Top US Stocks to Buy: A Guide for Indian Investors

Unlock the essentials of trading and investment education tailored for beginners and intermediate traders interested in the Indian market. Discover strategic insights now!

Introduction

Indian investors are increasingly looking outside the boundaries of their home market to diversify portfolios and tap into global wealth-creation opportunities. Traditionally, Indian equities have offered robust returns, but the world’s largest technology, healthcare, and consumer brands are listed in the United States. This growing interest is not just a fad—it's a strategic shift propelled by the performance of US markets and the need for diversification.

For instance, over the past decade, the S&P 500 has delivered an average annual return of about 12%, outpacing many emerging market indices. Accessing companies like Apple, Amazon, and Tesla—which are not available on Indian exchanges—allows investors to participate in unique growth stories, robust global consumption trends, and the innovation ecosystem of the US.

Navigating the US Stock Market from India: The Challenge

Yet, the process of investing in the US from India can be daunting for beginners. The legal framework, tax implications, choice of brokerage platforms, and even the process of currency conversion create hurdles that often leave investors confused.

Unlike investing through India's NSE or BSE, accessing US stocks requires compliance with the Liberalised Remittance Scheme (LRS) by the Reserve Bank of India, knowledge of foreign brokerage costs, and an understanding of different market hours. For example, while Zerodha offers US stock investing via tie-ups with third-party platforms, the onboarding process is different than what Indian investors are used to. Large banks like ICICI Direct and HDFC Securities also offer dedicated global investment products with varying features and fees.

What This Guide Covers

This guide unpacks actionable strategies for evaluating US companies, introduces high-performing stocks with global reach, and breaks down the regulatory and procedural steps to get started. Whether you’re hoping to buy shares of Microsoft or allocate funds to the S&P 500 via an ETF, each topic includes examples and clear action points.

By the end, you'll have the foundational knowledge needed to confidently begin your cross-border investing journey, equipped with stepwise guidance and real-world insights tailored for Indian retail investors and market enthusiasts.

Understanding the US Stock Market Opportunity

What Are "US Stocks to Buy" and Why Do They Matter?

The phrase "US stocks to buy" refers to publicly traded shares of American companies that present strong investment potential. These stocks often attract foreign investors, including those from India, because the US market features leading global brands, robust financial regulations, and opportunities for wealth creation that sometimes outpace local markets.

For Indian investors, the US stock market isn’t just about blue-chip names—it’s a gateway to industries and innovation sometimes unavailable on local exchanges. Companies such as Apple, Microsoft, and Tesla have witnessed substantial growth and global impact, making them compelling options. Beginners often start with widely-known tech giants or diversified index ETFs like the S&P 500, which recorded an average annual return of around 10.7% over the past 30 years. This steady performance offers both stability and growth potential.

Getting started is now more accessible than ever. Opening a brokerage account that allows international investments, or choosing avenues such as International Mutual Funds or GIFT City Funds, can bridge Indian investors with US equities seamlessly.

Why Should Indian Investors Care About US Stocks?

Geographical diversification is a key benefit. By allocating part of their portfolio to US equities, Indian investors reduce the risk associated with domestic downturns. The US stock market provides exposure to sector leaders like Google (Alphabet) in tech, Johnson & Johnson in healthcare, and JPMorgan Chase in finance—companies with international operations and resilient earnings.

Currency appreciation is another factor. When the US dollar strengthens against the Indian rupee, the value of US investments often increases correspondingly, enhancing overall returns. For example, a 5% rupee depreciation amplifies gains beyond market returns.

Cross-border investing, however, comes with considerations: greater currency volatility, compliance with RBI’s Liberalised Remittance Scheme (LRS), and understanding foreign tax treatment. Due diligence and awareness of these risks are crucial before diversifying globally.

Who Benefits from Investing in US Stocks?

Accessing US stocks is particularly advantageous for various types of Indian investors. Retail investors aiming for global exposure gain not just from potential returns but also by learning how international markets operate differently from domestic bourses.

Beginner and intermediate traders can experiment with different asset classes, sector ETFs, or specific industries like artificial intelligence and electric vehicles. A trader who started with Indian mid-caps might find new strategies trading US-listed ETFs such as Vanguard Total Stock Market ETF (VTI) or focused funds like ARK Innovation ETF (ARKK).

For individuals curious about international finance, investing in the US creates exposure to market cycles, regulatory trends, and economic indicators unique to the world’s largest economy. This experience develops skills and confidence to participate successfully in global capital markets.

Top US Stocks to Buy: In-Depth Reviews

Top US Stocks to Buy: In-Depth Reviews

Investing in leading US stocks offers Indian investors access to some of the world’s most innovative and resilient companies. In this section, we break down the fundamentals, competitive edge, and practical investing approach for top US stocks, focusing on critical details meaningful to retail investors from India.

Apple Inc. (AAPL)

Apple has established itself as a global technology leader, known for unparalleled brand loyalty and an integrated ecosystem. Its product launches – such as the iPhone 15 and growth in Services revenue – have consistently propelled stock performance.

Key Features

- Strong brand reputation and global presence

- Consistent dividend payouts (e.g., $0.24 per share paid quarterly in 2024)

- Robust quarterly earnings (Q2 2024: $90.75 billion in revenue)

Pros and Cons

| Pros | Cons |

|---|---|

|

|

User sentiment reflects trust in Apple for long-term wealth building. For example, even during market downturns, AAPL’s five-year returns have outperformed the S&P 500 index, making it a cornerstone for beginners.

Microsoft Corporation (MSFT)

Microsoft caters to both corporate giants and everyday consumers, offering solutions across Office 365, Azure Cloud, and Xbox gaming. Its focus on enterprise and cloud has driven sustained growth despite competitive challenges from Amazon AWS and Google Cloud.

- Technical Ease: Shares of MSFT are commonly available on platforms like Zerodha and Vested, allowing Indian investors simple access.

- Key Example: Q1 2024, Microsoft reported revenue of $61.86 billion, with cloud services growing 28% year-over-year. The company’s innovation is visible through regular updates to Office products and expansions in AI-driven services.

Market sentiment favors MSFT for risk-managed compounding. Many Indian investors choose Microsoft as a primary exposure to the US tech sector, citing the company’s resilience and annual dividend increases as attractive features.

Alphabet Inc. (GOOGL)

Alphabet is synonymous with digital advertising through Google, with strong diversification into cloud and artificial intelligence. Its dual-class share structure (GOOG and GOOGL) adds flexibility for different types of investors.

- Competitive Positioning: Alphabet leads global search and ad revenues, outpacing rivals like Meta Platforms, though faces rising antitrust scrutiny in the US and EU.

- Example: Alphabet's ad sales reached $61.7 billion in Q1 2024, with Google Cloud Services crossing $9.5 billion, highlighting both ad dominance and cloud potential.

Investors particularly appreciate Alphabet’s reinvestment into AI (e.g., Gemini and Google Bard) and YouTube monetization, ensuring ongoing relevance in digital disruption. However, regulatory risks warrant attention for conservative investors.

Amazon.com Inc. (AMZN)

Amazon occupies a unique position by combining e-commerce leadership and top-tier cloud computing via AWS. The company balances low e-commerce profit margins with high-margin AWS services, making it an unconventional but rewarding stock for risk-tolerant portfolios.

- Features:

- AWS drives almost 70% of Amazon's operating profit, as seen in their Q1 2024 results

- Amazon Prime has over 200 million global members, ensuring recurring revenue

- Pros:

- High revenue growth; Market leader in several sectors

- Diversified business model; Strong logistics and technology backbone

- Cons:

- High volatility; No dividend payouts

- Thin e-commerce margins compared to cloud profits

User sentiment often highlights Amazon’s reinvestment strategy, which sometimes depresses immediate profits but supports expansion into new sectors like healthcare (e.g., Amazon Clinic).

Tesla Inc. (TSLA)

Tesla is widely regarded as the benchmark for clean energy and electric vehicle innovation, holding the first-mover advantage in global EV markets. Led by Elon Musk, Tesla’s valuation and volatility regularly dominate headlines.

- Example: Tesla delivered 1.8 million vehicles in 2023 and expanded gigafactories in China and Germany, cementing its manufacturing scale.

- Features:

- Market disruptor in EVs and battery tech

- Brand appeal driven by high-profile CEO initiatives and product launches (Cybertruck, Powerwall)

- Pros:

- High growth potential; Strong brand recognition

- Early-mover in EV sector; Investor enthusiasm

- Cons:

- High stock volatility (spanned $150-$300 in 2024)

- No dividend; heavily reliant on CEO vision

Tesla garners attention from investors seeking technology-led disruption. However, its shares experience rapid moves—making it suitable only for those with higher risk tolerance and a long-term view.

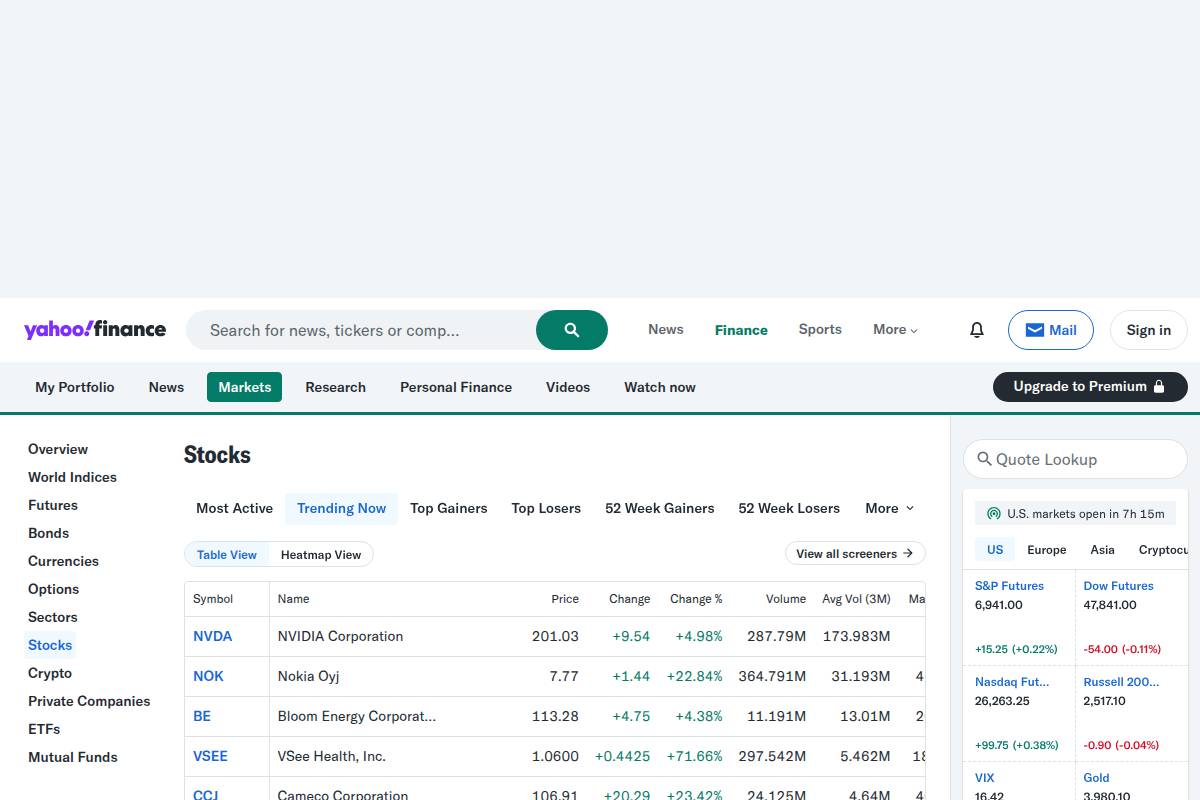

Top Trending Stocks: US stocks with the highest interest ...

Choosing the Right US Stocks for Your Investment Goals

Selecting the ideal US stocks begins with understanding your personal investment goals. Whether you want steady returns, rapid growth, or reliable income, focusing on the right type of companies is crucial. US equities offer a vast landscape, with blue-chip giants and disruptive innovators accessible via popular platforms such as convenient Indian platforms like INDmoney or Vested for investors based abroad.

For Beginners Wanting Stability: Apple and Microsoft

For those new to US stock investing, established companies known as blue-chip stocks can offer peace of mind. Apple (AAPL) and Microsoft (MSFT) are leaders in their respective domains, demonstrating remarkable resilience through economic cycles.

For example, Microsoft’s cloud segment, Azure, saw year-over-year growth above 25% in recent quarters, providing consistent returns with lower volatility. Apple, known for its robust iPhone and ecosystem sales, has maintained profitability even during market downturns. This stable performance makes them top picks for risk-averse or beginner investors.

For Tech-Focused Investors: Alphabet’s Growth and Reach

Investors keen on technological innovation and digital expansion often look to Alphabet (GOOGL), the parent company of Google. With dominance in search, digital advertising, and a growing cloud segment, Alphabet has delivered annual revenue growth consistently above 10% over the past five years.

In practical terms, Google’s global search market share remains above 90%, allowing it to capture sustained advertising revenue and reinvest in future technologies such as AI, self-driving cars, and cloud computing.

For Aggressive Growth Seekers: Amazon and Tesla

Those comfortable with higher risk might consider Amazon (AMZN) and Tesla (TSLA), which offer significant growth potential alongside greater price swings. Amazon expanded its global logistics network during the pandemic, growing annual revenue to over $500 billion by 2023.

Tesla, on the other hand, scaled production quickly and disrupted the auto sector, with deliveries exceeding 1.8 million vehicles in 2023. However, both stocks are known for double-digit percentage price movements in short periods, making them suitable primarily for those with higher risk tolerance.

If You’re Pursuing Dividends: Consistency from Apple and Microsoft

Dividend-focused investors often seek companies with a strong track record of returning capital to shareholders. Both Apple and Microsoft offer quarterly dividends and have steadily increased their payouts over the past decade.

For instance, Microsoft’s dividend yield, while modest compared to utilities, is backed by consistent earnings growth and recent dividend increases of over 10% annually. Apple’s massive cash reserves provide similar reliability, making both suitable for those looking to blend growth with income.

For Sector Diversification: A Balanced Portfolio

Smart investors rarely put all their funds into a single basket. Diversifying across technology (Microsoft, Apple), digital advertising and cloud (Alphabet), e-commerce (Amazon), and electric vehicles (Tesla) spreads risk and exposes your portfolio to multiple growth drivers.

For example, mixing Microsoft’s enterprise software stability with Tesla’s growth potential and Amazon’s e-commerce scale helps reduce overall volatility and capture upside from different industry trends. Accessing these US stocks is streamlined for Indian investors via platforms like INDmoney or Vested, making this balanced approach more accessible than ever before.

Frequently Asked Questions (FAQs)

1. How can Indians open accounts to invest in US stocks?

Accessing US stock markets from India has become much simpler over the past few years. Several Indian-friendly brokerage platforms enable residents to open accounts online, leveraging digital onboarding and streamlined processes. This means aspiring investors—whether they're in Mumbai or Chennai—can start their US stock journey from home without any physical paperwork.

For instance, platforms like Vested Finance, INDmoney, and Groww offer fully digital sign-up and onboarding. These platforms comply with KYC (Know Your Customer) regulations and allow funding via the RBI’s Liberalised Remittance Scheme (LRS). Typically, the account set-up is finished within 3–7 business days for most people, as long as the documentation is accurate and complete.

2. What are the tax implications for Indians investing in US stocks?

Indian investors must be mindful of both US and Indian tax obligations when holding American equities. Dividends paid by US companies are subject to a 25% withholding tax by the US Internal Revenue Service, though this can sometimes be reduced to 15% under the India-US Double Taxation Avoidance Agreement (DTAA) if you submit the right forms.

Capital gains tax is not levied by the US for non-resident Indians, but any gains from selling US stocks are taxable in India, typically as per your applicable slab. For example, if you bought Apple shares in 2021 and sold them in 2023 at a profit, you would owe capital gains tax upon filing your Indian income tax return. Consulting with a tax specialist is recommended to take advantage of DTAA benefits and ensure compliance.

3. Is there a minimum investment amount required?

Contrary to common perception, you do not need thousands of dollars to start investing in US stocks from India. Many modern brokerage apps now permit fractional share investing, which means you can buy a portion of high-value stocks like Alphabet or Tesla.

For instance, on Interactive Brokers or Vested Finance, you can typically start with as little as $1. This has democratized access, enabling college students, young professionals, and retail investors to diversify globally without waiting to build a large corpus.

4. How do I manage currency risk when investing in US stocks?

Investing overseas introduces currency risk—your investment's INR value shifts as the rupee-dollar exchange rate fluctuates. A gain of 8% in the US stock market might be offset if the USD depreciates significantly against the INR during your holding period.

Some experienced investors actively monitor the INR-USD trend and occasionally use forex hedging tools or currency ETFs to mitigate this risk. For example, seasoned NRI investors may hedge part of their dollar exposure using products available through banks like HDFC or ICICI. While not essential, being aware of currency swings can help you better assess real returns.

5. Can I repatriate money back to India after selling US stocks?

Yes, Indian investors have the right to bring back both their original capital and profits after liquidating US stock holdings. The repatriation process involves specific paperwork under RBI guidelines and usually proof of tax compliance on the remitted funds.

For example, after liquidating shares on Upstox or ICICI Direct Global, investors can instruct the platform to transfer proceeds back to their Indian savings account. Most leading brokerage services will provide the required Foreign Inward Remittance Certificate (FIRC) and help guide you through regulatory requirements for a seamless process.