Top 5 Indian ETFs to Consider in 2025

Explore the top 5 Indian ETFs for 2024—ideal for US investors seeking diversified, low-cost access to India’s equity markets. Start your research here.

Introduction

Indian Exchange Traded Funds (ETFs) have become increasingly prominent on the global stage as foreign investors look for high-growth opportunities beyond traditional markets. India’s robust GDP growth—exceeding 7% for several consecutive years—combined with its tech-driven economy and broad consumer base, has pushed Indian equities into the international spotlight.

For investors based in the US or elsewhere who want straightforward, diversified access to Indian stocks, US-listed Indian ETFs offer a strategic solution. These funds present a convenient and cost-effective way to gain exposure to sectors like information technology, financial services, and consumer goods without taking on single-stock risk. For instance, the iShares MSCI India ETF (INDA) and WisdomTree India Earnings ETF (EPI) are both widely traded vehicles popular among US retail investors.

This curated compilation spotlights the most reliable and liquid US-listed Indian ETFs available for 2024. It delivers actionable insights for anyone aiming to diversify globally, outlining which funds have consistently attracted assets, delivered strong historical returns, and maintained high liquidity. Special consideration is given to factors such as expense ratios, tracking accuracy, and portfolio concentration. Understanding these elements can help investors avoid common pitfalls and build confidence in navigating emerging market ETFs.

iShares MSCI India ETF (INDA)

Overview

The iShares MSCI India ETF (INDA) stands out as one of the largest and most actively followed India-focused exchange-traded funds available to U.S. investors. This ETF tracks the MSCI India Index, offering a gateway for global investors seeking exposure to a broad slice of the Indian equity market.

Given INDA’s size and popularity, it is often regarded as a benchmark for U.S. investors interested in Indian equities. Numerous financial news outlets rank INDA among the 10 best India ETFs for 2024, reflecting its wide adoption and robust trading volumes.

Key Details

Understanding the structural features of INDA can help investors assess if the fund matches their portfolio needs. The ETF is managed by BlackRock, a leader in investment management globally.

| Attribute | Details |

|---|---|

| Ticker | INDA |

| Issuer | BlackRock |

| Expense Ratio | 0.66% |

| Assets Under Management | ~$6.5 billion |

These details highlight INDA's status as an accessible, sizable fund with operational efficiency suitable for diverse investors.

What Makes It Special

INDA attracts attention due to its comprehensive coverage of the Indian equity market. By holding approximately 100 stocks, primarily among large- and mid-cap companies, the fund offers diversified exposure that minimizes the risk of investing in any single Indian company.

Major holdings include names like Reliance Industries, Infosys, and HDFC Bank, which are leaders in various sectors. This breadth allows investors to capture growth across India’s dynamic industries with a single investment vehicle.

Considerations

Choosing INDA comes with specific sector exposure characteristics. The ETF notably skews toward financials and information technology—two powerhouse industries in the Indian economy. For example, financial companies like HDFC Bank and ICICI Bank typically constitute a significant portion of the portfolio.

This sector concentration means investors may face heightened risk if these industries underperform, so those looking for broader sectoral balance should weigh this consideration accordingly.

Best For

INDA’s structure makes it highly appealing for investors who want broad, hassle-free access to Indian equities without needing to analyze and select individual stocks listed overseas.

It is an ideal choice for both beginner and experienced investors seeking long-term exposure to India’s economic prospects or short-term tactical allocations to emerging markets.

Additional Info

Liquidity and tradability are paramount for ETF investors. INDA consistently ranks among the highest in daily trading volume for India-focused ETFs, making it easy to enter or exit a position without significant price impact.

This high liquidity, combined with its comprehensive portfolio, means INDA is suitable for those seeking both straightforward, long-term investment and more active tactical trading strategies.

WisdomTree India Earnings Fund (EPI)

WisdomTree India Earnings Fund (EPI)

Overview

The WisdomTree India Earnings Fund (EPI) provides investors with unique access to Indian equities, but with a powerful twist. Unlike many funds that simply track the largest stocks in the market, EPI focuses on Indian companies selected primarily based on their earnings power.

This earnings-based approach aims to target businesses that demonstrate actual profitability rather than just large market capitalizations. As a result, EPI's portfolio extends beyond just established conglomerates and includes smaller, fast-growing firms like Dabur India Ltd. or Bharat Electronics Ltd. that have shown consistent profit growth.

Key Details

Investors considering EPI should know a few essential details about this fund. Each attribute provides insight into its structure and competitive landscape among India-focused ETFs.

- Ticker: EPI

- Issuer: WisdomTree

- Expense Ratio: 0.84%

- Assets Under Management: Approximately $2.6 billion as of 2024

The fund's expense ratio sits higher than some broad index peers, reflecting its strategic, rules-based approach to stock selection.

What Makes It Special

EPI differentiates itself by focusing on company profitability, which can offer a better alignment with long-term shareholder value. This method helps reduce exposure to unprofitable businesses that can drag on portfolio performance, especially in volatile emerging markets.

The inclusion of smaller, profitable companies means EPI doesn’t just mirror the Nifty 50 or BSE Sensex, which are more limited. Instead, it provides exposure to names like Godrej Industries or PI Industries, which may not be as well-known internationally but have robust earnings histories.

Considerations

Potential investors should recognize that sector weightings within EPI can vary substantially from year to year. Since companies are weighted by earnings, sectors with surging profitability—like Indian information technology in 2023, with firms such as Infosys—can end up dominating the portfolio.

During times when banking or pharmaceutical companies report strong earnings, their representation can rise sharply. This performance-driven reshuffling introduces a different risk profile than traditional market-cap weighted funds.

Best For

EPI is well-suited for investors seeking diversified access to the Indian equity market while favoring companies that are actually making money. Its focus can appeal to those wary of speculative stocks and looking for more fundamental-based exposure.

For example, a U.S.-based investor looking to capitalize on the Indian growth story—without exposure weighted solely to giants like Reliance Industries—could benefit from EPI’s balanced approach to profitability and sector variety.

Additional Info

Quarterly dividend payments are an added feature of EPI, appealing to income-focused investors. These distributions stem from the fund’s earnings-focused approach, as profitable companies are typically more likely to pay regular dividends.

In recent years, EPI’s annual yield has fluctuated but can offer an attractive stream in addition to potential capital appreciation, especially when compared with Indian ETFs that focus solely on growth stocks and pay little or no dividends.

Reference: EPI - WisdomTree India Earnings ETF

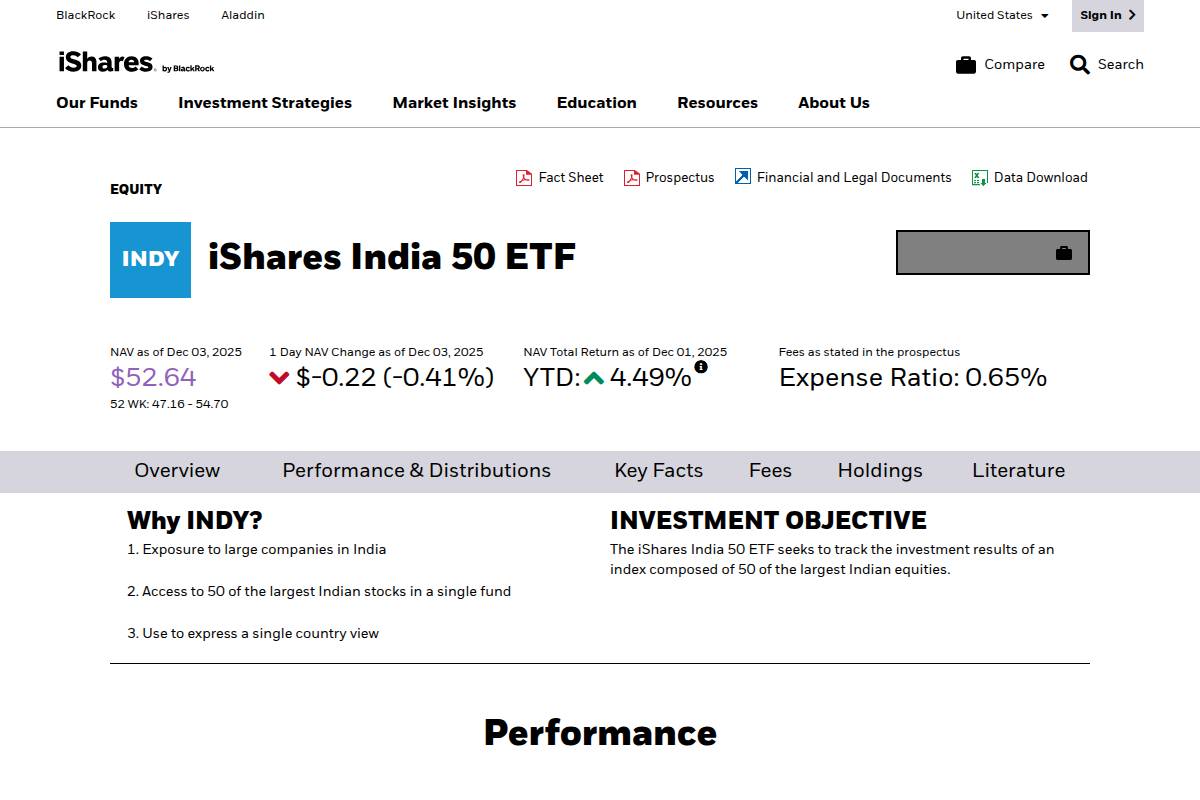

iShares India 50 ETF (INDY)

iShares India 50 ETF (INDY)

Overview

The iShares India 50 ETF (INDY) stands out as a targeted investment vehicle for those wanting exposure to India’s most prominent and financially stable companies. At its core, INDY replicates the performance of the Nifty 50 Index—India’s flagship equity benchmark composed of 50 of the country’s largest blue-chip stocks.

This ETF offers investors a streamlined way to participate in the growth trajectory of India’s leading industry players without the complexity of direct international stock selection or dealing with local Indian brokerage accounts. It is included among the 10 Best India ETFs For 2024 and is noted for its reputation and focused approach.

Key Details

When analyzing an ETF, some key statistics help investors understand its positioning and cost structure. INDY is issued by BlackRock, a globally renowned asset manager known for its rigorous risk controls and scale.

| Detail | Specification |

|---|---|

| Ticker | INDY |

| Issuer | BlackRock |

| Expense Ratio | 0.89% |

| Assets Under Management | ~$1.5 billion |

With over $1.5 billion in assets under management, INDY is one of the more liquid and established India-focused ETFs available on US exchanges.

What Makes It Special

INDY distinguishes itself through its concentrated strategy, honing in on India’s largest, most established companies. This laser focus appeals to investors seeking reliability, since these companies—such as Reliance Industries, HDFC Bank, and Infosys—have a proven track record of weathering economic cycles and delivering steady returns.

For comparison, a broader Indian ETF might provide greater diversification, but could include smaller companies with higher volatility and less predictable performance. INDY’s approach fosters more stability, aligning with investors pursuing dependable, long-term growth in emerging markets.

Considerations

While INDY’s focus is its primary advantage, it’s also important to recognize what the fund doesn’t offer. By tracking only the Nifty 50, INDY has minimal to no exposure to India’s mid- and small-cap segments, which historically can deliver outsized growth but come with additional risks.

This means investors who prefer broader market representation, or who want exposure to up-and-coming Indian enterprises, may want to supplement INDY with other funds. For instance, funds like the WisdomTree India Earnings Fund (EPI) provide a wider market cap range but may be subject to greater volatility.

Best For

Reflecting its composition, INDY is a fit for investors who prioritize blue-chip security, robust corporate governance, and exposure to well-known Indian brands. Those newer to international investing or seeking a solid, growth-oriented anchor for their India allocation are typical users.

Retirement accounts or long-term portfolios seeking equity growth—with less concern about short-term swings—can benefit from holding INDY as a foundational India ETF.

Additional Info

The INDY ETF’s current top holdings include industry titans like Infosys (IT services), HDFC Bank (financial services), and Reliance Industries (conglomerate specializing in energy, retail, and telecom). These companies have not only shaped India’s economic landscape but also have global recognition, with Infosys and HDFC Bank regularly appearing in international market discussions.

By investing in INDY, holders tap into the performance of companies repeatedly featured in major market news and analyses, underscoring the fund’s reputation as one of the 10 Best India ETFs For 2024.

Reference: iShares India 50 ETF | INDY

Invesco India ETF (PIN)

Invesco India ETF (PIN)

Overview

The Invesco India ETF, trading under the ticker "PIN," provides investors exposure to India's equity market through the Indus India Index. Unlike single-sector or blue-chip funds, this ETF includes a wide array of large and mid-cap companies. This diversity helps capture growth from fast-evolving sectors while still anchoring on established players.

For example, the fund allocates to industry leaders such as Reliance Industries in energy and Infosys in technology. By spanning multiple sectors, PIN mirrors India's broader economic landscape, making it an attractive play for those seeking to diversify country-specific risk.

Key Details

Investors should note a few important metrics that define PIN:

- Ticker: PIN

- Issuer: Invesco

- Expense Ratio: 0.78%

- Assets Under Management: Approx. $549 million

Its $549 million in AUM places it among the largest India-focused ETFs available to U.S. investors. The 0.78% expense ratio is slightly above the category average, reflecting the fund's strategy and access to specific Indian equities not easily obtained on U.S. exchanges.

What Makes It Special

PIN’s construction goes beyond basic market tracking by merging sectors and company sizes into one ETF. Rather than focusing only on familiar tech giants, it also invests in consumer, healthcare, and financial leaders such as HDFC Bank and Tata Consultancy Services. This approach captures both India's rapid tech adoption and its traditional banking growth.

For instance, when India's financial reforms boosted private banking stocks, PIN’s broad exposure helped investors benefit from both established and emerging sectors—a nuanced blend that stands out among more concentrated funds.

Considerations

While PIN provides broad exposure, cost-conscious investors may want to examine its 0.78% expense ratio, which is higher compared to some peer funds. Lower-cost alternatives like the iShares MSCI India ETF (INDA) present competition, though INDA may differ in its underlying index methodology.

If expense management is a top priority and you don't require as nuanced sector exposure, alternatives may be more suitable. Still, for those prioritizing a diversified play on India's economy, PIN's structure can justify the higher fee.

Best For

PIN appeals to investors looking for a mix of growth and value within India. It's designed for retail buyers who want efficient access to both high-flying tech names and solid financials or consumer companies, without the need to research individual Indian stocks or manage foreign accounts.

If your portfolio strategy includes balancing growth potential with steady income—and you value inclusion of firms like State Bank of India alongside tech leaders—PIN enables this blend through a single, U.S.-traded instrument.

Additional Info

One notable structural aspect is PIN's semi-annual rebalancing. This feature ensures the ETF's holdings adapt as India's markets shift, adding or resizing positions every six months based on index changes. For example, if a mid-cap firm like Avenue Supermarts, operator of DMart retail stores, grows significantly, it may become a larger component during the next rebalance.

This timely review keeps PIN's sector mix relevant, benefiting investors who wish for up-to-date representation of India’s evolving market landscape.

Reference: Invesco India ETF

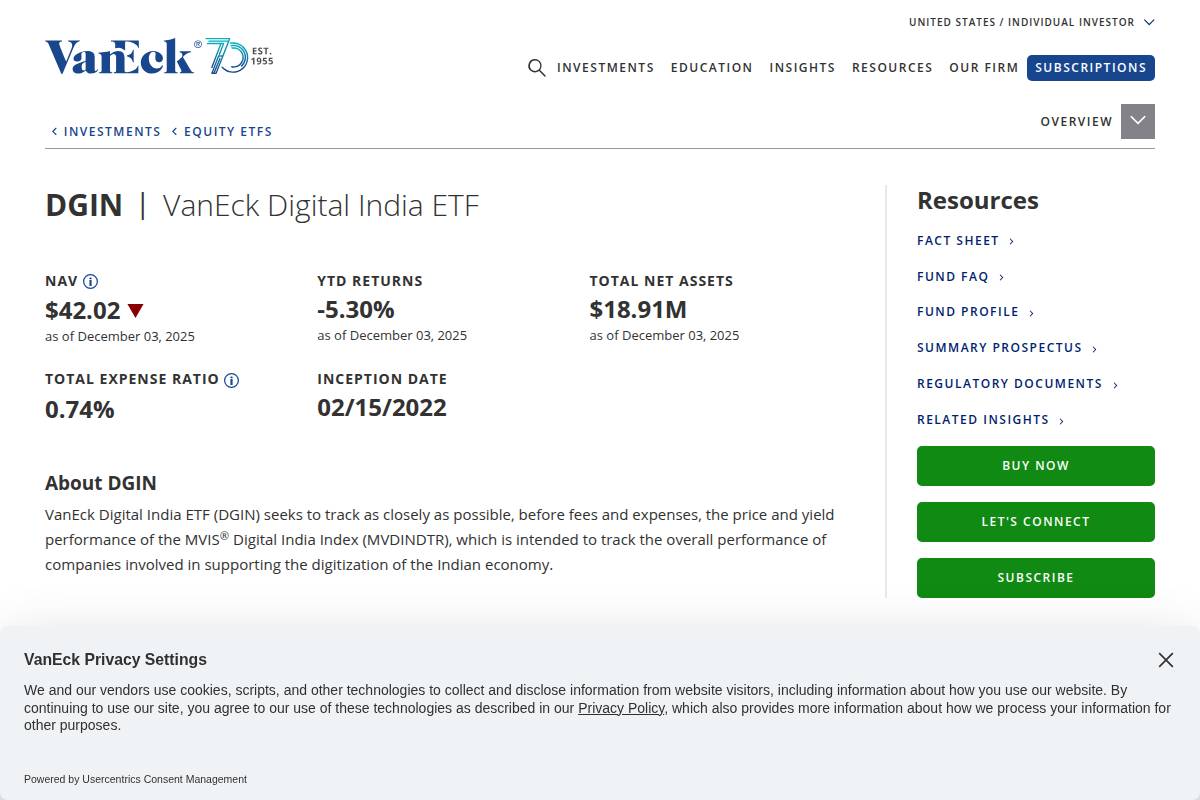

VanEck Digital India ETF (DGIN)

VanEck Digital India ETF (DGIN)

Overview

The VanEck Digital India ETF (DGIN) was developed to capture the momentum of India's rapidly expanding digital economy, offering investors exposure to sectors propelling the country's transformation. As digital infrastructure and technology adoption gain traction in India, DGIN stands out as one of the few US-listed ETFs providing direct access to this growth story.

This ETF focuses exclusively on firms positioned at the forefront of India's digital landscape. Its investment universe spans industries such as technology, telecommunications, and fintech—areas that are integral to the subcontinent's push towards a more digital-first economy.

Key Details

Understanding the basic specifications can help investors decide if DGIN aligns with their portfolio strategy:

- Ticker: DGIN

- Issuer: VanEck

- Expense Ratio: 0.75%

- Assets Under Management: Approximately $40 million

VanEck, a global investment manager known for its niche thematic ETFs, oversees DGIN. The fund's $40M AUM subset reflects its growing popularity since launch. The 0.75% expense ratio is positioned in line with other thematic ETFs offering exposure to emerging markets and technology-driven sectors.

What Makes It Special

Few US-based ETFs provide targeted exposure to India's tech sector. DGIN is designed to track the MVIS Digital India Index, which includes companies like Infosys, Tata Consultancy Services, Bharti Airtel, and HDFC Bank—firms playing pivotal roles in India's digital growth. These constituents represent diverse corners of the market, from IT services and mobile connectivity to digital banking and payments.

This thematic focus on digital transformation distinguishes DGIN from broad-based India ETFs such as INDA or PIN, which may have heavier weightings in traditional industries. Investors seeking concentrated bets on India’s leapfrogging tech ecosystem find DGIN’s unique selection criteria appealing.

Considerations

The focused nature of DGIN makes it susceptible to higher price swings, particularly given its concentration in a limited number of digital-centric companies. While the index methodology helps ensure exposure to industry leaders, it also exposes the ETF to sector-specific risk should the digital economy face regulatory hurdles or growth setbacks in India.

Recent periods have seen pronounced volatility in key holdings like Paytm and Bharti Airtel due to competition, regulatory challenges, and shifting consumer behavior. Investors should weigh their risk tolerance before considering DGIN as a portfolio addition.

Best For

DGIN is tailored for growth-oriented investors who predict continued acceleration in India’s digital ecosystem. Those bullish on trends such as mobile-first commerce, digital financial services, e-learning platforms, and the rollout of 5G networks will find this ETF closely aligned with their outlook.

For example, retail investors who missed early gains in China’s tech sector may see DGIN as an accessible entry point to participate in similar long-term growth themes emerging in India.

Additional Info

Launched in February 2022, DGIN entered the market during heightened global interest in India's digital revolution. Within its first year, it attracted over $30M in assets and has since seen increased trading volumes, reflecting its resonance with investors seeking thematic, non-US tech exposure.

The fund’s relatively short track record means it may experience periods of underperformance compared to more established, diversified India ETFs. However, its growing adoption suggests an expanding audience recognizing the opportunity in India's digital trajectory.

Reference: DGIN - VanEck Digital India ETF | Holdings & Performance

Franklin FTSE India ETF (FLIN)

Franklin FTSE India ETF (FLIN)

Overview

The Franklin FTSE India ETF (FLIN) offers U.S. investors broad exposure to Indian equities at a notably low cost. By tracking the FTSE India 30/18 Capped Index, this fund enables investors to gain access to both large- and mid-cap segments of India's dynamic stock market, without the need for direct offshore accounts.

Managed by Franklin Templeton, known for their expertise in international investing, FLIN appeals to those looking to participate in India's economic growth story. Unlike actively managed mutual funds, FLIN's passive approach focuses on mirroring its target index's performance, providing market returns with minimal intervention.

Key Details

Understanding the essential metrics of any ETF helps investors make more informed decisions. FLIN stands out in several categories:

- Ticker: FLIN

- Issuer: Franklin Templeton

- Expense Ratio: 0.19%

- Assets Under Management: Approximately $377 million (as of March 2024)

The competitive expense ratio is especially significant when compared with similar funds such as the iShares MSCI India ETF (INDA), which charges 0.89%, or WisdomTree India Earnings Fund (EPI) with 0.84%. For investors sensitive to fees, this difference can translate into meaningful long-term savings.

What Makes It Special

What sets FLIN apart is its position among the lowest-cost India-focused ETFs available in the U.S. market. This cost advantage directly supports higher net returns for buy-and-hold investors, especially over long periods.

To illustrate, a $10,000 investment in FLIN would cost just $19 annually in expenses. In contrast, the same investment in INDA would incur $89 per year—over four times more. For large accounts or portfolios emphasizing international exposure, these savings compound significantly.

Considerations

While FLIN offers an attractive fee structure, investors should be aware of its smaller asset base and lower average trading volumes compared to some peers. The fund's $377 million in assets is substantially below INDA (over $6 billion) or EPI (about $3 billion).

Realistically, this may result in wider bid-ask spreads and less on-screen liquidity for large trades. For example, investors trading high volumes (e.g., institutional allocators or trading desks) may see better execution efficiency in larger ETFs, though most retail investors would find FLIN's liquidity sufficient for typical buy-and-hold strategies.

Best For

FLIN fits the needs of fee-conscious investors seeking efficient access to India's equity markets. It may appeal to U.S.-based individuals adding emerging markets diversification to their portfolios, or those using a core-and-satellite approach where cost minimization is critical.

For example, a retail investor with an S&P 500 ETF core might use FLIN as a satellite holding to tap into India's growth, without sacrificing returns to excessive fund fees.

Additional Info

Employing a fully passive, index-based strategy, FLIN aims to replicate the performance of the FTSE India 30/18 Capped Index. Unlike some active funds, it doesn't rely on manager discretion or market timing—just straightforward, transparent index tracking.

This approach offers predictable methodology, low turnover, and high tax efficiency, which can be advantageous for U.S. investors concerned about the impact of short-term capital gains. Investors looking for a rules-based, emerging markets exposure often choose such products for simplicity and transparency.

Reference: Franklin FTSE India ETF - FLIN

Global X MSCI India ETF (GLIN)

Global X MSCI India ETF (GLIN)

Overview

The Global X MSCI India ETF (GLIN) offers investors a pathway to gain broad-based exposure to Indian public equities. Unlike single-sector or large-cap only instruments, GLIN is constructed to track the performance of a wide swath of companies across various market capitalizations—including large-, mid-, and small-cap stocks.

This ETF is particularly appealing to investors who want to engage with a dynamic emerging market like India while achieving portfolio diversification. For instance, instead of being limited to heavyweights like Reliance Industries or Infosys, the fund also taps into expanding sectors such as consumer discretionary and financials, as tracked by the MSCI India Index.

Key Details

Understanding the vital statistics of an ETF helps assess its suitability. GLIN is issued by Global X and trades under the ticker GLIN. The fund currently maintains an expense ratio of 0.85%, which includes management and administrative fees. As of early 2024, its assets under management stand at approximately $180 million, placing it in the mid-tier range for India-focused ETFs.

Compared to larger funds like iShares MSCI India ETF (INDA), which boasts billions in AUM, GLIN caters to a more specialized segment looking for diversified exposure but with a tolerable fee structure and manageable fund size.

What Makes It Special

The unique aspect of GLIN lies in its broader sector and market cap coverage. Not only does it feature industry giants such as HDFC Bank, Tata Consultancy Services, and Bharti Airtel, but it also captures emerging players in the pharmaceuticals and technology sectors—a shift in the Indian economy that’s illustrated by fast-rising companies like Divi’s Laboratories and Info Edge.

This strategy allows investors to participate in sectors fueling India’s economic growth, such as digital services, infrastructure, and green energy, which are often underrepresented in narrower, large-cap indices.

Considerations

Liquidity is an important factor when selecting an ETF, impacting both trading costs and the ability to enter or exit positions efficiently. GLIN typically sees lower average daily trading volumes compared to giants like INDA or WisdomTree India Earnings Fund (EPI).

This could lead to wider bid-ask spreads for U.S. investors. It’s advisable to use limit orders and monitor trading volumes, especially for sizable transactions. For example, some retail investors have noticed price slippage when attempting trades over 5,000 shares in a single order, so careful execution is recommended.

Best For

GLIN is ideal for investors who want to take a comprehensive approach to Indian equities—beyond just blue-chip names. This suits market participants interested in sectors like IT services and emerging e-commerce, as well as those looking for exposure to companies benefitting from themes such as Indian urbanization and rising middle-class consumption.

An individual seeking diversified geographic allocation within their overall emerging markets portfolio can use GLIN as a core holding to capture growth across India’s economy.

Additional Info

GLIN distributes dividends on an annual basis. The payout is composed of the underlying companies’ aggregate dividends, minus fund expenses. For instance, in recent years, investors received annual distributions typically timed after the fiscal year-end, providing an added layer of return beyond capital appreciation.

Dividend-paying ETFs like GLIN can appeal to investors who appreciate an income component along with their growth exposure—a dual benefit that makes it especially attractive for long-term, globally minded investors.

Reference: VanEck India Growth Leaders ETF (GLIN)

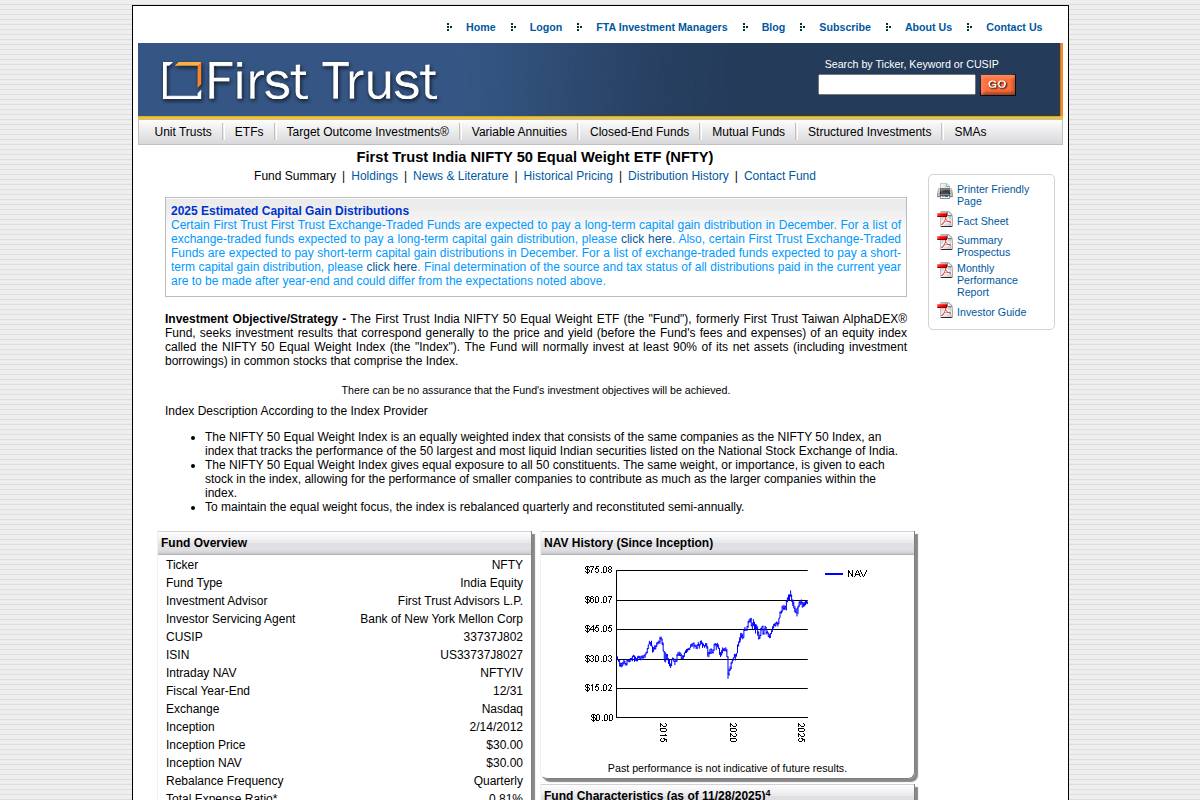

First Trust India NIFTY 50 Equal Weight ETF (NFTY)

First Trust India NIFTY 50 Equal Weight ETF (NFTY)

Overview

The First Trust India NIFTY 50 Equal Weight ETF (NFTY) offers investors unique exposure to Indian equities by tracking the Nifty 50 Index. Unlike conventional index funds that overweight large-cap companies, this ETF applies an equal weighting methodology, giving each of the 50 constituent stocks identical portfolio influence.

This design shifts the performance dynamics significantly. For example, major players like Reliance Industries and HDFC Bank, which dominate the regular Nifty 50 by market capitalization, carry the same weight as smaller constituents such as Bharat Petroleum or Divi’s Laboratories. This helps mitigate the outsized influence of a few mega-cap firms.

Key Details

For investors considering NFTY, a clear understanding of its structure and costs is key. The ETF's ticker is NFTY, and it is issued by First Trust, a recognized provider of thematic and index-based ETFs on US exchanges.

- Expense Ratio: 0.80% – reasonable for a specialized international ETF, but higher than some US-based passive funds.

- Assets Under Management: Approximately $67 million as of early 2024, reflecting modest but growing interest in Indian market diversification among US investors.

What Makes It Special

The equal-weighting structure sets NFTY apart from traditional Nifty 50 or India-focused ETFs. By distributing portfolio weight equally, the fund aims to control sector and stock-level concentration risk.

For example, in cap-weighted Indian ETFs such as iShares MSCI India ETF (INDA), financial heavyweights like HDFC Bank or Infosys can often account for over 8% of total assets each, potentially creating vulnerabilities if those stocks stumble. NFTY, by contrast, limits each company to roughly 2% of the portfolio, creating a more balanced approach.

Considerations

Investors should recognize that performance may deviate from mainstream cap-weighted versions of the Nifty 50. In bull markets driven by India’s biggest firms, equal-weight ETFs may lag their cap-weighted counterparts.

For instance, during multi-year rallies where Reliance Industries or Tata Consultancy Services surge, cap-weighted ETFs tend to outperform. Conversely, when mid-cap or lesser-known names perform better, NFTY’s structure could provide improved risk-adjusted returns.

Best For

NFTY can appeal to those seeking diversified blue-chip access without overweighting India’s largest corporations. This structure supports investors keen on minimizing single-stock risk and preferring a more democratic allocation among top Indian companies.

Retail investors new to Indian equities or those concerned about overexposure to a handful of firms—such as when Infosys or ICICI Bank experience volatility—might find NFTY’s balanced strategy especially reassuring.

Additional Info

NFTY is rebalanced quarterly, ensuring the portfolio doesn't drift into concentration over time. This helps maintain its equal-weight objective and adapt to changing market capitalization.

Regular, rules-based rebalancing can sometimes lead to higher turnover compared to cap-weighted funds, but it can also provide opportunities to systematically “buy low, sell high” on individual Indian blue chips when weightings reset.

Reference: First Trust India NIFTY 50 Equal Weight ETF (NFTY)

Motilal Oswal NASDAQ Q 50 ETF (MOQ50)

Motilal Oswal NASDAQ Q 50 ETF (MOQ50)

Overview

The Motilal Oswal NASDAQ Q 50 ETF (MOQ50) offers Indian investors exposure to the NASDAQ Q-50 Index, which tracks the 50 largest non-NASDAQ-100 companies listed on the NASDAQ stock exchange. These are considered the next generation of potential growth leaders in the U.S. equity market and include prominent names on the cusp of joining the NASDAQ-100, such as Datadog and Airbnb.

This ETF allows market participants in India to invest in U.S. technology and innovation sectors without having to open direct foreign trading accounts—making global diversification easier and more cost-effective. The product is benchmarked to a widely-followed index known for identifying rising stars that have historically transitioned to the NASDAQ-100, providing exposure to dynamic, technology-driven businesses before they hit large-cap status.

Key Details

Key product specifications matter for decision-makers considering international ETFs. MOQ50 is issued by Motilal Oswal Asset Management Company, a trusted name in the Indian asset management industry.

- Ticker: MOQ50

- Issuer: Motilal Oswal AMC

- Expense Ratio: 0.3% per annum, offering cost-effective access relative to most actively managed international funds

- Assets Under Management (AUM): Approximately $36 million as of February 2024, reflecting growing interest among Indian investors

What Makes It Special

Unlike other Indian-listed ETFs that typically focus on mature U.S. indices, MOQ50 is currently the only India-domiciled ETF providing direct exposure to the NASDAQ Q-50 Index. This sets it apart in the Indian investment landscape for those seeking U.S. technology and growth opportunities.

For instance, if an investor wants to capture upside from companies that may eventually become the next Adobe, Netflix, or Tesla, MOQ50 is tailored for this objective. Historical data shows that over a dozen NASDAQ Q-50 constituents have graduated to the NASDAQ-100 in the past five years—highlighting this ETF's focus on tomorrow’s potential large-cap leaders.

Considerations

Investing in an India-based international ETF comes with unique logistical requirements. While MOQ50 trades on Indian stock exchanges, investors without an Indian brokerage account or NRI status might face additional steps to access this product.

For example, residents outside India must determine if their brokerage provides access to NSE-listed ETFs. Even Indian investors should verify international exposure limits under RBI’s Liberalised Remittance Scheme before deploying substantial capital abroad via such funds.

Best For

This ETF is particularly well-suited for Indian market investors aiming to diversify their equity exposure globally. Rather than buying ADRs of individual U.S. stocks or setting up complicated U.S. brokerage accounts, MOQ50 provides a straightforward avenue for adding U.S. growth-oriented companies.

It’s a practical fit for individuals wanting the opportunity to participate in success stories like CrowdStrike or Atlassian before these firms become household names in large-cap indices.

Additional Info

MOQ50 is listed and trades on the National Stock Exchange (NSE), one of India’s largest and most liquid stock exchanges. This eases execution for local investors and ensures greater price transparency and accessibility.

Liquidity levels have improved in 2024, with daily trading volumes often exceeding 100,000 units. For investors accustomed to U.S. or European markets, it’s essential to review typical spreads and execution windows, as Indian stock exchange hours and regulations may affect trading strategies.

Reference: Motilal Oswal Nasdaq Q 50 ETF

Nippon India ETF Nifty Next 50 (NIFTYBEES)

Nippon India ETF Nifty Next 50 (NIFTYBEES)

Overview

Nippon India ETF Nifty Next 50 (NIFTYBEES) is designed to track the performance of the Nifty Next 50 Index, offering investors exposure to the next rung of large-cap companies in India. The Nifty Next 50 includes 50 companies that are just outside the benchmark Nifty 50, forming an incubator for future blue chips.

This ETF is especially notable for representing sectors and companies poised to break into the main Nifty 50. For example, companies like Adani Total Gas, Tata Power, and DLF have, at times, been constituents, demonstrating how this index can spotlight emerging leaders before their ascent to the primary Nifty 50 index.

Key Details

Investors seeking clarity on specifications will find the following details important:

- Ticker: NIFTYBEES

- Issuer: Nippon India Mutual Fund

- Expense Ratio: 0.15% – Among the lowest in its category, minimizing investors' costs over time

- Assets Under Management: Approximately $1.2 billion (as of mid-2024)

These details signal that NIFTYBEES is both a liquid and cost-efficient option among Indian ETFs. Its low expense ratio is comparable to the most competitive passive funds in the US, such as the Vanguard S&P 500 ETF, making it a value-oriented choice for fee-sensitive investors.

What Makes It Special

NIFTYBEES distinguishes itself by enabling investors to gain early access to companies that may soon become household names. Historically, several companies in the Nifty Next 50 have transitioned into the Nifty 50, rewarding early shareholders with significant upside. For example, Asian Paints, Avenue Supermarts (DMart), and Divi’s Laboratories first appeared in the Next 50—and later became Nifty 50 mainstays.

This "next in line" focus provides a balance between established performance and growth potential, catering to those looking to capture future leaders at an earlier stage. The ETF’s strategy can complement existing exposure to the Nifty 50 for more diversified large-cap allocation.

Considerations

While NIFTYBEES is listed on Indian exchanges such as NSE and BSE, it may not be directly accessible for US-based retail investors. Individuals in the US may need to invest via offshore brokerage platforms or through India-specific investment accounts offering access to Indian equities.

Investors should be mindful of foreign investment regulations, taxation of overseas assets, and forex risk when considering NIFTYBEES. For instance, the tax treatment of Indian ETFs for US residents differs from domestic ETFs; consult a tax advisor familiar with cross-border investing before proceeding.

Best For

This ETF suits those with a long-term investment horizon aiming for growth by targeting companies with the potential to advance into India’s premier index. It is particularly valuable for investors comfortable with higher short-term volatility in exchange for higher long-term growth prospects.

For example, Indian residents building multi-decade retirement portfolios or NRIs (Non-Resident Indians) looking to maintain an Indian equity allocation often choose NIFTYBEES for its blend of stability and upside potential.

Additional Info

NIFTYBEES consistently ranks among the most traded ETFs in India, highlighting its widespread adoption. Its popularity extends to both resident Indians and NRI investors seeking systematic, index-based exposure to Indian growth stories. According to recent NSE data, its daily average turnover often exceeds Rs 100 crore (about $12 million), signifying strong liquidity and broad trust among diverse investor groups.

While especially favored by Indian retail and institutional investors, NIFTYBEES is also a familiar name among Indian expatriate investment circles, frequently cited as a core holding in India-centric portfolios abroad.

Reference: Nippon India ETF Nifty Next 50 Junior BeES

How to Choose the Right Indian ETF

For US-based investors seeking access to India's growth potential, Indian ETFs provide a compelling entry point. Selection, however, involves more than picking the biggest fund—factors like investment objectives, costs, liquidity, underlying assets, and tax considerations all play critical roles. Understanding these elements can help investors select the ETF that aligns best with their personal strategy and risk profile.

Define Your Investment Goals

Clarifying your objectives—whether that's maximizing growth, seeking stable income, diversifying beyond domestic markets, or targeting a specific theme—is essential. Each Indian ETF offers a distinct approach. For example, the iShares MSCI India ETF (INDA) focuses on broad market exposure, suitable for long-term growth, while the WisdomTree India Earnings Fund (EPI) emphasizes companies with strong earnings, catering to investors seeking value and income.

The possible outcomes, risk levels, and volatility will vary between options. If you’re interested in green energy trends in India, you might look for thematic ETFs, though such products are less common for Indian markets compared to more diversified funds.

Compare Fees and Expenses

Expense ratios directly impact your net returns over time. Many Indian ETFs have fees in the 0.60-0.90% range. For instance, the INDA ETF's expense ratio is 0.65%, whereas iShares India 50 ETF (INDY) charges 0.89%.

Lower fees can lead to significant savings for buy-and-hold investors, particularly over a multi-year horizon. Always compare similar funds side by side and factor in all costs, including brokerage commissions and the fund's bid-ask spread.

Evaluate Liquidity

Liquidity reflects how easily you can buy or sell ETF shares without significantly affecting their market price. High average daily trading volumes, like those seen with INDA (over 2 million shares traded daily), generally mean tighter spreads and simpler execution.

Less liquid ETFs, such as the Franklin FTSE India ETF (FLIN), may carry higher trading costs due to wider spreads and lower trading volumes (typically below 200,000 shares per day). Prioritizing liquidity helps avoid hidden costs during volatile market conditions.

Check Underlying Holdings

It's vital to analyze the sector and stock concentration within an Indian ETF. For example, INDA allocates more than 35% to financials, leading to higher sensitivity to banking sector trends. If you prefer broader diversification, compare the weightings and top holdings across multiple funds.

Assessing the underlying index methodology can also reveal if a fund is over-reliant on a handful of large-cap stocks, such as Reliance Industries or Infosys, which affects risk and return dynamics.

Consider Tax Implications

US investors holding international ETFs, like those focused on India, must navigate IRS tax rules. Distributions may be subject to foreign withholding taxes, and PFIC (Passive Foreign Investment Company) regulations can impact reporting requirements.

For instance, gains from INDA are taxed as US capital gains, but any Indian dividend withholding taxes may be partially recoverable via US tax credits. Consult a tax advisor to ensure compliance and to optimize after-tax returns when investing internationally.

Frequently Asked Questions

Q1: Are Indian ETFs suitable for US investors?

Investing in Indian Exchange Traded Funds (ETFs) is an accessible way for US investors to gain exposure to one of the world’s fastest-growing economies. Indian ETFs are typically traded on major US exchanges like the NYSE and Nasdaq, allowing for easy purchase through standard brokerage platforms such as Charles Schwab or Fidelity.

For instance, the iShares MSCI India ETF (INDA) and WisdomTree India Earnings Fund (EPI) are two prominent options that track a diversified set of Indian equities. These funds operate under US regulatory oversight, enhancing investor protection and ensuring transparent reporting standards. This makes them a practical choice for US-based investors seeking international diversification.

Q2: What are the typical risks associated with Indian ETFs?

Investors need to be aware that Indian ETFs come with risks distinct from domestic funds. Currency fluctuation can impact returns, as changes in the Indian rupee versus the US dollar may either enhance or diminish profits. For example, between 2018 and 2020, the rupee depreciated over 10% against the dollar, affecting dollar-based returns.

Additional risks include emerging market volatility, which frequently causes sharp swings in asset prices. Certain ETFs might also have sector concentration; for example, many Indian ETFs are heavily weighted toward financials and information technology, such as Reliance Industries or Infosys. Political or regulatory shifts, like the 2016 demonetization effort, can also directly affect market performance.

Q3: How are Indian ETF dividends taxed for US investors?

Dividends from Indian ETFs generally fall under foreign dividend taxation for US investors. These are usually taxed at ordinary income rates unless the ETF qualifies for the lower qualified dividend rates. Taxes may also be withheld at source by Indian authorities, subject to double taxation treaties.

It remains essential to consult a qualified tax advisor familiar with international investment taxation, as individual circumstances, such as residency or tax treaty status, will impact the final tax liability. Vanguard and iShares both provide guidance documents for their international ETF holders to clarify common questions around withholding and credits.

Q4: Is it better to invest in India-focused ETFs or Indian stocks directly?

For most US-based investors, India-focused ETFs often represent a superior choice compared to direct individual stock purchases. ETFs such as the iShares MSCI India Small-Cap ETF (SMIN) provide exposure to hundreds of companies, offering diversification that would be cost-prohibitive when buying single stocks.

Trading Indian equities directly on the National Stock Exchange of India can be challenging due to regulatory restrictions, higher fees, and currency conversions. In contrast, ETFs simplify the process through US exchanges and have lower transaction costs. Fidelity’s analysis indicates that direct Indian ADRs are limited and often carry less diversification compared to broad-market Indian ETFs.

Q5: How often should I review my Indian ETF holdings?

Regular portfolio review is a cornerstone of effective investment management. Reviewing your Indian ETF holdings at least annually helps to ensure alignment with your overall financial goals, risk appetite, and market developments. If significant events occur—like India’s general elections or major regulatory changes—it is advisable to reassess your exposure sooner rather than later.

Real-world investor case studies, such as those highlighted by Morningstar, suggest that disciplined annual rebalancing can help maintain optimal asset allocation and manage emerging market risks, compared to a more reactive approach.