Top 10 Mutual Fund Platforms Revolutionizing Investments: From KarvyMFS to Coin by Zerodha

Explore the top 10 mutual fund platforms transforming how Indians invest, with exclusive insights on innovative features, transparency, and smarter decision-making tools.

Investing in mutual funds is undergoing a transformation as digital platforms bring greater accessibility, transparency, and efficiency to American investors. With platforms like KarvyMFS, Coin by Zerodha, Groww, and others leading the charge, investors have more choices and tools than ever before to help grow and diversify their portfolios.

This article explores the top 10 mutual fund platforms that are redefining the investment experience for US investors. From intuitive user interfaces to robust educational resources, each platform offers unique features designed to empower both beginners and seasoned traders. Our goal is to provide actionable insights and clear comparisons to support smarter investment decisions in the evolving world of mutual funds.

In a landscape where technology meets investment acumen, the platforms we choose become the architects of our financial future—reshaping how Americans perceive mutual funds, from the traditional touch of KarvyMFS to the innovative ease of Coin by Zerodha.

Further Read: https://decentro.tech/blog/mutual-fund-investment-apps/

Introduction

Finding the right mutual fund platform can make a significant difference in an investor’s experience, especially in a landscape marked by countless choices and complex information. Investors rely on these platforms not just for transaction execution, but also as trusted sources for research, transparent fee structures, and user-friendly tools. For both first-time mutual fund buyers and those seasoned in the markets, selecting a reliable platform is a decision that impacts portfolio growth and peace of mind. Our business specializes in providing data-driven answers, market insights, and educational resources to empower such well-informed decisions.

Technology is continuously shaping how Americans invest and trade, making the process more accessible and transparent. From user interfaces that simplify navigation to integrated risk assessment tools, technological advancements now allow investors of all backgrounds to make choices that better align with their financial goals. The ease of access that technology introduces, however, also means that careful evaluation of platforms becomes crucial to avoid missteps and ensure that investments are aligned with individual needs.

How to invest in SIP

This guide highlights ten innovative mutual fund platforms that stand out for their dedication to empowering US investors. Each platform has been selected based on its commitment to delivering trustworthy information, seamless convenience, and educational features tailored for individuals at all stages of their investment journey. With clarity in recommendations and a focus on transparency, these platforms aim to simplify mutual fund investing and support smarter investment choices every step of the way.

1. KarvyMFS: Pioneering Mutual Fund Investments

KarvyMFS has established itself as a trailblazer in the mutual fund landscape, catering to a diverse audience ranging from beginner traders to seasoned finance enthusiasts. The platform differentiates itself by offering comprehensive solutions for mutual fund investments, backed by technology and a strong commitment to investor education. As a trusted source for market insights and trading support, KarvyMFS empowers investors with the resources and guidance necessary for informed decision-making.

Streamlined digital onboarding and portfolio management

Getting started with mutual funds on KarvyMFS is straightforward, thanks to a user-friendly digital onboarding process. New investors can create accounts, complete compliance checks, and begin building their investment portfolio within minutes, all online. The platform also simplifies ongoing portfolio management, offering tools for tracking performance, setting financial goals, and rebalancing investments as market conditions evolve. For individuals seeking a seamless way to start and manage their mutual fund journey, KarvyMFS delivers efficiency without compromising on security or compliance.

In-depth data analytics and research tools for informed decisions

KarvyMFS distinguishes itself through its integration of advanced data analytics and robust research tools. Investors have access to a wide array of performance reports, fund comparisons, and real-time market analytics tailored for mutual fund selection. The platform enables users to evaluate fund managers, historical returns, and risk profiles, supporting deeper investment acumen. This comprehensive suite of research capabilities allows both novices and experienced investors to confidently align their strategies with financial objectives based on transparent, actionable insights.

Reliable customer support and comprehensive educational resources

A key pillar of KarvyMFS’s value proposition is its unwavering commitment to customer support and investor education. The platform offers responsive assistance across channels, addressing investor queries in a timely manner. Additionally, KarvyMFS provides a rich library of educational resources — from beginner guides to expert market commentaries — designed to elevate financial literacy and empower users. Whether needing clarification on mutual fund basics or seeking advanced trading strategies, investors benefit from accessible, expert-driven guidance that builds confidence in their investment decisions.

Further Read: https://mfs.kfintech.com/investor/

2. MF Central: One-Stop Solution for All Mutual Fund Services

MF Central brings together a comprehensive suite of mutual fund services, streamlining the experience for individual investors, finance enthusiasts, and those just exploring mutual funds for the first time. As a platform that empowers users with actionable insights and transparent information, MF Central strives to make every aspect of mutual fund investing more efficient and accessible. Powered by a commitment to investor education and clarity, the platform stands out for its holistic approach to trading and market inquiries. Below, we explore the core offerings that set MF Central apart.

Aggregated Portfolio Management Across Multiple AMCs

One of the standout features of MF Central is its ability to consolidate investment holdings from various Asset Management Companies (AMCs) into a single, intuitive dashboard. Investors no longer need to navigate multiple platforms or track disparate statements. Instead, MF Central provides a unified view of all mutual fund investments, enabling users to monitor performance, distribution, and asset allocation with ease. This centralized portfolio management simplifies record-keeping and gives investors greater clarity when analyzing their mutual fund strategies, empowering them to make informed decisions tailored to their financial goals.

Advanced Transaction Features: Switching, Redeeming, and Tracking

MF Central offers investors a range of transaction tools designed to enhance flexibility and control over their mutual fund investments. Users can execute switches between different funds, initiate redemptions, or track the status of ongoing transactions—directly from the platform. These features are seamlessly integrated to minimize administrative effort and expedite the investment process. By putting advanced transaction capabilities at investors' fingertips, MF Central ensures that users can respond quickly to market developments and adjust their investment portfolios as needed, all while maintaining a streamlined user experience.

Seamless Integration with Digital KYC and Compliance Tools

Regulatory compliance and investor protection are central tenets of MF Central’s platform. The system offers seamless integration with digital Know Your Customer (KYC) processes, ensuring that onboarding and ongoing compliance checks are both efficient and secure. Investors can complete verification procedures, update personal information, and monitor compliance status from within their account—eliminating paperwork and reducing turnaround times. This digital-first approach allows users to focus more on their investment choices and less on administrative hurdles, fostering a trustworthy environment for mutual fund transactions and portfolio management.

Further Read: https://www.mfcentral.com/

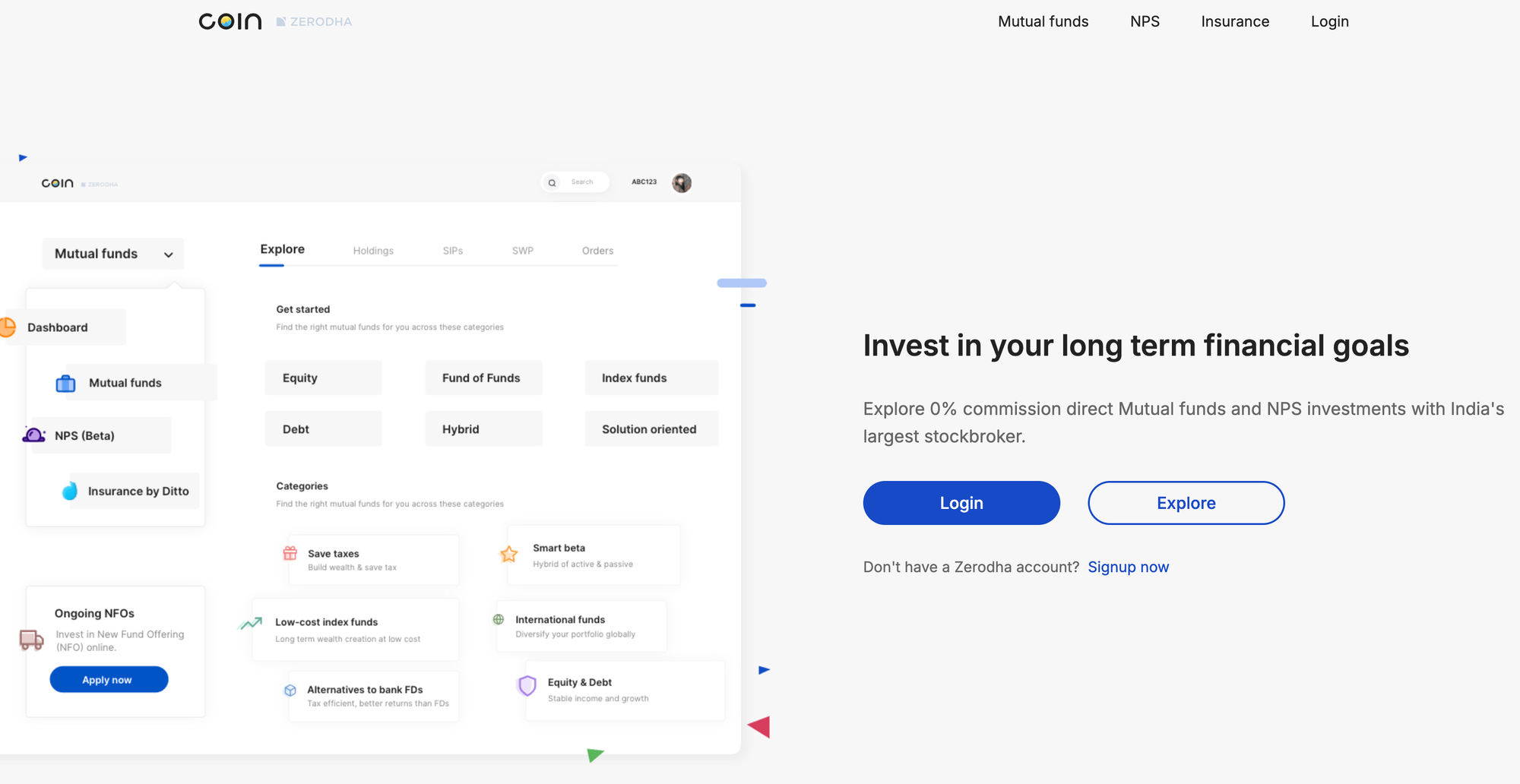

3. Coin by Zerodha: Zero Commission Direct Mutual Funds

Coin by Zerodha stands out as a dedicated platform for mutual fund investment, seamlessly connecting investors with a vast array of direct mutual fund plans. Designed for those who are keen on maximizing returns and minimizing costs, Coin is integrated within the broader Zerodha ecosystem—making it a reliable choice for individual investors, beginner traders, and finance enthusiasts eager to learn and grow.

Zero Commission Access to Direct Mutual Fund Plans

One of the signature features of Coin by Zerodha is its zero-commission model for investing in direct mutual fund schemes. This means users invest directly with mutual fund companies, avoiding the expense of distributor commissions that are typical with regular plans. The absence of these recurring charges enables investors to retain a higher portion of their investment gains over the long term. This transparent and cost-effective approach empowers users to optimize their financial growth, aligning with the platform’s mission to support informed decision making in trading and investments.

Effortless Integration with Zerodha’s Brokerage Ecosystem

Coin is designed to work flawlessly with Zerodha’s acclaimed brokerage services, simplifying the investment experience for users. Investors can manage mutual funds alongside other financial instruments like stocks and bonds, all from a centralized dashboard. This integration enhances convenience, making portfolio supervision straightforward and intuitive while streamlining tracking and reporting. New and seasoned investors alike benefit from consolidated insights and efficient management tools, simplifying what can often be a complicated process.

Intuitive Dashboard with Real-Time Tracking and Recommendations

Another key attribute of Coin by Zerodha is its user-friendly dashboard that delivers real-time portfolio tracking and investment recommendations. The interface displays the latest updates on fund performance and enables investors to monitor their goals with clarity and confidence. Personalized suggestions are offered based on user profiles and market trends, guiding both novice and experienced investors toward smarter decisions. This thoughtful design and educational focus reflect the platform’s commitment to making mutual fund investing accessible and empowering for all users.

Further Read: https://coin.zerodha.com/mf

4. Groww: Investing Simplified for New-Age Investors

Empowering investors with actionable insights and answers, Groww stands out as a go-to resource for individuals exploring trading and mutual funds. The platform offers a seamless experience, enabling first-time and seasoned investors to access a broad spectrum of mutual fund investment options and educational support. By blending intuitive tools with educational resources, Groww simplifies complexities for American investors looking to make well-informed decisions in the markets.

User-Friendly Interface for Mutual Fund Purchases and Tracking

Groww's platform is designed to make mutual fund investments approachable for everyone, especially for those just beginning to explore financial markets. The user interface combines clarity with robust functionality, ensuring tasks like researching, purchasing, and tracking mutual funds are straightforward. Investors are guided through each step, minimizing confusion and helping users maintain control over their portfolios, making it easier to monitor performance and stay on top of investment goals without being overwhelmed by technical jargon or cluttered dashboards.

Educational Blogs and Investment Guides for Beginners

Recognizing the need for investor empowerment, Groww provides an extensive library of well-structured blogs and guides. These educational resources are created specifically for individuals with varying levels of market knowledge. The content breaks down complex investment topics, offers practical tips, and addresses frequent queries related to trading and mutual funds. By prioritizing accessible language and real-world scenarios, Groww supports novice investors in building a strong foundational understanding, all while keeping the learning process engaging and interactive.

Fast SIP Initiation and Automated Portfolio Rebalancing

Setting up a Systematic Investment Plan (SIP) with Groww is engineered to be quick and hassle-free, allowing users to begin investing in just a few steps. The platform also features automated portfolio rebalancing tools, which help align investments with an individual's risk tolerance and financial goals over time. This automation reduces the manual effort required to maintain a healthy portfolio, providing investors with peace of mind and more time to focus on their long-term strategies. Groww thus simplifies both the initiation and ongoing management of mutual fund investments for its user base.

Further Read: https://groww.in/

5. Paytm Money: Powerful Mutual Fund Investing on the Go

Paytm Money has made mutual fund investing more accessible and straightforward for individuals who value convenience and robust insights. As a platform dedicated to answering queries about trading and markets, Paytm Money empowers investors through a seamless digital experience, offering educational resources and curated fund recommendations. Here’s how the app enhances the mutual fund investing journey for American investors seeking control and clarity in their investment choices.

Access to a Wide Range of Mutual Fund Schemes

With Paytm Money, users gain access to an expansive array of mutual fund options spanning various asset classes, risk profiles, and investment objectives. Whether you prefer equity, debt, or hybrid funds, the platform connects investors to schemes from leading asset management companies. This diversity allows for customization based on personal financial goals, risk tolerance, and time horizons, enabling you to build a portfolio that truly reflects your individual needs.

Detailed Fund Analysis with Performance and Rating Comparisons

Paytm Money supports informed decision-making by providing in-depth analysis of each mutual fund. The app features detailed insights into fund performance histories, risk-adjusted returns, and comparison tools that position multiple funds side by side. Investors can easily gauge the reliability and consistency of funds by reviewing ratings from reputed agencies, expense ratios, historical returns, and peer comparisons. This analytical approach helps demystify fund selection and empowers even novice investors to make confident choices.

Secure Transactions with 24/7 In-App Support

The platform prioritizes the security of every investor’s transaction and data with advanced encryption and stringent authentication protocols. Paytm Money’s commitment to investor safety is complemented by round-the-clock in-app support, ensuring assistance is just a tap away. Whether you’re troubleshooting a purchase or need clarity on fund features, responsive support agents help you resolve issues swiftly. This focus on reliability and assistance gives users peace of mind throughout their investing journey.

Further Read: https://www.paytmmoney.com/mutual-funds

6. ET Money: Personal Finance Made Easy

ET Money is designed to simplify financial management for investors and individuals navigating the complexities of personal finance. The platform provides accessible tools and data-driven recommendations, allowing you to make confident decisions about mutual funds and daily money matters. Its user-focused approach is ideal for American investors seeking reliable ways to manage their portfolios and gain insights into trading and investments. Here’s how ET Money empowers users with practical features and actionable insights.

Advanced Fund Recommendation Engine and Risk Profiling

Choosing the right mutual fund product can be challenging, especially for beginners or those exploring new investment opportunities. ET Money addresses these concerns with its robust fund recommendation engine, which leverages analytics and past fund performance to match users with suitable products. It incorporates comprehensive risk profiling, ensuring recommendations align with your unique investment goals and risk tolerance. By asking a few pertinent questions about your investment horizon and financial objectives, ET Money creates a personalized shortlist, guiding you toward mutual funds that reflect your preferences and comfort with market fluctuations.

Automated Expense Tracking Alongside Mutual Fund Investments

Keeping a clear overview of your finances is crucial for building wealth and avoiding overspending. ET Money offers automated expense tracking that integrates seamlessly with your mutual fund investments, giving you a holistic view of your money flow. With minimal manual input, the platform categorizes spending and highlights trends, enabling you to spot areas for savings and improvement. As you monitor both expenses and investments side-by-side, it becomes easier to identify opportunities to redirect surplus funds into growth avenues, fostering disciplined financial habits and smarter investment contributions.

Personalized Insights and Tax-Saving Suggestions

Maximizing returns and minimizing tax liabilities are fundamental to sound financial management. ET Money stands out by providing tailored insights drawn from your spending and investment data, offering suggestions for efficient tax-saving strategies. The platform identifies eligible tax-saving mutual funds and highlights deduction opportunities based on your profile, helping you optimize your income and investment returns. Whether you’re a seasoned investor or just starting out, actionable tips and educational guidance within the platform empower you to make informed decisions, turning knowledge into measurable benefits and contributing to your long-term financial well-being.

Further Read: https://www.etmoney.com/learn/personal-finance/

7. Kuvera: Goal-Based and Transparent Investing

For American investors exploring the world of mutual funds, Kuvera offers a distinctive approach centered around clear objectives and transparent practices. As a resource for individuals looking to build and optimize their portfolios, Kuvera emphasizes tools and features that empower you to make smarter decisions about your money. This section highlights the key aspects of Kuvera's platform, focusing on how goal-based planning and transparency benefit investors of all experience levels.

Goal-setting Tools for Personalized Investment Planning

Setting financial goals is the first critical step toward successful investing. Kuvera equips users with goal-setting tools designed to personalize your investment journey. These tools allow you to input your financial targets, such as saving for retirement, a child's education, or a major purchase. Based on these parameters, Kuvera recommends suitable mutual fund portfolios and provides insights on how much to invest to achieve your objectives. This level of personalization not only keeps you motivated but also ensures your investment strategy aligns with your unique financial needs, offering clarity and confidence at each stage.

Family Portfolio Management and Real-Time Alerts

Managing investments for a family can quickly become complex. Kuvera simplifies this process by allowing you to oversee all family portfolios in one place. With its intuitive dashboard, you can track individual and family-wide investment progress. Real-time alerts keep you informed of important portfolio events and changes, enabling quick action when needed. Whether you're monitoring market shifts or upcoming SIP dates, these timely notifications help maintain control and foster a proactive investment approach for your entire household.

Exclusive Direct Fund Access for Cost-Efficient Investing

Lowering costs is vital for maximizing long-term investment returns, especially in mutual funds. Kuvera offers exclusive access to direct mutual fund plans, which come without the additional commissions and fees associated with regular fund options. By choosing direct funds through Kuvera, investors benefit from greater cost efficiency and improved overall returns. The transparent fee structure and unbiased recommendations make it easier for you to invest with confidence, knowing that your interests are prioritized above all else.

Further Read: https://kuvera.in/blog/goal-based-investing/

8. Upstox: Speed and Simplicity in Mutual Fund Trading

Upstox focuses on making mutual fund trading more accessible and efficient for individual investors and beginner traders. As a platform dedicated to investor education, Upstox helps users get answers to their trading queries while providing tools that simplify the investment process. Here’s how Upstox stands out in speed, ease of use, and investor empowerment.

Fast Order Execution and Instant Investment Features

Efficiency is a priority when investing, and Upstox delivers by offering fast order execution across its platform. Investors can make mutual fund purchases and redemptions quickly, with most transactions requiring only a few clicks or taps. Instant investment features allow users to respond to market opportunities without unnecessary delays, which can be especially reassuring for new investors aspiring to act on educational insights immediately. This streamlined process allows users to stay focused on their investment goals rather than navigation or paperwork.

Unified Account for Equities, ETFs, and Mutual Funds

Upstox simplifies portfolio management by offering a single account that enables access to equities, exchange-traded funds (ETFs), and mutual funds. This unified platform design saves investors from juggling multiple accounts or logins, cutting down on administrative headaches. With all portfolio assets visible in one interface, users can track their holdings more efficiently, make more informed decisions, and compare investment performance easily. The integration supports a seamless experience, ideal for both experienced and novice investors seeking consolidated market insights.

Extensive Educational Content for Beginner Investors

Education is central to the Upstox platform, which regularly provides in-depth guides, articles, and tutorials tailored to beginner investors. From explaining mutual fund basics to offering actionable tips and the latest trends, Upstox’s educational resources empower users to invest with confidence. These materials are written in straightforward language, making it easier for newcomers to navigate the complexities of mutual fund trading. By combining actionable knowledge with a robust platform, Upstox supports informed decision-making at every step.

9. Scripbox: Curated Investing for Hassle-Free Experience

Scripbox stands out in the crowded landscape of investment platforms by centering its approach on clarity and ease. Designed for individual investors, beginner traders, and finance enthusiasts, Scripbox simplifies the mutual fund investment journey. As a trusted resource for market insights and trading education, the platform is dedicated to empowering users with the knowledge needed to make informed financial decisions. Here’s how Scripbox’s curated investing approach enables a seamless, guided experience for all investors.

Scientific Curation of Mutual Funds Based on Investor Profile

Scripbox employs a data-driven, scientific process to recommend mutual funds tailored to each investor’s unique profile. The platform takes into account factors such as risk tolerance, investment goals, and time horizon. This thorough analysis ensures that every recommendation aligns closely with the user’s financial objectives. As a result, investors can confidently build a mutual fund portfolio that reflects their personal circumstances without the stress of sifting through a vast array of options.

Step-by-Step Investment Guidance for Wealth Building

Understanding that the investment landscape can be daunting, especially for those new to mutual funds, Scripbox provides clear, actionable steps for starting and growing investments. From account setup to fund selection, guidance is broken down into manageable phases. This structured approach not only builds investor confidence but also encourages consistent investment habits. By following Scripbox’s step-by-step guidance, users are empowered to steadily work toward their long-term wealth-building goals.

Auto-Review, Rebalancing, and Easy Goal Tracking

Scripbox streamlines ongoing portfolio management through its automated review and rebalancing features. The platform regularly assesses users’ portfolios, suggesting adjustments to keep investments aligned with their goals and market movements. Investors can also track their progress through intuitive goal-tracking tools, making it simple to see how their investments are performing in relation to desired financial outcomes. This combination of automation and transparency reduces the day-to-day hassle of managing investments while fostering greater confidence among users.

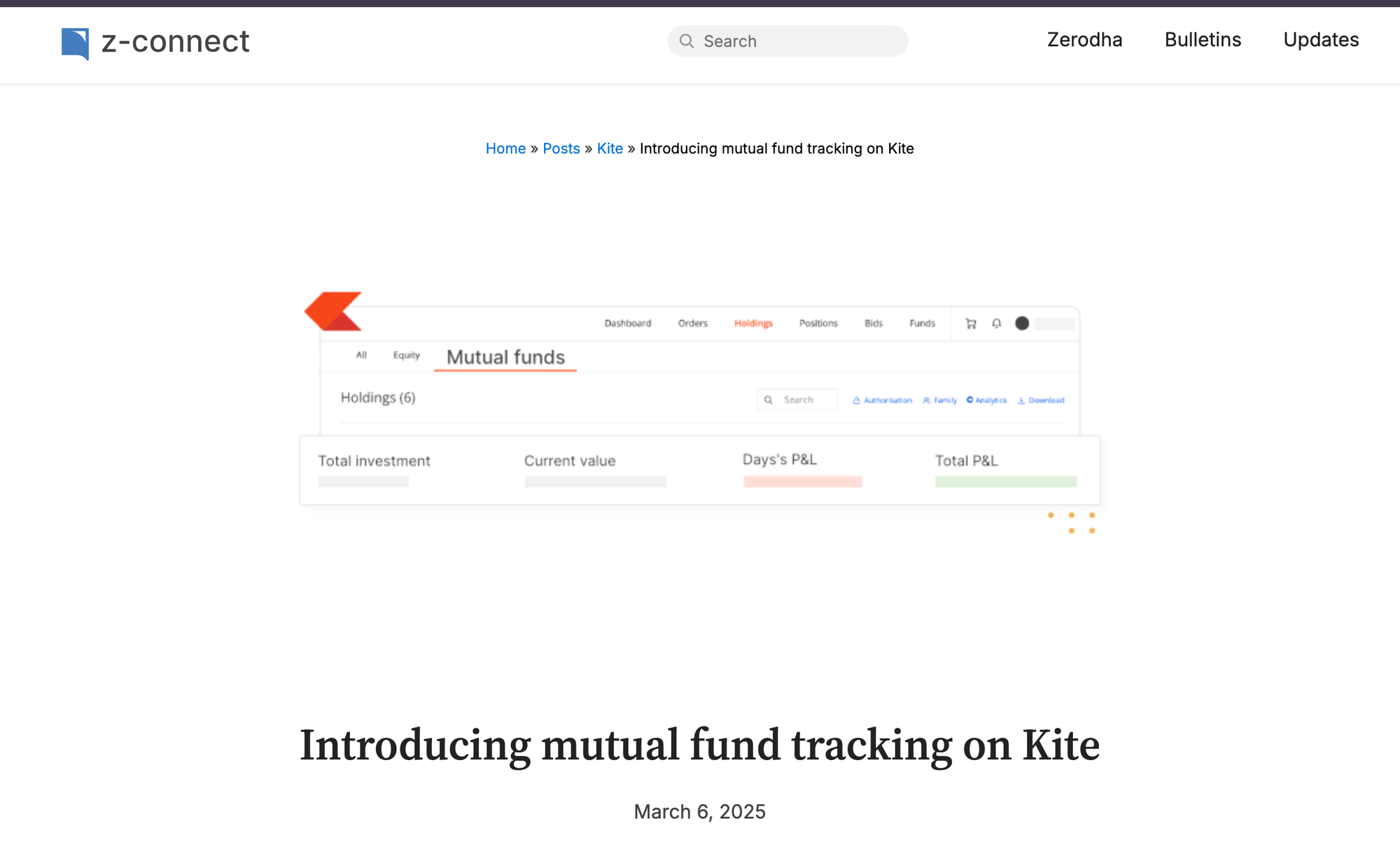

10. Zerodha Kite: Empowering Investors with Data and Intuition

Zerodha Kite stands out as a robust trading and investment platform that enhances how investors interact with the markets. By fusing advanced data analytics with practical investment tools, Zerodha Kite caters to both new traders and seasoned investors, especially those keen on mutual funds. The platform is instrumental for individuals seeking knowledge, actionable insights, and a seamless experience in financial markets.

Deep Market Analytics and Mutual Fund Screeners

For investors who want to make data-driven decisions, Zerodha Kite provides access to advanced market analytics tools. These tools offer detailed visualizations, customizable charts, and in-depth data points for stocks and mutual funds. The mutual fund screener is particularly beneficial for those exploring new opportunities, allowing users to filter funds based on parameters like performance, expense ratio, and asset allocation. With these analytics, even beginners can sift through vast market data, compare fund performance, and choose investments that align with their financial goals.

Integrated News, Alerts, and Trend Indicators

Staying updated on market movements and news is crucial for timely investment decisions. Zerodha Kite integrates real-time news updates, personalized alerts, and trend indicators directly into its dashboard. This means investors and traders don't have to switch between multiple platforms to monitor events impacting their portfolios. Immediate notifications enable users to respond quickly to significant price changes or industry developments, while the trend indicators help identify buying or selling opportunities. Having these features on one platform equips users with the information they need, exactly when they need it.

Seamless Access Between Trading and Mutual Fund Investments

Zerodha Kite offers a unified investing experience by allowing effortless movement between stock trading and mutual fund investing. This seamless integration ensures that users can allocate or rebalance funds without redundant processes or delays. The platform's intuitive interface guides beginners and seasoned investors alike through executing trades, exploring mutual funds, and monitoring portfolio performance in one ecosystem. By centralizing these services, Zerodha Kite reduces complexity and empowers users to diversify their investments conveniently, supporting informed financial decisions across various asset classes.

Conclusion

As you navigate the world of mutual funds, understanding the role of the platform you choose is a critical step toward reaching your financial objectives. At our core, we aim to empower investors through informed insights, practical recommendations, and a supportive educational environment tailored for both novice traders and seasoned finance enthusiasts.

- Choosing the right mutual fund platform is key to optimizing portfolio growth and achieving financial goals.

Selecting a mutual fund investment platform is more than just about convenience; it is a foundational decision that can influence portfolio performance over time. A platform suited to your investment style, risk tolerance, and financial aspirations enables you to track, manage, and rebalance your portfolio efficiently. By prioritizing platforms with reliable performance tracking tools, robust reporting, and accessible customer support, investors can place themselves in a strong position to optimize returns and confidently work toward their financial milestones. - Platforms from KarvyMFS to Coin by Zerodha blend user-centric features, education, and transparency.

The mutual fund ecosystem offers platforms with unique attributes, ranging from KarvyMFS's comprehensive research resources to Coin by Zerodha's simplified digital investment experience. These platforms distinguish themselves through user-friendly interfaces, educational content geared toward building investment acumen, and transparency that fosters trust. This range provides individual investors and finance enthusiasts with the flexibility to choose a provider that aligns with their strategy, whether they prioritize ease of use, learning opportunities, or actionable insights. - Leveraging these options empowers US investors and new traders to make informed, confident, and empowered investment decisions.

By leveraging the strengths of top-rated mutual fund platforms, investors in the US—especially those new to trading and mutual funds—can gain the confidence to take decisive steps toward their financial aspirations. The combination of extensive resources, clear information, and educational guidance prepares individuals to navigate market complexities with assurance. Ultimately, the right platform serves not just as a transactional gateway, but as an enabler of financial literacy and long-term wealth creation, furthering our mission to answer your trading queries and support your investment journey.

FAQs

Understanding Mutual Fund Platforms: Key Questions Answered

As you explore mutual fund investments, it’s natural to have questions about the various digital platforms and their unique value. Here’s a detailed explanation addressing some of the most frequently asked questions to empower your investment journey with knowledge and actionable insights.

What is the main advantage of using platforms like KarvyMFS or MF Central for mutual fund investments?

- Platforms such as KarvyMFS and MF Central offer centralized access to multiple mutual funds from different asset management companies. The primary benefit is the convenience of managing all your investments in one place. These platforms provide consolidated account views, simplified transaction tracking, and easier documentation, making the investment process more efficient. For both beginners and experienced investors, this integration removes much of the paperwork and complexity associated with managing different portfolios.

How do direct mutual fund platforms like Coin by Zerodha help reduce investment costs?

- Direct mutual fund platforms, such as Coin by Zerodha, offer investors a way to buy funds directly from the asset management companies without involving intermediaries. By eliminating distributor commissions and fees, investors gain access to lower expense ratios, which means higher potential returns over time. These cost savings can significantly impact long-term wealth accumulation, making direct platforms an attractive option for cost-conscious investors.

Are these mutual fund platforms suitable for beginners?

- Most mutual fund investment platforms are designed to be user-friendly, featuring intuitive interfaces and guided workflows tailored for those new to investing. Beginners benefit from step-by-step onboarding processes, FAQs, and support options that simplify account setup, fund selection, and ongoing management. The platforms typically provide recommendations and helpful content which demystify mutual funds, making them approachable for individuals with little to no prior investment experience.

How secure are my transactions and data on these digital investment platforms?

- Trusted mutual fund platforms adhere to robust security protocols, including encryption, two-factor authentication, and strict regulatory compliance. These measures are designed to safeguard users' personal data and financial transactions from unauthorized access. Reputable platforms also collaborate with regulatory authorities, regularly updating their security features to address emerging threats, offering investors peace of mind regarding the safety of their digital investments.

Can I manage SIPs and portfolio rebalancing seamlessly across these platforms?

- Digital mutual fund platforms generally support seamless initiation, management, and modification of Systematic Investment Plans (SIPs). Many also offer tools for tracking portfolio performance and suggest rebalancing based on your goals. This enables investors to adjust asset allocation in response to market changes or evolving personal objectives, ensuring that your investment strategy remains aligned and efficient over time.

What educational resources do these platforms provide to support investor knowledge?

- Investor education is a key component of many leading mutual fund platforms. They offer a wealth of resources—including tutorials, webinars, articles, and market insights—to guide users through different investment concepts and strategies. Such resources empower both beginners and experienced investors to make well-informed decisions, reinforcing the mission of this platform: providing actionable insights and supporting smarter investment choices in trading and markets.