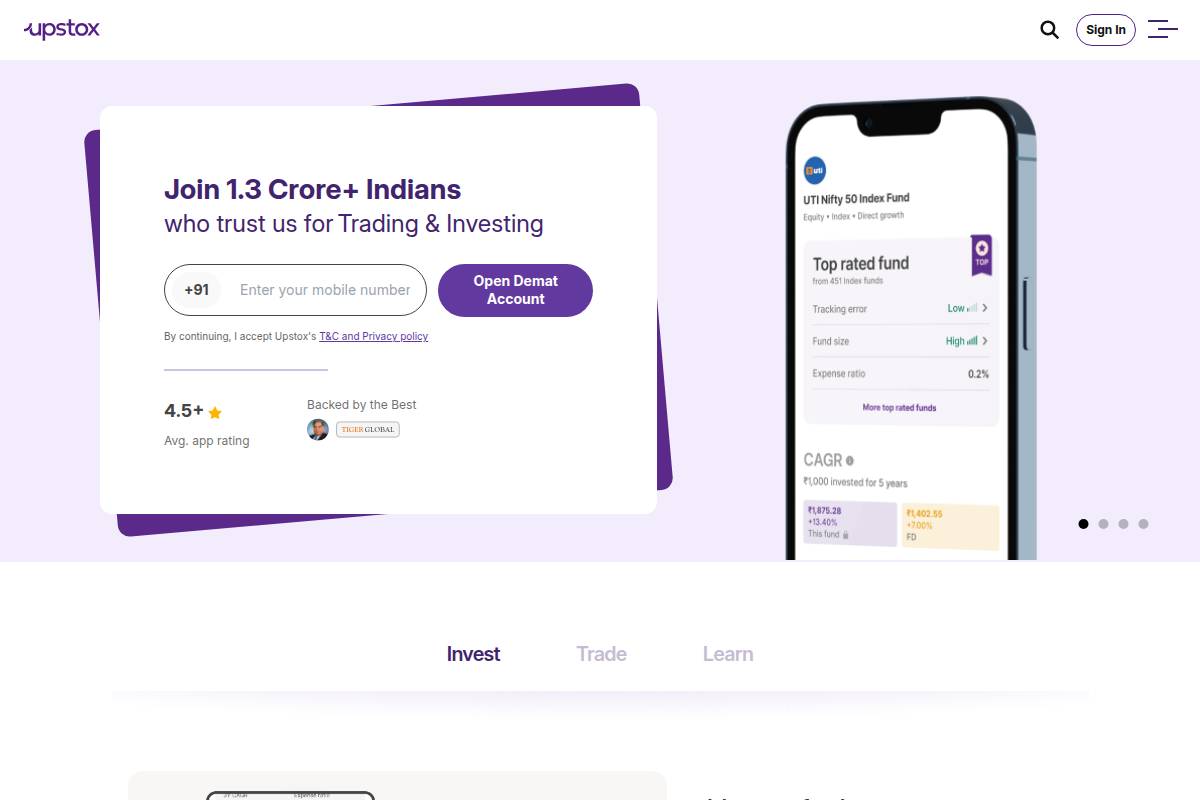

Upstox

Upstox

Overview

Upstox has built a reputation for delivering advanced trading tools and highly competitive pricing structures. Its appeal spans both tech-savvy traders and beginners exploring the stock market for the first time, thanks to an intuitive interface and robust mobile solutions.

This broad user base is evidenced by Upstox's surge in customer acquisition, making it one of the most popular discount brokers ranked immediately after industry leaders like Zerodha and 5paisa, as cited in the Top 10 Discount Brokers in India 2025 report.

Technical Requirements

Getting started with Upstox doesn’t require high-end hardware. An internet-enabled smartphone, tablet, or computer is sufficient to access their trading platform. Most of the features are lightweight and the mobile app is designed to run efficiently even on mid-range devices.

To fulfill regulatory standards, you’ll need basic KYC documents like PAN, Aadhaar, and a bank account. Traders can register and verify identity online, ensuring a seamless onboarding experience even for those new to the financial markets.

Competitive Positioning

Upstox stands out in a crowded marketplace by prioritizing innovation. The platform frequently rolls out updates; for example, the addition of advanced charting tools like TradingView integration offers granular analysis for experienced traders.

Recognition as one of India’s most innovative discount brokers is reflected in awards and consistently growing customer numbers, confirming its place among the fastest-growing digital brokerages alongside peers such as Zerodha and 5paisa.

Getting Started

Opening a trading account with Upstox involves a simple online signup process. You need your PAN, Aadhaar, and bank details. With e-KYC, accounts are often activated within a few hours, making it convenient for those eager to start investing quickly.

For example, a user registering at 10 AM typically gains access to the trading dashboard by early afternoon, ideal for anyone wanting same-day trading opportunities.

Key Features

| Feature | Description |

|---|---|

| Flat ₹20/order | On all intraday and F&O trades; predictable costs for frequent traders. |

| Free equity delivery | No brokerage charged on stocks held overnight or longer. |

| Upstox Pro | Advanced charting and analytics; includes 100+ indicators. |

| IPOs, Mutual Funds | Direct access to primary markets and mutual fund investments. |

| Paperless onboarding | All account opening formalities are completed digitally. |

Pros

- Technology-driven platform with frequent updates and new features.

- Low, transparent brokerage fees suitable for active traders.

- Diverse range of investment products, including mutual funds, ETFs, and IPO allotments.

- User-friendly, responsive mobile application consistently rated above 4.0 on the Google Play Store.

Cons

- Some users have experienced occasional app bugs, notably during peak market hours.

- Customer support response times can lag, especially during market volatility.

Pricing

Upstox offers zero-brokerage equity delivery, allowing long-term investors to buy and hold stocks without recurring charges. For those who engage in intraday or derivatives trading, a flat ₹20 per executed order applies—making high-frequency trading predictable and cost-effective.

For instance, a day trader executing 20 intraday trades in a session would incur ₹400 in brokerage, regardless of trade value, which is notably competitive compared to traditional full-service brokers.

User Sentiment

Upstox consistently receives praise for its ease of use and comprehensive charting solutions. Traders value the real-time price alerts and customizable watch lists.

On the other hand, users report occasional technical glitches, such as brief outages or app freezes during high-volume periods, and cite slower response rates from customer service as pain points. These factors are crucial considerations for those expecting seamless experiences during volatile markets.

Trade & Invest: Online Share Market Trading App in India | Upstox

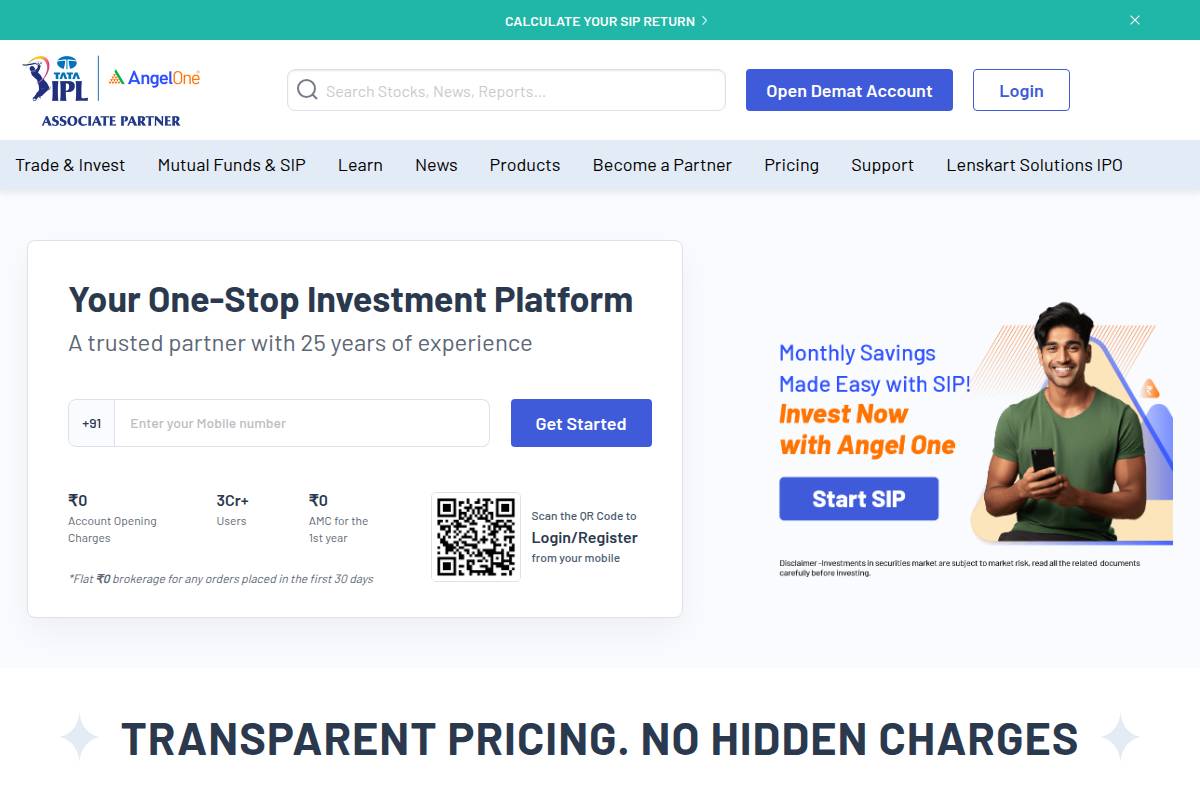

Angel One

Angel One

Overview

Angel One, previously known as Angel Broking, has carved a unique niche by combining the low-cost ethos of discount broking with a robust suite of advisory and research services. Unlike pure-play discount brokers such as Zerodha or 5paisa, Angel One strives to support both active day traders and long-term investors with tailored tools and insights.

This dual focus makes it a practical choice for those new to markets as well as experienced traders hunting for actionable research. For example, a first-time investor can benefit from step-by-step portfolio recommendations, while seasoned F&O traders have access to advanced charting and analytics directly on the Angel One platform.

Technical Requirements

To get started with Angel One, users need to fulfill standard KYC compliance and have internet access on a web browser or mobile app. The Angel One app supports both Android and iOS, making it accessible to a wide user base.

Active traders who value fast execution can also use Angel SpeedPro, a dedicated desktop application optimized for heavy trading volumes — a feature not commonly available across peers. For instance, many intraday traders switch to SpeedPro for its keyboard shortcuts and real-time market depth tools.

Competitive Positioning

The broker stands out by offering free equity delivery trades, which appeals to long-term investors, while maintaining industry-standard charges—₹20/order—for intraday and F&O segments.

Distinctly, Angel One invests heavily in brokerage research. Its daily market reports, detailed stock analyses, and thematic investment strategies differentiate it from low-fee apps like Upstox, which often forgo deep research support to keep costs minimal.

Getting Started

Opening an account with Angel One is a digitally streamlined process. Applicants submit documents for KYC online, and most accounts are activated within 24-48 hours.

Customer support is notably responsive, often providing step-by-step guidance through WhatsApp or email for first-time investors. For example, a Delhi-based user reported full onboarding and app orientation within two days after applying—a strong testament to Angel One’s support framework.

Key Features

- Free equity delivery trades; ₹20/order on intraday, F&O, commodities

- Research-backed investment recommendations—daily stock picks, quarterly sector updates

- Smart Money educational platform with tutorials, courses, and webinars

- All-in-one app for equities, commodities, mutual funds, IPOs, and portfolio tracking

- 24x7 multilingual customer support via chat and phone

Pros

- Zero brokerage on equity delivery—ideal for long-term investors

- Comprehensive market research and educational tools, including free webinars

- High user satisfaction with onboarding and support

- Extensive product coverage: stocks, mutual funds, commodities, F&O, and more

Cons

- User interface is less modern compared to Groww or Upstox

- Some users report occasional trade settlement delays, especially during peak market hours

Pricing

| Segment | Brokerage Fee |

|---|---|

| Equity Delivery | Free |

| Intraday, F&O, Commodities | ₹20 per order |

User Sentiment

User reviews and ratings frequently acknowledge Angel One's strong research insights and educational initiatives. For instance, many users on Google Play and Trustpilot highlight the actionable daily reports and interactive webinars as beneficial learning tools.

However, the most cited drawback is the interface, which some traders feel lags behind sleeker competitors like Zerodha Kite or Groww. Nonetheless, Angel One continues to upgrade its apps in response to these critiques, demonstrating a commitment to user feedback.

Angel One: Online Trading & Stock Broking in India

Groww

Groww

Overview

Groww has rapidly become one of the most popular investment platforms in India, especially among millennials and rookie investors. Its visually clean, intuitive design makes navigating investments less intimidating for those without a financial background.

The platform's rise can be attributed to its user-friendly interface and streamlined processes, removing complex jargon that often deters new users from entering the financial markets. Reports show that as of 2023, Groww had more than 20 million users, with a significant portion being under 30 years old.

Technical Requirements

Getting started with Groww requires minimal hardware or software. Users can access the platform either via the Groww web portal or through its mobile app, which is optimized for both Android and iOS devices.

To open an account, a KYC-verified bank account and personal identification documents—such as PAN card and Aadhaar—are mandatory. The digital nature of onboarding means nearly anyone with internet access and required documents can begin investing within minutes.

Competitive Positioning

Groww distinguishes itself in the competitive Indian brokerage landscape by focusing on first-time investors who may be put off by jargon-heavy platforms like Zerodha Kite or traditional brokers like ICICI Direct.

By using plain language and offering clear, simplified workflows, Groww has managed to attract new market participants, particularly from Tier II and III cities where financial literacy is still an emerging concept.

Getting Started

The onboarding process is one of Groww’s strongest selling points. Registration is completed entirely through the app, requiring basic identity and banking details.

For example, a user registering in Mumbai reported completing KYC within ten minutes, uploading PAN and Aadhaar details from their smartphone and getting instant access to invest in mutual funds and stocks.

Key Features

- Simple, minimalist user interface

- Free equity delivery trades; ₹20/order for intraday & F&O

- Mutual fund investing directly from the app

- Rapid, paperless KYC process

- Multiple language support

| Feature | Groww | Traditional Broker |

|---|---|---|

| Equity Delivery | Free | ₹15–₹30/trade |

| Mobile User Experience | Modern/UI-centric | Outdated in most cases |

| KYC Process | Fully digital, fast | Paperwork, days to approve |

Pros

- Modern UI and user experience

- Quick onboarding

- Low-cost investment options

- Beginner-friendly education

Cons

- Limited advanced analytics or reporting

- Lacks phone-based customer support

Pricing

- Equity Delivery: Free

- Intraday/F&O: ₹20/order

User Sentiment

Feedback from new investors consistently highlights Groww’s simplicity and accessibility as major positives. A Bengaluru-based college student cited the easy account setup and clean interface as key reasons for choosing Groww for her first mutual fund SIP.

Active traders, however, sometimes point out missing features such as real-time charting or the lack of immediate phone-based support, which heavy users might find on platforms like Angel One. Despite this, for beginners and casual investors, Groww remains a top recommendation for its seamless start and low entry barriers.

Groww - Online Demat, Trading and Direct Mutual Fund Investment ...

5paisa

5paisa

Overview

5paisa has positioned itself as a leading discount broker in India, recognized for its cost-efficient trading solutions. The platform’s low brokerage charges attract investors seeking high turnover or minimal transaction costs.

Traders executing multiple orders per day, such as in day trading or options strategies, can benefit substantially from 5paisa’s pricing. For instance, a frequent trader placing 50 orders a month would spend ₹1,000 on brokerage with 5paisa’s flat ₹20/order plan, compared to substantially higher fees on percentage-based plans from full-service brokers like ICICI Direct.

Technical Requirements

5paisa’s platform is engineered for accessibility, supporting both Android and iOS smartphones as well as major web browsers. This ensures compatibility for users on most modern devices.

The onboarding process is fully digital, relying on an e-KYC system. Applicants need only provide Aadhaar details, PAN information, and basic banking credentials. For example, a user opening an account through the 5paisa app can complete documentation, identity verification, and start investing in under 15 minutes, provided all requirements are ready.

Competitive Positioning

Known for its disruptive flat-fee structure, 5paisa directly undercuts traditional brokers. Its commitment to transparent, flat-rate pricing appeals to cost-conscious retail investors, especially when compared with percentage-based commissions charged by competitors like HDFC Securities.

According to NSE market share statistics, 5paisa ranks among the most-used discount brokers in India, particularly with small investors who value simplicity and low entry barriers.

Getting Started

Setup on 5paisa is streamlined, allowing investors to register via both its website and dedicated mobile app. The step-by-step process is beginner-friendly, ensuring minimum downtime between signup and first trade.

Most users experience onboarding in under 30 minutes. Several trader testimonials on social media, such as those documented in Quora threads, cite near-instantaneous activation, making it attractive for those eager to capitalize on urgent market opportunities.

Key Features

| Feature | Description |

|---|---|

| Flat ₹20/order | Simple, low-cost transaction model across segments |

| Discounted plans | Power Investor plan offers trades as low as ₹10/order |

| Stock SIP | Long-term wealth building via regular equity investments |

| Direct mutual funds | Zero commission investments in mutual funds |

| Robo-advisory | AI-driven portfolio recommendations for beginners |

| Multi-asset trading | Single platform access to equity, currency, commodities, and mutual funds |

As a specific example, retail investors can use the Smart Investor tool, part of 5paisa’s paid offering, for AI-based suggestions tailored to their goals—a value typically added by premium brokers.

Pros

- Ultra-low brokerage charges are among the most competitive; ideal for active traders

- Access to equities, derivatives, commodities, and direct mutual funds

- Quick digital onboarding with user-friendly interface

- Innovative tools like robo-investing cater to novice and tech-focused investors

Cons

- Occasional lag or technical issues reported with the app, especially during peak market hours

- Limited research and educational resources compared to platforms like Zerodha Varsity

Pricing

5paisa offers straightforward pricing with no hidden charges. The standard plan is ₹20 per executed order, regardless of trade value or volume. An upgraded ‘Power Investor’ subscription further reduces fees to ₹10/order, plus added analytics tools.

For example, a user subscribing to the Power Investor plan at ₹499/month would spend ₹100 in brokerage for ten executed orders, compared to ₹200 on the standard plan—a clear savings for active traders.

User Sentiment

Many users praise 5paisa’s cost savings, especially those who otherwise paid significantly higher brokerage with legacy firms. Its simplified app interface and broad product access also receive positive mentions.

However, reviews on Play Store or Trustpilot reveal recurring complaints about laggy performance during market rush hours and a dashboard that can feel unintuitive to first-timers unfamiliar with trading jargon or workflows. Despite these, its core value proposition—affordable, multi-asset investing—remains strong among retail investors.

Recommendations: Which Broker Is Right for You?

Choosing the ideal stockbroker hinges on your investing style and experience level. Each leading platform in India caters to distinct user needs—whether you’re a first-time investor, an active trader, or someone seeking guided research. Understanding these differences can help you optimize your trading journey and maximize portfolio growth.

First-Time Investors: Groww’s User-Friendly Experience

Groww is known for its intuitive onboarding and clean interface, making it a top pick for individuals new to investing. Its seamless KYC process, typically completed in minutes, removes much of the paperwork headache.

For example, in 2023, Groww saw a surge in Gen Z account openings, attributing much of this growth to their straightforward app design. Investors can easily explore direct mutual funds, stocks, and ETFs in just a few taps, which reduces friction and confusion for beginners.

Active or Frequent Traders: 5paisa for Cost Efficiency

Traders who make several trades daily or weekly need robust cost savings and market access. 5paisa delivers with flat Rs. 20 brokerage per order across all segments, including equity, derivatives, and commodities.

In Q1 2024, experienced swing traders cited significant savings compared to percentage-based brokers—one Mumbai-based trader saved an estimated Rs. 5,000 monthly after switching to 5paisa. The unified platform allows access to stocks, mutual funds, and even US equities—all under a single dashboard.

DIY Learners & New Traders: Zerodha’s Educational Edge

Zerodha stands out for empowering self-learners with its acclaimed Varsity module, which offers free, in-depth lessons on every aspect of trading and investing. It’s been referenced by numerous Indian finance YouTubers as a go-to educational resource.

Alongside education, Zerodha’s Kite trading platform provides a distraction-free interface, enabling trial-and-error learning without overwhelming new users. This makes it ideal for college students and DIY enthusiasts eager to build foundational investing skills.

Tech-Enthusiasts & Data-Driven Traders: Upstox’s Advanced Tools

Upstox excels for those who rely on cutting-edge charting, real-time analytics, and automation. Its integrated TradingView charts and customizable watchlists allow users to spot trends and set alerts efficiently.

For instance, algorithmic traders in Bangalore have leveraged Upstox’s rapid order execution and seamless technical analysis tools—giving them the speed advantage during volatile market sessions.

Investors Needing Research & Advisory: Angel One’s Robust Support

For investors seeking guidance, Angel One provides in-depth research reports, stock recommendations, and model portfolios at highly competitive pricing. Their team of SEBI-registered experts generates regular market commentary and actionable advice.

Users report added confidence with Angel One’s daily stock picks and sector analyses. The broker was recognized by ET Now in 2023 for its extensive research output and customer-friendly innovations, making it a strong fit for those wanting structured support at a low cost.

Frequently Asked Questions

1. Can NRIs use these discount brokers in India?

Non-Resident Indians (NRIs) have growing interest in Indian equities and often seek low-cost platforms for investing back home. Most major discount brokers, such as Zerodha and Upstox, offer specific provisions for NRIs to open trading and Demat accounts.

However, the onboarding process and available features can differ from resident accounts. For instance, Zerodha lets NRIs trade in equity and IPO segments, but options trading is restricted. Angel One provides NRI services but mandates linking with NRE/NRO accounts. Always verify eligibility, documentation, and charges with each broker before proceeding, as there are regulatory and procedural differences compared to resident accounts.

2. How fast can I open an account and start trading?

Account opening with leading discount brokers is predominantly digital, enabling quick onboarding for most investors. For resident Indians using platforms like Groww or Upstox, the process hinges on e-KYC (electronic Know Your Customer) verification facilitated by Aadhaar integration.

In many instances, if your details are easily verifiable, activation can take as little as 30 minutes. For example, users on Groww regularly report same-day activation if all documents are in place, while other brokers may take up to one business day for manual checks. NRIs or those with special cases should expect a slightly longer duration due to additional compliance requirements.

3. Is my money safe with discount brokers?

Investor safety is a crucial concern, especially with the rise in digital transactions. All SEBI-registered brokers, including 5paisa and Zerodha, are required to adhere to strict regulations regarding client funds, including keeping client assets segregated from the broker’s own funds.

Brokers like Angel One regularly conduct third-party audits and prominently display their SEBI registration details on their websites. Always look up the broker’s SEBI registration status and review their customer protection measures. For instance, Upstox offers 256-bit encryption and two-factor authentication to safeguard user data—practices that reflect broader industry norms.

4. What should I do if I face technical issues while trading?

Technical glitches can interrupt trading, especially during high-volume sessions. The best course of action is to immediately contact your broker’s customer support. Most platforms, including Groww and Upstox, provide in-app chat and email support—typically responding within minutes for high-priority issues.

If the issue is time-sensitive and your trade or investment is at stake, escalate the matter via official Twitter handles or other social media channels. For instance, users have resolved urgent issues with Zerodha faster by tagging their support handle on Twitter, as public outreach sometimes expedites responses.

5. Can I invest in US stocks or global assets through these platforms?

Interest in international diversification is on the rise among Indian investors. Some discount brokers now provide solutions for investing in global markets. For example, Upstox and Groww have tie-ups with third-party platforms such as Vested or DriveWealth, which facilitate investment in US stocks.

Each broker lists their international investing options under dedicated sections on their websites. Fees, available markets, and regulatory protections differ for global assets compared to Indian securities, so review these details before initiating cross-border trades. In some cases, like with Zerodha, such services may not be directly available, requiring use of partners or separate accounts for US equity access.