Best Lowest Brokerage Charges Apps for Indian Investors

Unlock powerful trading strategies tailored for the Indian market. Elevate your investment skills with expert guidance for beginners and retail investors.

Introduction: Finding the Right App for Cost-Effective Trading

Entering the stock market often feels daunting, especially when confronted with a variety of trading platforms all promising the lowest fees. For new and seasoned investors alike, trading costs can quietly eat into profits over time. India's dynamic fintech ecosystem has seen a surge in mobile trading apps, many touting zero or minimal brokerage models. However, not all low-cost claims translate into real savings, making due diligence crucial before selecting a trading platform.

Understanding the genuine cost structure of a trading app is important to avoid unexpected charges. For instance, while some popular apps like Zerodha charge a flat ₹20 per trade or 0.03% (whichever is lower), others like Groww and Upstox have introduced zero brokerage on equity delivery but may impose charges on intraday or F&O transactions. According to a recent SEBI report, brokerage fees can reduce retail investor returns by 1-2% annually if not managed well. Over an investment horizon of 10 years, this can lead to a noticeable difference in wealth accumulation.

This guide brings clarity by spotlighting leading Indian trading apps with genuinely low brokerage charges. It goes beyond fee comparisons to outline key features, usability factors, and offers practical guidance for investors aiming to maximize their returns. By the end, you’ll find actionable insights on how to align your choice of trading app with your investment strategy, risk appetite, and financial goals.

Understanding Lowest Brokerage Charges Apps and Their Importance

What Are Lowest Brokerage Charges Apps, Discount Brokerage Apps, and Zero Brokerage Trading?

Lowest brokerage charges apps are digital trading platforms that focus on minimizing or eliminating transaction fees for their users. These platforms are designed to make investing accessible and cost-effective, especially by lowering overheads associated with every buy or sell order.

Discount brokerage apps such as Zerodha, 5paisa, and Angel One have become popular in India by offering flat rates—sometimes as low as ₹20 per trade. As illustrated in the Lowest Brokerage Charges in India for Online Trading report, these platforms allow active traders to manage large numbers of transactions without excessive commission costs.

Zero brokerage trading refers to segments or products (often equities) where platforms charge no commission. For example, Zerodha charges zero brokerage for delivery trades in equities, encouraging more participation from cost-sensitive investors.

Why Do They Matter in Modern Investing?

The rise of low-brokerage trading platforms has had a substantial impact on investment returns, especially for those who trade regularly or hold smaller portfolios. By reducing fees, every saved rupee can be re-invested, compounding returns over time.

These apps promote greater financial inclusion. An investor with a modest capital—say ₹10,000—can trade via 5paisa's ₹20-per-order plan, rather than paying 0.5% per transaction at traditional brokers, which would quickly erode profits. As a result, the investment ecosystem becomes more open and competitive for retail participants.

Who Stands to Benefit Most?

Lowest brokerage apps are tailored to fit the needs of several investor segments in India. First-time investors, with limited capital and risk appetite, can minimize the erosion of returns due to fees, making their initial experience more rewarding.

Active traders and intermediate investors also find value in these apps. Someone executing 100 trades a month with a platform like Angel One, which charges a flat ₹20 per order, will pay ₹2,000 monthly—potentially thousands less than with a traditional fee structure. Beyond cost savings, these apps often offer user-friendly dashboards and research tools, making them suitable for anyone keen to explore mobile-based investment opportunities.

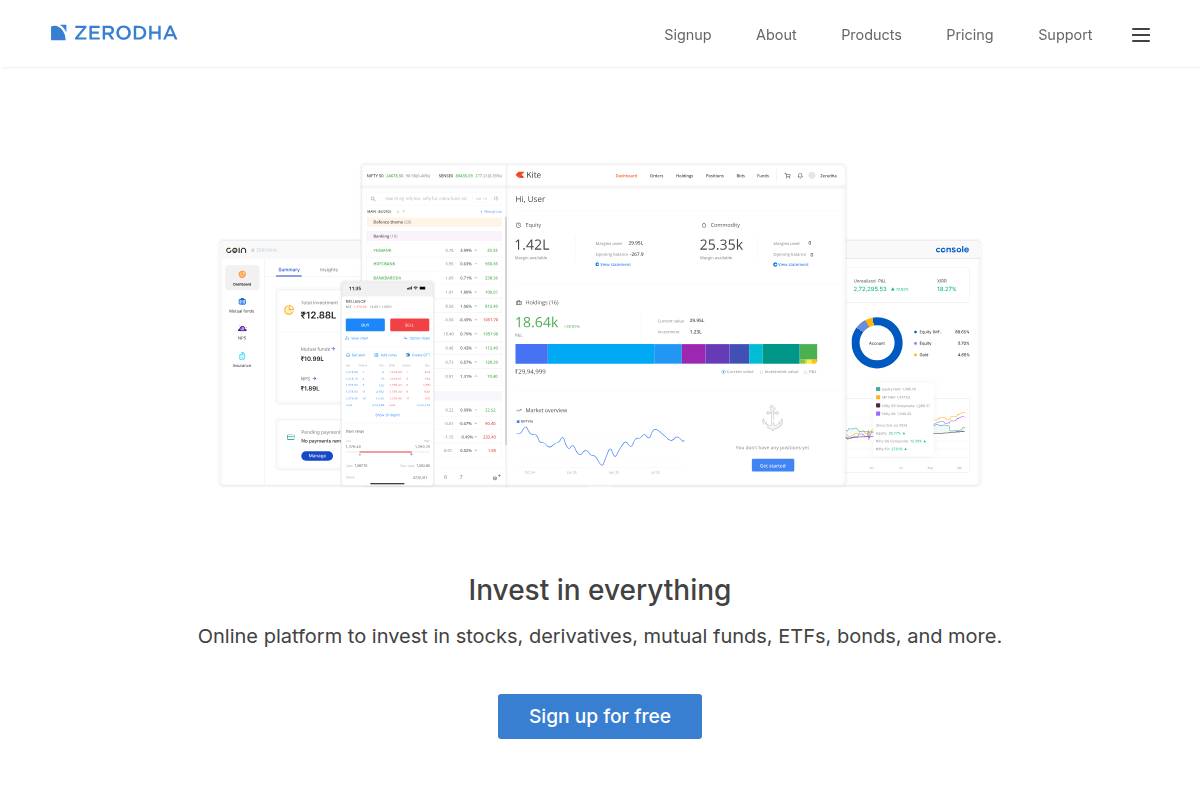

Zerodha

Zerodha

Overview

Zerodha has established itself as a pioneer in the Indian discount broking sector, making stock trading more accessible and cost-effective for both first-time investors and seasoned traders. Since its launch in 2010, Zerodha has grown to serve over 10 million clients, making it India's largest stockbroker by active retail clients.

The brand is acclaimed for its minimalistic and intuitive Kite platform, which caters to investors at all levels. The platform's simple dashboard and fast execution tools appeal especially to new entrants who may find older brokerage interfaces overwhelming.

Technical Requirements

Accessing Zerodha’s services is designed for maximum convenience. The platform operates seamlessly on most web browsers and provides dedicated apps for both Android and iOS, ensuring broad accessibility.

To open an account, users must complete electronic Know Your Customer (e-KYC) by linking their PAN and Aadhaar details. Connectivity requirements are modest—a stable internet connection is critical for real-time price feeds, and a linked bank account simplifies fund transfers and settlements.

Competitive Positioning

Zerodha competes robustly through transparent pricing with no hidden charges, gaining user trust. Its security protocols—like two-factor authentication—ensure transactional safety, which positions it ahead of many recent entrants.

The broker’s mature ecosystem includes tools like Varsity for learning and Sentinel for notifications. Unlike upstarts such as Groww or Paytm Money, Zerodha integrates deeply with trading APIs and automation platforms, exemplifying a more established infrastructure for savvy investors.

Getting Started

Account setup is straightforward, enabling most new users to start trading within a day. The process involves digital KYC steps such as uploading PAN, Aadhaar, and a bank proof. All documentation and verification are done online, removing branch visits entirely.

After account approval, users access trades via the Kite web or mobile app—used for everything from equity to derivatives trading. For instance, a college student in Bengaluru can open an account remotely and begin trading in less than 24 hours.

Key Features

- Direct Mutual Fund Investments via Coin: Users can buy direct mutual funds with zero commissions using Zerodha Coin, often saving on distributor expenses compared to brokers like ICICI Direct.

- Advanced Charting and Trading Widgets: The Kite app integrates ChartIQ and TradingView charts, offering professional-level technical analysis to both retail and institutional investors.

- Wide Asset Options: Trade in equities, commodities, currency, and derivatives through a single dashboard, making portfolio diversification straightforward.

- Educational Resources: Zerodha’s Varsity platform is a free, in-depth learning resource used by students and self-learners nationwide.

Pros

- One of the lowest flat fee structures (₹20 per executed order, ₹0 for delivery trades)

- User-centric design of the Kite app

- Onboarding process typically completed within a few hours

- Access to comprehensive analytics like streak and Smallcases integration

Cons

- Brokerage-free trades limited to equity delivery; charges apply for other segments

- Customer support response may lag during market volatility, as seen on major expiry days

- Lack of advisory services, pushing DIY investing

Pricing

Zerodha is recognized for a straightforward pricing model: there is no brokerage charge for equity delivery trades, while intraday, F&O, and currency trades incur a ₹20 flat fee per order regardless of trade size. Compared to major brokers like HDFC Securities (which may charge up to 0.5% per order), Zerodha’s cost savings can be significant for active traders. These transparent charges are published directly on their pricing page to avoid confusion.

User Sentiment

User feedback consistently highlights Zerodha's ease of use and cost transparency. Ratings on Google Play and the App Store frequently exceed 4.2 stars, with thousands praising the platform’s reliability and fast order execution. For example, a 2023 MoneyControl survey showed users trusted Zerodha more than most fintech competitors for security and pricing.

However, some users point out that during major market moves—such as the Adani Group stock volatility in early 2023—support queues increased, delaying resolutions. The lack of advisory services is also noted, especially by first-time investors seeking hand-holding or personalized recommendations.

Zerodha: Online brokerage platform for stock trading & investing

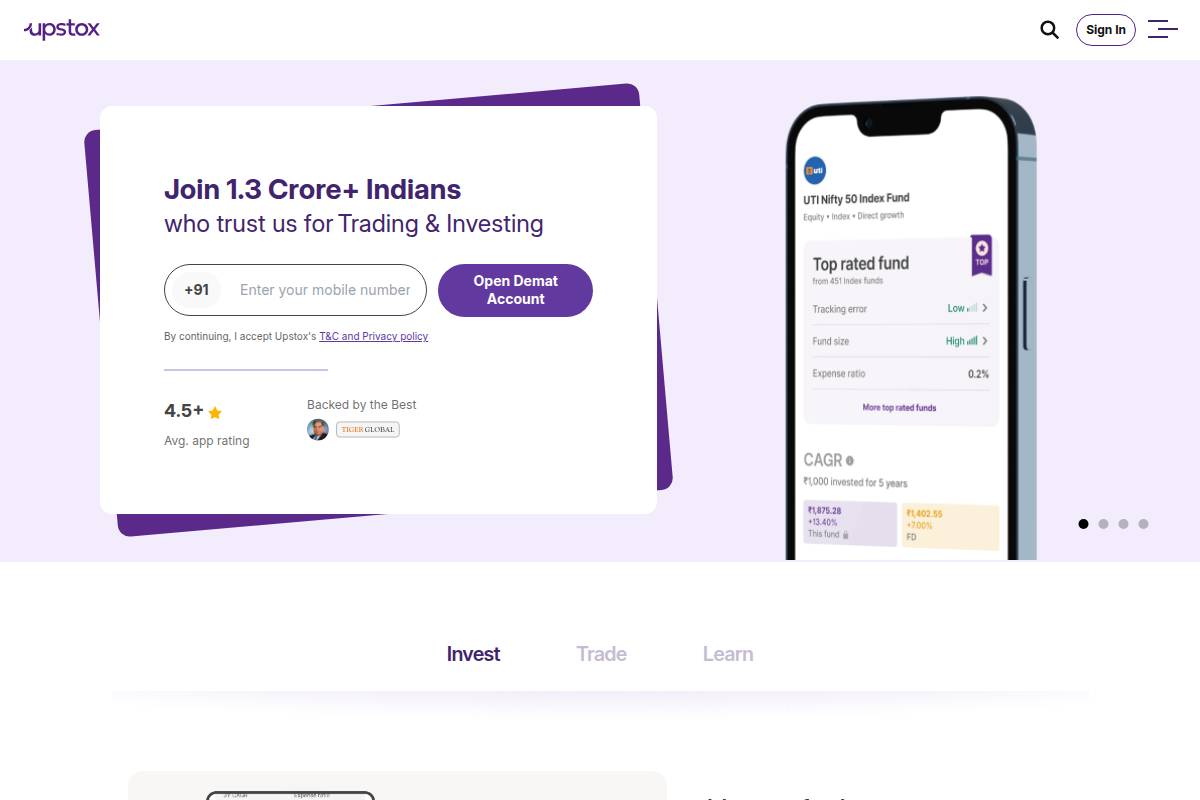

Upstox

Upstox

Overview

Upstox is a widely recognized online trading platform designed for tech-savvy urban millennials and value-conscious investors. It stands out by blending modern technology and investing, with a focus on intuitive design and usability. The platform is popular among users seeking a streamlined way to access equity, F&O, and commodity markets in India.

Upstox’s reputation partly comes from its clean interface and robust market tools. For example, its advanced charting and market data features make it easy for users to analyze stocks—something that attracts intermediate traders who previously used platforms like Zerodha or ICICI Direct for technical insights.

Technical Requirements

To use Upstox, traders can install the app on iOS, Android, or access it through web browsers like Chrome and Firefox. The versatility ensures accessibility from smartphones, tablets, and laptops alike.

Before trading, users must complete KYC verification. Reliable internet and a compatible device are essential, as real-time trading depends on fast data feeds and app responsiveness. For example, a user with a basic Android device and a stable 4G connection can seamlessly buy shares or track prices during earnings season.

Competitive Positioning

Upstox differentiates itself by rolling out regular updates and integrating advanced trading tools—features not always available in legacy brokerage apps. The platform's approach to pricing, offering both low-cost transactions and sophisticated charting, appeals to both seasoned and new traders.

Unlike industry giant Zerodha, Upstox regularly introduces advanced features earlier, such as multi-indicator charts and quick order placement. This positions Upstox as an agile competitor among India’s top 10 trading apps.

Getting Started

New users can register directly through the website or mobile app. The process includes submitting KYC documentation—a scan of PAN, Aadhaar, and bank proof. This procedure, which traditionally took days, is now completed within minutes due to digitized verification.

Once registration is complete, users receive instant access to their Demat and trading accounts. Through Upstox Pro, they can begin tracking stocks, placing orders, or applying for IPOs often in less than 30 minutes from sign-up.

Key Features

- Receive real-time price alerts and notifications for stocks like HDFC Bank or Reliance, crucial for day traders monitoring intraday swings.

- Analyze trends with multi-indicator charts—useful for technical traders, such as overlaying RSI and Bollinger Bands on Tata Motors charts.

- Apply to IPOs like Mamaearth directly and track application status within the app, ensuring retail investors don’t miss out on buzz-worthy listings.

- Link major Indian banks and use apps like Smallcase for diversified thematic investing.

- Access webinars—many focused on F&O strategies—plus a knowledge base tailored for beginners and intermediate investors.

Pros

- Consistently low brokerage rates benefit high-frequency traders.

- The app’s sleek and responsive interface enhances real-time order execution.

- Supports a range of order types—bracket, cover, and AMO orders—plus advanced charts with up to 100+ indicators.

- No brokerage charges on equity delivery, making it attractive for long-term investors compared to peers.

Cons

- Mutual fund selection is limited compared to dedicated platforms like Groww.

- The app may experience temporary glitches during events like major IPOs or market rallies.

- Customer service response can lag at peak times, as users noted during the LIC IPO subscription period.

Pricing

For equity delivery trades, Upstox charges zero brokerage, echoing the competitive pricing seen in top Indian brokerages. Intraday and F&O transactions incur a flat ₹20/order or 0.05% of turnover, whichever is lower. This transparent fee structure is detailed in rankings for the best brokerage rates in India.

User Sentiment

Many users praise Upstox for its modern interface and the speed of order execution, especially during high-volatility trading sessions. For example, traders monitoring earnings season stocks frequently note the app’s real-time responsiveness as a key advantage.

However, some users report intermittent downtime during periods of high volume, such as government budget announcements. The app’s commitment to transparent pricing has, nonetheless, built strong trust in the trading community.

Trade & Invest: Online Share Market Trading App in India | Upstox

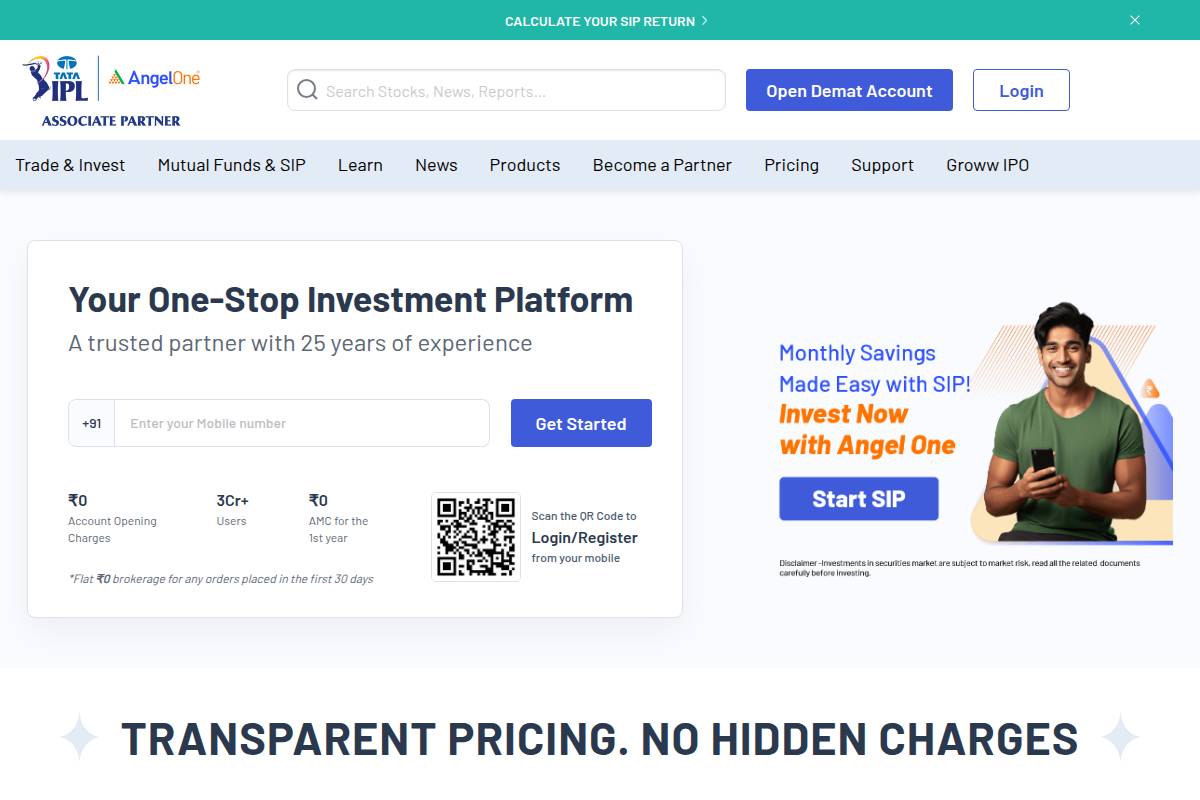

Angel One (formerly Angel Broking)

Angel One (formerly Angel Broking)

Overview

With a history spanning over 30 years, Angel One (formerly Angel Broking) has made a name for itself by blending established broking expertise with a robust, modern platform. The brokerage rebranded itself as Angel One to emphasize a digital-first strategy, targeting both experienced and first-time investors in India.

The platform offers a zero brokerage model for equity delivery—an attractive proposition for long-term investors. For active traders, competitive discount brokerage rates make frequent trading more cost-effective. This dual approach allows Angel One to cater to a wide audience.

Technical Requirements

Angel One provides seamless access across major devices. Its trading app is available on Android, iOS, and through an intuitive web interface, supporting traders whether they're on-the-go or at their desks.

To open an account, users must complete online KYC with a valid PAN or Aadhaar number, ensure reliable internet connectivity, and hold a functioning bank account. This mirrors the onboarding process at top brokers like Zerodha and Groww, ensuring compliance and ease of access.

Competitive Positioning

The platform stands out by integrating advanced research tools, AI-driven advisory, and a zero-brokerage framework. While traditional brokers like ICICI Direct focus on premium advisory and legacy trust, and new-age platforms like Upstox target tech-savvy youth, Angel One bridges both through full-service offerings and aggressive pricing.

Their in-house ARQ Prime engine delivers data-backed personalized investment ideas, helping both seasoned traders and beginners make more informed choices—demonstrating their effort to serve a wide user demographic.

Getting Started

Account creation is designed to be speedy and frictionless. Users can sign up online, uploading PAN and Aadhaar details for quick e-KYC verification. Once documents are submitted, most accounts are activated within a few hours—streamlining entry for time-conscious investors.

For tech-driven traders, Angel One's Smart API provides access to algo-trading. For instance, programmers can build custom strategies to automate stock selection and order execution, similar to what Zerodha Kite Connect API offers.

Key Features

- Zero brokerage on equity delivery trades

- Comprehensive market research and insights through ARQ Prime

- Personalized investment advice based on portfolio patterns

- Real-time portfolio tracking with customized alerts

- Algo-trading support via Smart API for advanced users

Pros

- Access to thorough research and in-house advisory

- No brokerage on equity delivery; ideal for long-term investors

- User-friendly interface suitable for beginners and intermediates

- Wide product portfolio, including stocks, mutual funds, and commodities

Cons

- Intraday and F&O trades incur ₹20 per order

- Users have reported occasional app lag during high market volatility

- Research tools can be complex for absolute beginners to navigate

Pricing

Angel One's pricing makes high-frequency trading more affordable compared to legacy brokers who charge percentage-based fees. The zero-brokerage offering for equity delivery is particularly popular among value investors.

A flat ₹20 per order applies for intraday equity, F&O, and commodity trades—aligning its fee structure closely with that of peers like Upstox and Zerodha. This transparency appeals to cost-conscious investors monitoring every rupee.

User Sentiment

Reviews on platforms like Google Play and Trustpilot highlight how Angel One appeals to both new and seasoned traders. Many praise the platform's comprehensive research suite for making stock selection easier, while do-it-yourself investors cite the zero-brokerage model as a key strength.

On the flip side, some users have requested faster feature roll-outs and app updates, especially during periods of market volatility, indicating ongoing opportunities for technical improvements.

Angel One: Online Trading & Stock Broking in India

Groww

Groww

Overview

Groww was launched to make investing accessible to millennials and first-time investors. Designed for the modern Indian user, the platform removes many barriers encountered in traditional trading and mutual funds by focusing on an intuitive, sleek interface. This has contributed to its rapid rise in popularity, especially among a younger demographic who value simplicity and minimal setup.

Users can buy stocks and invest in both regular and direct mutual funds from a single dashboard. This all-in-one approach means investors no longer have to toggle between disparate apps or deal with complicated portals. Reports from Groww show it has garnered over 2 million users within its first couple years, highlighting its strong appeal for those getting started with investing.

Technical Requirements

Getting set up with Groww is a digital-first experience. The app is available on both Android and iOS, and users can also access their portfolios from any web browser. This cross-platform availability allows users to check investments or execute trades from any device, a convenience especially valued by remote workers or digital nomads.

Opening an account requires just a PAN card and Aadhaar number, along with standard banking details. Digital KYC eliminates much of the paperwork, with most users able to complete the process in less than 10 minutes. For example, a Mumbai-based software engineer can finish eKYC verification on her lunch break and start trading the same day.

Competitive Positioning

Groww has differentiated itself by targeting newcomers rather than seasoned day traders. Its onboarding process is known for being quick, often beating more complex alternatives like Zerodha Kite or Angel One, which tend to cater to traders seeking sophisticated features.

Groww's simplified fee structure and clear in-app messaging mean that beginners are less likely to be caught out by hidden charges—a concern that has caused friction with competitors. However, advanced traders might miss features like options analytics or extensive charting found in Fyers or Upstox.

Getting Started

Opening an account with Groww is nearly instantaneous. The digital KYC process is a progression from the long, form-heavy signups once required by legacy brokers. Most users with basic ID and bank account details can be fully verified and ready to trade in under 30 minutes.

Transferring funds is simple and supports popular payment methods, including UPI and net banking. A Delhi student, for instance, can move ₹2,000 instantly from her bank account and purchase Tata Motors shares within minutes, reflecting Groww’s focus on low-friction entry.

Key Features

- Commission-free direct mutual funds

- 100% paperless stock trading

- Modern, minimal app interface

- Built-in educational content and investing guides

- Goal-based investment tracking features

Pros

- Exceptional for beginners thanks to intuitive UX

- Transparent, easy-to-understand fee structure

- Rapid onboarding compared to traditional brokers

- Access to over 5,000 mutual fund schemes from leading AMCs like HDFC and Nippon India

Cons

- Lack of advanced tools for derivatives or algorithmic trading

- No facilities for commodities or currency trades (as offered by platforms like 5paisa)

- Customer support experience is mixed, with some users citing delays during high-volume events

Pricing

Groww’s pricing model is straightforward, which helps avoid confusion for new investors. There’s no account opening charge, making it more attractive for dabblers or students who want to test the waters without a financial commitment.

The brokerage fee is capped at ₹20 or 0.05% per order, whichever is lower. For example, if you place ten trades in a month, each costing below ₹40, you’d pay less than competitors like Sharekhan, which often apply fixed fees regardless of trade size or frequency.

User Sentiment

Groww’s minimalist approach has won significant favor among millennial and Gen Z investors. Users routinely mention the absence of hidden charges as a reason for their loyalty. Positive social media chatter and app ratings (4.4+ on the Google Play Store) point to a user base that appreciates simplicity.

Certain segments, such as retired professionals or seasoned traders, express a desire for more in-depth analytics and research—features that platforms like Motilal Oswal provide. Still, for digital-first customers seeking an effortless investing start, Groww is highly regarded.

Groww - Online Demat, Trading and Direct Mutual Fund Investment ...

5paisa

5paisa

Overview

5paisa stands out in the Indian discount broking sector by offering cost-effective access to a range of investment products. Its primary appeal comes from helping traders and investors save substantially on brokerage fees. Individual investors often turn to 5paisa for its ability to combine equities, mutual funds, insurance, and other investment options in one streamlined platform.

For investors like Ramesh in Mumbai, seeking to diversify holdings affordably, 5paisa is regularly highlighted as a top choice by fintech reviewers for value-conscious users. Its all-digital solutions make it a fit for anyone looking to maximize returns by minimizing platform costs.

Technical Requirements

Getting started on 5paisa is straightforward, as the platform is accessible via Android, iOS, and standard web browsers. This flexibility means users can seamlessly switch between devices, accessing their trades and portfolios wherever they go.

New users should be prepared with Know Your Customer (KYC) documentation and a linked Indian bank account. A stable internet connection is essential to ensure timely order placements and portfolio monitoring, especially for frequent day traders.

Competitive Positioning

5paisa’s flat-fee trading model—₹20 per executed order—sets it apart from traditional brokers who may charge a percentage-based commission. This appeals to high-frequency traders who see fees add up quickly elsewhere.

The platform also stays competitive by bundling products, such as exclusive value packs for frequent traders who want to save even more, while integrating mutual fund account management. For example, users like Priya, who actively trade stocks and SIP into mutual funds monthly, appreciate doing both under one dashboard.

Getting Started

Opening an account with 5paisa is entirely digital and can be completed within minutes using e-KYC. The process is fully automated, with guided steps for uploading documents and linking a bank account.

New clients, such as recent college graduates entering investing, often highlight the app’s walkthroughs and help cues. This user-focused onboarding lowers the barrier for those new to stock market investments.

Key Features

- Ultra-low trading fees for equities, F&O, and commodities

- One-stop-shop for equities, mutual funds, insurance, loans, and more

- Automated investing via 5paisa’s Smart Investor/risk profile tools

- Customizable value packs for high-volume, professional traders

- Paperless management of all accounts and investments

Pros

- Low brokerage fees, ideal for day traders with frequent transactions

- Sleek, user-friendly mobile and desktop platforms

- Diverse investment universe: stocks, mutual funds, insurance, and more

- Quick and straightforward digital onboarding

Cons

- No-cost basic plan may include extra transaction charges

- Top features—like advanced analytics—require premium subscriptions

- Best charting and algo trading tools limited to Pro and Ultra packs

Pricing

5paisa charges a fixed brokerage rate of ₹20 per completed trade order, making costs predictable regardless of trade volume. For high-frequency traders, the platform offers special plans, like the 5paisa Power Investor Pack, which reduce effective trading costs via flat monthly fees and added privileges.

User Sentiment

User reviews often praise 5paisa’s affordability and easy access to varied investment products. Many cite experiences like saving over ₹20,000 in annual brokerage, compared to legacy brokers charging percentage fees.

Some users note the platform's efforts to upsell premium features. However, overall pricing transparency and simple comparison charts make it easy for customers to choose the right plan for their investing needs.

Recommendations: Choosing the Best App for Your Needs

Choosing the right investment app can make a substantial difference in your trading journey. Factors such as user interface, the variety of available investment products, and the depth of research tools can shift the experience dramatically for both beginners and experienced traders. Aligning these features with your individual trading goals and knowledge levels will help ensure a positive and productive experience.

Groww: For First-Time Investors Focused on Stocks or Direct Mutual Funds

Groww's intuitive design appeals to newcomers who prefer simplicity over a clutter of technical options. The onboarding process is streamlined—from e-KYC to first-time purchase—and users can start with as little as ₹100 in SIPs. For instance, new investors often cite Groww’s in-app learning resources and a minimalistic dashboard as reasons for their confidence in starting equity SIPs or exploring direct mutual funds without feeling overwhelmed.

Zerodha and Upstox: Ideal for Active Traders Needing Advanced Tools

Traders who rely on technical analysis and rapid order execution favor platforms like Zerodha and Upstox. Zerodha’s Kite platform, for example, offers advanced charting with over 100 indicators, and its average daily turnover is among the highest in India. Upstox, on the other hand, provides fast execution and customization for day traders, allowing rapid switching between market screens—vital for intraday strategies such as those used during events like Budget Day trading surges.

Angel One: Blending Research with Legacy and Modern Features

Angel One appeals to those who value a blend of traditional research and modern features. The app supplies detailed reports on both blue-chip and mid-cap stocks, while also offering zero brokerage on equity delivery. For example, Angel One’s ARQ Prime robo-advisory tool delivers personalized recommendations, allowing both legacy investors and newer traders to benefit from data-backed decisions.

5paisa: Recommended for High-Frequency Traders and Value Seekers

5paisa has carved a niche among cost-conscious, frequent traders by providing bundled plans like the Power Investor Pack. This includes access to research, mutual funds, and insurance—all under one flat fee. High-frequency traders, such as small business owners who route profits into short-term options, often select 5paisa for its consistently low charges.

Choosing Based on Goals, Volume, and Preferences

Ultimately, your choice should reflect your end goals. A new investor looking to build passive wealth may find Groww suits their needs. Those trading F&O or using chart strategies might gravitate towards Zerodha or Upstox. If research and multi-asset access matter, Angel One or 5paisa's bundled services provide a robust alternative. Always consider which platform aligns with your asset interests, frequency of trading, and learning curve comfort level.

Frequently Asked Questions (FAQs)

1. How can I verify that an app truly charges the lowest brokerage fees?

Determining whether a broker delivers the lowest fees often comes down to research and direct comparison. While most apps advertise attractive rates, subtle differences in pricing or additional charges may impact your actual trading costs.

Begin by checking each broker's official fee chart and pricing page. For example, Zerodha maintains a transparent pricing page listing a flat ₹20 per executed order across F&O, and free equity delivery trades. Angel One provides similar details online, offering flat fee structures and a side-by-side segment comparison chart.

It's important to compare charges as they vary by segment—Groww offers zero brokerage on equity delivery but charges ₹20 or 0.05% (whichever lower) for intraday trades. User reviews on forums such as TradingQ&A or Value Research often reveal hidden costs or real-world billing issues, offering insights that official sites may lack.

2. Is it safe to use these discount brokerage apps for sizable investments?

Security is a primary concern, especially when investing substantial amounts. Most established discount brokers are SEBI-registered and implement robust safeguards. Look for features like mandatory two-factor authentication, regular security audits, and clear compliance protocols.

For example, Upstox has received ISO 27001 certification and uses biometric logins, while Zerodha utilizes app-based OTPs for additional protection. Maintaining a list of client support and emergency contacts can help resolve technical issues swiftly.

3. What documents are typically needed to open an account?

Digital KYC procedures have made account opening faster, but you’ll still need to provide key identification and address proofs. The most common requirements are a PAN card, Aadhaar card, and a recent bank statement to verify your account linkage.

Some apps, like Angel One, prompt users to upload a live photo or flagged e-signature to complete KYC. These measures reduce fraud risk and ensure regulatory compliance. Always keep scanned, updated copies ready to streamline the signup process.

4. Can I switch between multiple apps for different kinds of trading?

It's common for investors to use one app for stocks and another for mutual funds or options, depending on features and fee structures. For instance, you might use Zerodha for F&O trades due to its segment expertise, and switch to Groww for straightforward mutual fund investments.

However, you must manage KYC processes and bank account details separately for each platform. Each broker needs its own set of verification documents, so staying organized makes multi-app usage smoother.

5. Do these apps offer tax reporting or capital gains statements?

Leading brokerage platforms typically offer integrated tax and statement tools. For instance, Upstox and ICICI Direct both provide downloadable capital gains statements to simplify tax filing for Indian investors. These are available within each app’s dashboard or reports section.

Beyond basic profit and loss statements, many brokers deliver end-of-year summaries specifically formatted to streamline reporting for income tax return preparation. This service eases portfolio tracking and ensures compliance during tax season.