10 Best US Stock Market Apps for Easy Investing

Curious about how personal finance and investment strategies differ between the US and India? Discover insights tailored for new investors and finance enthusiasts!

Introduction: Simplifying Your US Stock Market Journey

Getting started with US stock market investing can feel intimidating—especially when bombarded with technical jargon and an ever-growing list of apps promising everything from zero commissions to advanced analytics. Many first-timers, as well as experienced investors, find themselves stuck at this crossroads, unsure which app will truly match their needs.

This uncertainty isn't limited by geography. For instance, if you're an investor based in India hoping to buy shares of companies like Apple or Google directly on the US exchanges, regulations and complicated onboarding processes can pose real challenges. According to RBI guidelines, the Liberalized Remittance Scheme (LRS) allows individuals to remit up to $250,000 per year for investments abroad, yet navigating compatible apps remains a logistical hurdle.

The Importance of Choosing the Right Trading App

Whether you’re a first-timer dipping your toes into stocks or an experienced trader looking for deeper research tools, the choice of trading platform can fundamentally shape your experience. Not all apps cater equally to all investor profiles: for example, Robinhood made investing accessible for millions in the US by offering a slick mobile experience and zero-commission trading. In contrast, Interactive Brokers is often favored by active traders for its robust analytics and access to global markets, including Indian stocks.

Investors from India frequently use platforms like Vested and INDmoney, which streamline cross-border investing by integrating compliance and currency conversion, transforming a once-complex process into a few easy taps.

What This Guide Covers

This guide doesn’t just list apps—it unpacks what sets each apart, helping you match the features with your distinct investing style. For example, while Wealthfront excels for beginners through automated investing, power users may gravitate towards Thinkorswim by TD Ameritrade for its powerful charting tools and real-time data. Our goal is to guide you to the best US stock market app for your unique journey in 2024.

Understanding US Stock Market Apps and Investing Platforms

What Are US Stock Market Apps and Why Are They Popular?

US stock market apps have transformed the investment landscape by placing full-featured trading tools directly in the hands of users via smartphones and computers. These apps, such as Fidelity, E*TRADE, and Charles Schwab, offer real-time access to financial markets, allowing users to buy or sell stocks, monitor portfolios, and execute trades with just a few taps.

Beyond convenience, their growing adoption is fueled by straightforward interfaces and strong security protocols. For instance, Charles Schwab’s app is lauded for well-rounded features, including advanced research tools and robust educational material, making it an excellent option for a wide range of investors. Many apps break down complex investment terminology, offer learning modules, and even simulate trading environments to help beginners gain confidence before investing real money.

Who Benefits Most from These Trading Apps?

Users from varied backgrounds take advantage of these platforms for different reasons. Individual investors who seek to diversify beyond domestic assets often find platforms like Interactive Brokers ideal, thanks to their seamless access to US equities and global markets. The platform caters to both active traders and those aiming for long-term investments, as recognized in the 14 Best Stock Trading Apps for 2025 review.

New traders are attracted by user-friendly dashboards and built-in tutorials offered by apps like Fidelity, which also provides low-cost index funds and automatic investing options. Finance enthusiasts leverage advanced charting tools and options analyzers available on E*TRADE to track market movements and backtest strategies. International investors, particularly from India, increasingly use such apps to participate in the US stock market; according to recent survey data, Indian investors’ inbound trades via these platforms have grown by over 30% year-over-year. The diverse features of these leading apps empower every segment of the investing public to achieve their unique financial goals.

1. Robinhood

1. Robinhood

Overview

Robinhood has become a household name among US investors, especially those new to the stock market. The platform strips away trading jargon, offering a user-friendly app designed for those seeking a straightforward way to buy and sell stocks.

With more than 22 million users as of 2023, Robinhood's commission-free trading model attracts cost-conscious investors. For instance, college students or young professionals often cite Robinhood as their entry point into investing because of its simple interface and lack of fees.

Technical Requirements

Robinhood is accessible across iOS, Android, and browser-based web platforms, making it versatile for mobile-first and desktop users alike. To use it, you’ll need a stable internet connection and must be a US resident, as Robinhood currently restricts direct account opening to US citizens and permanent residents.

This limitation is evident when compared to platforms like Interactive Brokers, which accept clients worldwide, making Robinhood primarily suitable for users investing in US markets from within the US.

Competitive Positioning

Within the growing landscape of trading apps, Robinhood set itself apart early by pioneering zero-commission trades, challenging industry giants like Charles Schwab and E*TRADE to follow suit. While traditional brokers often charge up to $6.95 per trade (prior to 2019), Robinhood eliminated this barrier.

Its minimalistic design and quick sign-up process further differentiate it, especially compared to legacy brokers whose interfaces can intimidate new investors.

Getting Started

Opening an account with Robinhood is designed to be seamless. After downloading the app, users register with their email, provide identification details as required by the SEC, and can fund their accounts via instant bank transfers.

- Visit the Robinhood website or download the app.

- Sign up using a valid email address.

- Complete identity verification, including Social Security Number submission.

- Link a US bank account for deposits.

- Begin trading assets as soon as funds are available, often within minutes thanks to instant deposit features for up to $1,000.

Key Features

Robinhood is packed with features tailored for everyday investors. These are particularly impactful for those starting with smaller amounts or seeking to spread investments across multiple stocks.

| Feature | Description |

|---|---|

| Commission-Free Trades | No fees for stock, ETF, or options trades |

| Fractional Shares | Buy as little as $1 of popular stocks, like Tesla or Apple |

| Portfolio Dashboard | Easy monitoring of holdings and performance |

| Instant Deposits | Trade immediately after funding your account |

Pros

- No trading fees on stocks, ETFs, and options, allowing for frequent trading without cost barriers.

- Beginner-friendly design with a clean layout and helpful onboarding tips.

- Educational content built-in, such as explainers on stock market basics and notifications for major market news.

Cons

- Limited research tools: Advanced analytics or third-party reports (like those from Morningstar) are not natively integrated.

- Restricted to US users, so global investors must consider alternatives.

- Customer support can be slow, with some users reporting delays in resolving account issues, especially during periods of high volatility.

Pricing

One of the strongest appeals of Robinhood is its $0 commission pricing for trades. Still, users seeking enhanced features can opt for Robinhood Gold, which costs $5 per month. Gold offers benefits like Level II market data, larger instant deposits, and margin investing; for example, those who want to act quickly on pre-market news may find this valuable.

User Sentiment

Investors consistently praise Robinhood's ease of use, citing the quick account setup and no-cost trades as key advantages. Newer traders, such as those featured in financial publications like CNBC, often highlight how Robinhood made investing approachable.

However, active traders or those needing deep analytics sometimes express frustration over the limited research functionality. Some Reddit community members suggest using Robinhood for trade execution while relying on external platforms (like Yahoo Finance or Seeking Alpha) for research and analysis.

Robinhood: 24/5 Commission-Free Stock Trading & Investing

2. Fidelity

2. Fidelity

Overview

Fidelity stands out as a highly rated US brokerage, offering a robust suite of investment tools accessible via some of the most dependable mobile trading apps available. The platform appeals to both newcomers and seasoned investors through its range of services and accessible learning resources.

Many users find Fidelity’s mobile apps, available on both iOS and Android, particularly intuitive. For example, its app features streamlined account overviews and instant trade execution, allowing users like a first-time investor or a retiree managing their 401(k) to monitor and adjust portfolios efficiently on the go. As recognized by the best stock trading apps for 2025, Fidelity is noted for broad accessibility and strong performance across devices.

Technical Requirements

Accessing Fidelity’s tools requires only a US-based account, a compatible mobile device (iOS or Android), or a modern web browser. This minimal barrier to entry means most US investors can set up and start using Fidelity without special hardware.

The platform’s engineering ensures reliable performance — for instance, active traders running sophisticated screeners or real-time charting tools report smooth experiences on both flagship iPhones and mainstream Androids. Getting real-time quotes and executing time-sensitive trades on the go is a core advantage cited by active users.

Competitive Positioning

Fidelity distinguishes itself by combining responsive customer service and an extensive suite of research tools accessible even for those new to investing. This approach sets it apart from many legacy brokers, such as E*TRADE or TD Ameritrade, particularly for users who value in-depth market data and ongoing education.

As noted in recent comparisons with leading apps like Schwab, IBKR, and Robinhood, Fidelity is consistently recognized for its educational support features, including extensive video tutorials and real-time news feeds directly within its trading app.

Getting Started

Opening a Fidelity brokerage account is straightforward and largely digital. Users begin by completing an online application, providing identifying details, and undergoing standard verification. Once approved, it’s easy to transfer funds in from an external bank.

- Visit Fidelity’s website or download the mobile app.

- Apply for a brokerage account, uploading a valid US ID.

- Link a funding source, such as a checking account.

- Once funds clear, start trading stocks, ETFs, or mutual funds.

For example, new investors have reported being able to open and fund their accounts within two business days, allowing them to execute their first trade shortly thereafter.

Key Features

| Feature | What Sets Fidelity Apart |

|---|---|

| Free stock and ETF trades | Enjoy $0 commissions on most US-listed securities, including fractional shares for popular companies like Apple or Tesla. |

| Advanced market research tools | Access in-depth reports, analyst ratings, and comprehensive screeners — similar to platforms used by institutional investors. |

| Customizable alerts and notifications | Set mobile or email prompts for price changes, earnings events, or order executions based on personal investment criteria. |

| Retirement and IRA management | Easily manage Roth IRAs, rollover 401(k)s, and track progress with integrated planning tools and calculators. |

Pros

- No account minimums, enabling anyone to get started without a large upfront deposit.

- Highly rated customer service — for example, users frequently mention quick response times via Fidelity’s helpline or branch network.

- Wide asset selection, supporting stocks, ETFs, options, mutual funds, and fixed income products in one unified account.

Cons

- User interface may feel dense for absolute beginners; unlike Robinhood’s more minimal design, some users find the dashboard initially overwhelming.

- Certain features, such as access to international markets, are limited to US-based users only.

Pricing

Fidelity offers commission-free trades on US stocks and ETFs, helping reduce costs for both casual and frequent traders. Some mutual funds and specialty products may carry separate fees, so it’s important to review the fee schedule based on chosen investments.

For comparison, Fidelity’s no-commission model mirrors other leading brokers noted in the mobile trading app comparison for 2025, ensuring cost-effective investing for a range of strategies.

User Sentiment

Fidelity receives high marks for customer support and its broad library of educational resources. Many users cite the responsive live chat and step-by-step guidance for new investors as standout qualities.

While some users mention that technical account setup can feel complex, the overwhelming sentiment is positive, especially from those who take advantage of Fidelity’s tutorials and help center when navigating unfamiliar features or settings.

Fidelity Rewards Visa Signature Card | Credit Card

3. E*TRADE

3. E*TRADE

Overview

E*TRADE is a comprehensive brokerage platform trusted by millions of investors since its founding in 1982. With a reputation for offering both utility and depth, E*TRADE provides a blend of advanced analytical tools and approachable educational content. This makes it suitable for newcomers aiming to learn, as well as seasoned traders seeking nuanced capabilities.

For instance, E*TRADE’s Learning Center features live webinars, step-by-step tutorials, and real-world examples such as case studies on stock trading strategies and market analysis. These resources help users build investment knowledge over time while navigating real market scenarios.

Technical Requirements

To use E*TRADE efficiently, you’ll need either the mobile app—available on both iOS and Android—or access via a desktop browser. The platform is robust enough for heavy-duty trading sessions and regular research. Its mobile app is regularly updated, supporting push notifications and biometric logins for added security.

For instance, active traders like those who monitor multiple positions during market open hours benefit from the app’s rapid execution speeds and real-time data, ensuring they're not delayed by lag or outdated information. Ongoing updates are necessary to keep features and security in top shape.

Competitive Positioning

E*TRADE stands apart in the crowded brokerage landscape due to its blend of education and powerful trading tools. Its Learning Center features live trading webinars and a wide array of articles, making it attractive to investors wanting to deepen their skills.

While its interface is less visually minimal than apps like Robinhood, it compensates with depth: the Power E*TRADE platform offers tools like risk/reward graphing for options, usually found on more specialized platforms. Advanced traders often cite these features as a reason to choose E*TRADE over competitors.

Getting Started

Beginning with E*TRADE is streamlined and can be completed in less than 20 minutes for most users. The standard process involves:

- Registering online with name, address, and contact information

- Securely linking your bank account for funding

- Providing ID verification (such as a driver’s license or passport)

- Funding your account, with many users starting as low as $500

For example, after completing registration, first-time investors in the U.S. commonly fund their account using bank transfer, which is typically processed within 1-2 business days.

Key Features

| Feature | Details/Examples |

|---|---|

| Commission-free stocks/ETFs | Zero commission on online US-listed stock and ETF trades since October 2019 |

| Options trading with advanced tools | Graphical analysis, risk/reward calculator, and strategy scanners for multi-leg options |

| Built-in educational resources | Live webinars, tutorials, and a comprehensive Learning Center |

| Multiple account types | Taxable brokerage, traditional/Roth IRAs, custodial accounts |

Pros

- Extensive research and analysis, including Morningstar ratings and third-party analyst reports

- Strong options trading platform, favored by active traders like TD Ameritrade’s thinkorswim

- Multi-factor authentication and rigorous cybersecurity protocols

Cons

- Interface may feel overwhelming for those new to investing or used to minimalist apps like Webull

- Mobile and web apps can appear cluttered with dense information on single screens

Pricing

E*TRADE offers transparent pricing, which is a major draw for both casual and active users. Online stock and ETF trades are commission-free. For options contracts, each costs $0.65 per contract—which is competitive but not the lowest among major brokers. For example, Fidelity charges the same rate, while Charles Schwab sometimes offers pricing discounts for high-volume traders.

User Sentiment

Many users praise E*TRADE’s customer support and breadth of trading tools. On Trustpilot, reviewers frequently note the platform's fast support response and detailed help articles. However, some beginners mention a learning curve tied to the dense interface, mentioning that features like advanced charting or order types require some initial research to use effectively.

E*TRADE | Investing, Trading & Retirement

4. Charles Schwab

Overview

Charles Schwab stands out as a resilient force in online investing, blending traditional reliability with a comprehensive trading app. The firm is trusted by over 34 million brokerage accounts, making it one of the largest U.S. players in the sector as of 2023.

Schwab’s mobile and web platforms target users who seek low trading costs, extensive research, and credibility. Its app is highly rated, scoring 4.8 stars on the Apple App Store, reflecting satisfaction among active and long-term investors alike.

Technical Requirements

Running on both iOS and Android devices, as well as browsers, Schwab delivers seamless access without demanding high-end hardware. The app’s lightweight architecture ensures smooth operation on mid-tier smartphones—making it a good fit for users without the latest devices.

Advanced encryption and biometric authentication safeguard personal data. For instance, investors using Samsung Galaxy A53 or iPhone SE models typically experience no performance lag, even when accessing real-time market data.

Competitive Positioning

Schwab leverages its decades-long reputation to provide new investors with confidence seldom found in app-first fintech platforms. Unlike Robinhood, which excels at casual trading but lacks depth in research, Schwab offers both fundamental and technical insights powered by in-house analysts and Morningstar reports.

This unique positioning makes Schwab a compelling choice for users transitioning from DIY trading apps and seeking deeper analytics to inform their strategies.

Getting Started

Opening a Schwab account involves a few clear online steps, designed for user convenience. Applicants must submit identity verification, commonly using government-issued IDs, and satisfy U.S. KYC (Know Your Customer) regulations.

- Visit the Schwab website or app and click “Open an Account.”

- Select from individual, joint, retirement, or brokerage accounts.

- Submit documentation and complete verification.

- Fund your account and begin trading—as fast as same day, depending on bank transfers.

Key Features

| Feature | Description | Key Differentiator |

|---|---|---|

| No-fee trades on US stocks/ETFs | Trade U.S. equities and ETFs without commissions. | Competes with Fidelity and Robinhood; cost savings for frequent traders. |

| Schwab Stock Slices | Buy fractional shares starting at $5. Perfect for diversifying into high-priced stocks like Alphabet (GOOGL). | Not widely available in major legacy brokers. |

| In-depth market research reports | Access detailed analyses by Schwab experts and third parties (e.g., Morningstar). | Greater depth than fintech-only platforms like SoFi or Stash. |

| 24/7 support | Round-the-clock customer service via chat and phone. | Faster responses compared to some competitors. |

Pros

- Excellent reliability—consistently performs during volatile markets (e.g., maintained uptime during early-2023 market swings)

- Top-tier research tools rivaling platforms like Fidelity and E*TRADE

- Wide range of stocks, ETFs, bonds, and mutual funds available to U.S. investors

Cons

- Interface is less visually modern than Robinhood, with more complex navigation

- International users, especially from India and other countries, face extra verification and onboarding steps

Pricing

Charles Schwab charges zero commissions for U.S. stock and ETF trades, aligning with industry leaders such as Fidelity. However, users should note certain wire transfer or account transfer fees may still apply—typically in the $25–50 range. No hidden fees for inactivity or basic account maintenance add to Schwab’s appeal.

User Sentiment

User reviews consistently highlight Schwab’s dependability, especially during periods of high volatility. For example, multiple Reddit and Trustpilot reviews in March 2023 noted prompt customer support and smooth trade executions.

Some users express minor frustration with the interface, stating it feels less streamlined than newer apps. Still, the platform’s strengths in reliability and support frequently outweigh UI criticisms for most investors.

Charles Schwab | A Modern Approach to Investing and Retirement ...

5. Webull

5. Webull

Overview

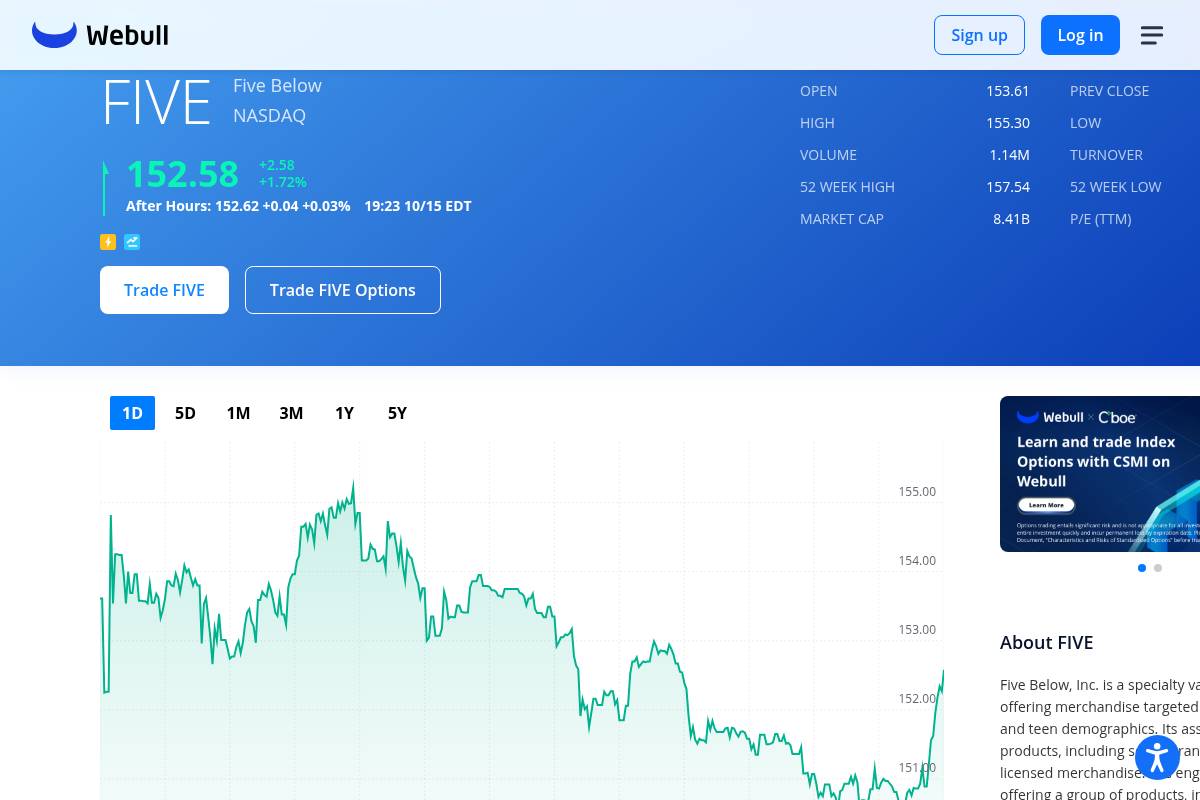

Webull stands out as a highly-regarded trading platform tailored to active investors who crave sophisticated analytics and real-time data. Launched in 2017, it quickly gained traction with US traders for providing free access to advanced research tools often reserved for professionals.

Unlike more basic apps like Robinhood, Webull packs in detailed charting and technical analytics at no extra cost. Current daily trading volumes frequently surpass one million transactions, highlighting its high adoption among self-directed investors seeking more control and information.

Technical Requirements

Webull offers a flexible trading experience across iOS, Android, web, and desktop platforms. Performance remains optimal for users on updated smartphones, such as the iPhone 14 Pro or Samsung Galaxy S23, and on Windows/Mac PCs with at least 8 GB RAM.

For those interested in desktop charting, the downloadable Webull app for PC supports multi-screen setups. This flexibility supports more complex trading strategies or data tracking, which is why many day traders favor Webull over a mobile-first competitor like Cash App.

Competitive Positioning

When comparing data and charting features, Webull distinguishes itself by offering free pro-level charts and technical indicators. For example, serious option traders and technical analysts often leverage over 50 built-in technical studies—like MACD, RSI, and moving averages—without having to pay for a premium subscription.

This surpasses what’s found on many beginner-friendly platforms such as SoFi, making Webull a logical step up for users graduating from basic investing apps to something more analytical.

Getting Started

Signing up with Webull involves several standard identity-verification steps, including uploading a government-issued ID and linking your US-based bank account for deposits and withdrawals. The process can be completed in under 15 minutes if your documentation is ready.

- Verify your identity by scanning your driver’s license or passport.

- Connect your checking or savings account (Chase and Wells Fargo accounts often sync in seconds).

- Try the paper trading simulator, which comes pre-loaded with $1 million in virtual funds. This allows practicing risk-free before committing real capital.

Key Features

- Commission-free trading on US-listed stocks, ETFs, and options

- Comprehensive charting tools with 50+ technical indicators and advanced drawing tools

- Extended-hours trading from 4:00 am to 8:00 pm EST, covering both pre-market and after-hours sessions

- Paper trading simulator, allowing users to develop strategies without risking actual money

Pros

- Zero commissions for standard trades

- Access to a wide array of analytical and research tools, rivaling platforms like Thinkorswim

- Ideal for active or semi-experienced investors who already understand fundamental trading concepts

Cons

- Customer support is primarily online; users have reported delays when seeking phone assistance, especially during volatile market days

- Interfaces and technical features may seem daunting to complete beginners—apps like Stash or Robinhood offer easier learning curves

Pricing

Standard trades in stocks, ETFs, and options are free of commissions. If you choose to trade on margin, rates start at 9.49% APR as of early 2024, which is in line with industry averages but can add up for heavy margin usage.

User Sentiment

User reviews consistently note Webull's value for active investors who need deep data at no extra charge. For instance, on Trustpilot, many users commend the robust analytics and cost savings as a reason to switch from E*TRADE or TD Ameritrade.

However, some users—especially newer traders—express a desire for more integrated educational content or easier onboarding tutorials, highlighting a gap for those just getting started in self-directed investing.

FIVE Stock Options Chain, Prices and News

6. SoFi Invest

6. SoFi Invest

Overview

SoFi Invest has emerged as a versatile investment platform appealing to younger generations and those new to the world of stocks and automated portfolios. It caters to users who seek simplicity without compromising access to popular asset classes like stocks, ETFs, and even cryptocurrencies.

For example, college students and young professionals often turn to SoFi Invest because of its strong educational resources and community support—features that set it apart from more traditional platforms such as TD Ameritrade.

Technical Requirements

Designed with the mobile-first user in mind, SoFi’s investing app is available on both iOS and Android. Its lightweight interface means it runs smoothly even on older smartphones—unlike some advanced trading platforms that require higher RAM or processor speeds.

This accessibility ensures that users don’t need to invest in expensive hardware to manage or grow their portfolios efficiently.

Competitive Positioning

SoFi Invest stands out because it uniquely combines commission-free self-directed trading with a robust robo-advisory solution. While platforms like Robinhood and Acorns each focus on a single mode (either active or automated), SoFi bridges the gap—making it easier for users to experiment with both approaches in one app.

This blend is attractive for those who want to start with hands-off investing and gradually explore more active strategies.

Getting Started

Opening an account with SoFi Invest is a straightforward process. After downloading the app from the App Store or Google Play, you’ll go through a quick ID verification—often just scanning your driver’s license and taking a selfie for security purposes.

- Choose between automated or self-directed investing options

- Fund your account using ACH transfer or linking an existing bank account

- Begin investing in stocks, ETFs, or SoFi’s selected automated portfolios

Key Features

| Feature | Description |

|---|---|

| Commission-free stocks/ETFs | Buy and sell without extra fees; comparable to Robinhood's zero-commission model. |

| Automated (robo) portfolios | AI-powered management and automatic rebalancing—ideal for hands-off investors. |

| Crypto investing | Direct purchase options for popular cryptocurrencies like Bitcoin and Ethereum, unlike some rival robo-advisors that lack crypto support. |

| Fractional shares | Invest as little as $1 in high-priced stocks such as Amazon, enabling broader diversification for small portfolios. |

Pros

- Offers both DIY and automated investing, making it easy to switch as your needs change

- Intuitive design with onboarding tools, benefiting those new to investing

- No account minimums, reducing the barrier to entry for first-time investors

Cons

- Lacks advanced order types like stop-limit or trailing stop—features active traders might expect from E*TRADE or Fidelity

- Not open to all international users, restricting access for US-residents only

Pricing

Most services offered by SoFi Invest, such as trading US-listed stocks and ETFs, come with no commission fees. This approach mirrors competitors like Webull or Charles Schwab, which have moved to $0 commissions in recent years.

However, users should be aware that crypto transactions include a 1.25% markup—consistent with industry standards from providers such as Coinbase or Gemini.

User Sentiment

User reviews across platforms like Trustpilot and the App Store frequently highlight SoFi Invest’s sleek interface and flexible investing choices. Many beginners appreciate the clear navigation and built-in educational modules.

On the other hand, some experienced investors express a desire for deeper charting and analysis tools, which they find in alternatives like Thinkorswim or Interactive Brokers.

Online Investing, Stock Trading, Brokerage

7. TD Ameritrade

7. TD Ameritrade

Overview

TD Ameritrade has been a respected name in online brokerage for decades, earning a reputation for offering robust research and trading tools. Both seasoned investors and newcomers will find a variety of resources to match their skill level.

Thanks to the platform's acquisition by Charles Schwab, clients benefit from an expanded ecosystem, but TD Ameritrade’s own thinkorswim platform remains a gold standard among day traders and active investors.

Technical Requirements

One key advantage is the breadth of device compatibility. TD Ameritrade offers native apps for iOS and Android, a feature-rich web interface, and the renowned thinkorswim desktop app.

The thinkorswim platform is known for resource-intensive operations but runs smoothly on most modern PCs and Macs. For example, investors using a recent MacBook Air or a mid-range Windows laptop can easily access advanced charting without lag.

Competitive Positioning

TD Ameritrade is recognized for its leadership in investor education and its sophisticated desktop platform. Its library includes immersive training modules and live webinars anchored by actual market events.

However, the mobile app's depth—such as customizable indicators and screeners typically seen in professional trading environments—can be daunting for new users. Experienced traders, conversely, appreciate these advanced features, as highlighted by thinkorswim's frequent top rankings in industry reviews by J.D. Power and Barron's.

Getting Started

Opening an account is a quick online process. Users may fund accounts through direct bank transfer, wire, or check, often seeing funds available within 1–2 business days. New traders can access paper trading via the thinkorswim simulator—ideal for testing strategies without risking capital.

For example, a beginner can create a simulated $100,000 account and practice executing options spreads or ETF trades, benefitting from real-time data before entering live markets.

Key Features

- Commission-free trading on stocks and ETFs

- Paper trading simulator with real-time market data

- Comprehensive research from third-party providers like Morningstar and CFRA

- Integrated, customizable news and alerts feed

Pros

- Unmatched educational resources, including an in-depth knowledge center and daily live broadcast (TD Ameritrade Network)

- Wide investment choices: stocks, ETFs, options, mutual funds, and futures

- Strong security protocols, including two-factor authentication and SIPC insurance

Cons

- App interface can be overwhelming due to the sheer number of features

- Site navigation isn’t as intuitive as some competitors like Fidelity or Robinhood

Pricing

TD Ameritrade adopted a $0 commission model in 2019 for stocks and ETFs, aligning with leading brokers. Options contracts are priced at $0.65 per contract. The absence of platform and inactivity fees makes it appealing for active and passive investors alike.

User Sentiment

The client base consistently praises TD Ameritrade’s analytics capabilities and responsive support team. Reddit’s r/investing community often cites the thinkorswim charting tools and educational webinars as primary reasons for their loyalty.

However, entry-level investors sometimes note a learning curve, particularly when transitioning from simple apps like Webull or Robinhood. Most agree the platform is worth mastering due to its depth and flexibility.

TD Ameritrade, Inc. is now at Schwab

8. Interactive Brokers

8. Interactive Brokers

Overview

Interactive Brokers (IBKR) is renowned for its expansive global reach, serving clients in over 200 countries. It stands out for individuals seeking direct access to US markets, even if they reside outside the USA or in countries like India. Its reputation for low-cost trades and transparent pricing attracts active traders and global investors alike.

For example, an investor in Mumbai can easily open an account and trade stocks on the NYSE with virtually the same tools as someone based in New York. Interactive Brokers bridges market accessibility gaps that often deter non-US residents from global investing.

Technical Requirements

IBKR provides robust platforms for various devices: mobile apps for iOS and Android, tablet interfaces, and its flagship Trader Workstation (TWS) desktop application. A secure, stable internet connection is essential, especially since IBKR executes trades in real time across multiple international markets.

The platform’s international compliance infrastructure manages multi-jurisdictional regulations, supporting two-factor authentication and strong encryption to keep accounts secure. For instance, IBKR’s mobile app features biometric login and device notifications to alert users of account activities.

Competitive Positioning

Few brokerages match IBKR's global footprint, offering direct trading on more than 135 exchanges across 33 countries. Its ultra-low commissions and access to advanced tools make it highly attractive for those outside the US seeking efficient market entry.

As an example, investors in Singapore can trade not just US stocks, but also access exchanges from Tokyo to Frankfurt through a single portal. Compared to competitors like Charles Schwab International, IBKR regularly wins on breadth of access and flexible funding.

Getting Started

Opening an account with IBKR is straightforward and fully digital. Prospective users provide identification, complete an online application, and can fund their account in local or major global currencies. For example, funding in INR is supported via wire transfers for Indian clients, who then gain USD access for US trading.

- Register online from your home country

- Upload government-issued ID and proof of address

- Link your bank account and deposit funds

- Begin accessing and trading global markets

Key Features

- Direct trading on 135+ global markets, including NYSE, NASDAQ, LSE, and NSE

- Lowest margin rates, with rates as low as 5.83% for USD accounts as of April 2024

- Advanced order types and real-time analytics through Trader Workstation

- Built-in currency conversion to manage multi-currency funding and settlements

Pros

- Unmatched access for global and cross-border investors

- Extremely low commissions—$0 trades on US stocks via IBKR Lite

- Highly customizable trading and research tools suitable for sophisticated traders

Cons

- High learning curve; Trader Workstation can be daunting for first-time users

- Customer support wait times may be longer during peak trading hours

Pricing

Interactive Brokers offers $0 commissions on US stocks and ETFs for IBKR Lite clients. For international users, fees are exchange-dependent and typically less than 0.1% per trade, making it one of the most affordable choices for active, cost-conscious investors.

For example, trading on the London Stock Exchange may incur a commission of £6, while Indian users trading NYSE stocks enjoy competitive forex conversion rates and minimal transaction fees.

User Sentiment

User feedback often highlights the platform's comprehensive market access and cost savings. On review sites like Trustpilot, clients from India and Europe praise IBKR for enabling seamless entry into US stocks, citing low fees and broad asset choices as big differentiators.

However, reviews also note the steep learning curve for beginners. New clients often report feeling overwhelmed by the menu of options and powerful interfaces, but suggest the effort pays off over time for serious investors who want sophisticated tools and access.

9. Stash

9. Stash

Overview

Stash is designed as a micro-investing platform that also emphasizes financial education, making it a compelling option for individuals taking their first steps into investing. The app's user-friendly design lowers psychological and financial hurdles, allowing even those with limited capital or investing experience to participate.

For beginners who are hesitant to invest large sums, Stash stands out by enabling account setups with as little as $5. Its curated educational content sets it apart from pure brokerage alternatives like Robinhood, aiming to increase investor confidence through knowledge and habit-forming features.

Technical Requirements

Stash is built with a mobile-first approach. It offers seamless experiences on both iOS and Android devices, catering specifically to users who are most comfortable managing finances from their smartphones.

The setup process typically takes under 10 minutes. For example, a new user, Sarah in Ohio, signed up and began investing directly from her iPhone without needing any desktop access, reflecting how Stash is engineered for on-the-go investing.

Competitive Positioning

In the crowded micro-investing space, Stash separates itself by blending investment and saving features in one app. Unlike Acorns, which primarily focuses on rounding up purchases to invest spare change, Stash encourages users to set specific savings goals and organize recurring deposits based on their preferences.

Notably, Stash builds financial habits through tools like "Set Schedule," which automates both saving and investing activities—key for those who need help establishing consistency, as seen in behavioral finance research from Common Cents Lab at Duke University.

Getting Started

Launching your Stash journey is straightforward. After downloading the app, you'll create a profile, providing basic financial details to personalize your experience.

- Create your profile: Enter your name, income bracket, and a few risk tolerance questions.

- Set financial goals: Choose from predefined objectives—like saving for a home or retirement—or create custom targets. For example, Michael used Stash’s goal tracker to save for a $2,000 emergency fund within a year.

- Invest: Start building your portfolio with as little as $5 by purchasing fractional shares, making it accessible regardless of budget.

Key Features

| Feature | Description | Example |

|---|---|---|

| Fractional share investing | Buy portions of stocks or ETFs, not just whole units. | Invest $5 in Amazon, even if a full share costs $3,500. |

| Personalized investment plans | Portfolio recommendations based on your risk tolerance and goals. | Samantha received a diversified mix including S&P 500 and Clean Energy ETFs. |

| Automatic recurring investments | Set up scheduled deposits weekly or monthly for consistent growth. | Set $20 to auto-invest every Friday into a retirement fund. |

| Financial education content | Wide range of interactive lessons and articles inside the app. | Read “Investing 101” tutorials and quizzes covering terms like ETFs and dividends. |

Pros

- Excellent for absolute beginners entering the investment world

- Encourages savings and investment habits using real-world behavioral triggers

- Accessible entry point—start investing with as little as $5

Cons

- Requires a monthly subscription, unlike free trading apps such as Public or Webull

- Lacks advanced features for technical or active traders—no options trading or advanced charting tools

Pricing

Stash offers simple, transparent pricing. Its core subscription starts at $3 per month, which covers account maintenance, portfolio management, and unlimited trades.

Importantly, you won’t be charged trading commissions—a contrast to certain competitors that may charge on a per-transaction basis for micro-deposits. The $3/month Stash "Growth" tier unlocks retirement account options, while higher plans ($9/month) add benefits like custodial accounts for families.

User Sentiment

Stash enjoys positive reviews across the App Store and Google Play, particularly for its approachable user interface and the clarity of its educational modules. A 2023 App Store review highlighted how the app allowed a college student to build a $700 portfolio within a year, starting from small, regular deposits.

However, a subset of users expresses a desire for more complex investing features and lower subscription fees as their confidence and assets grow—preferences often voiced in community discussions on Reddit’s r/personalfinance.

10. Groww

10. Groww

Overview

Groww is a widely recognized investment platform that has made it easier for Indian residents to participate in the US stock market. This platform addresses the unique regulatory and currency constraints India-based investors face when seeking global diversification.

Many Indian retail investors, particularly those new to international markets, choose Groww because it simplifies compliance and currency conversion. For example, since its launch in 2017, the company has attracted over 20 million users by streamlining overseas investing processes and reducing barriers to entry.

Technical Requirements

Accessible through both Android and iOS apps, as well as a full-featured website, Groww is tailored to modern preferences. Setting up an account only requires standard Indian documentation—like PAN and Aadhaar cards—making onboarding quick and user-friendly.

A standout feature is the seamless INR-to-USD transaction capability, letting users convert and transfer funds directly through the app. This addresses a major pain point for Indian investors accustomed to complex banking protocols when investing abroad.

Competitive Positioning

Groww carves out a niche by catering exclusively to Indian residents looking to invest in US equities. Unlike global platforms such as Interactive Brokers or TD Ameritrade, Groww streamlines the process for Indian KYC norms and tax compliance, making cross-border trading far smoother for its core audience.

For example, Indian tech professionals wanting to buy shares of Apple or Tesla no longer have to navigate cumbersome international wire transfers—Groww lets them do so directly within minutes, benefiting from tailored compliance support.

Getting Started

On Groww, users can create an account by signing up with a valid Indian mobile number, submitting PAN and Aadhaar details, and verifying through simple KYC steps. The onboarding process is designed for efficiency, making it possible to start investing in US markets in as little as 24 hours.

- Sign up with Indian documentation (e.g., PAN, Aadhaar).

- Pass KYC verification via the app.

- Add funds by transferring INR—converted to USD in-app.

- Browse and invest in US-listed stocks like Amazon, Microsoft, and Alphabet.

Key Features

- Direct investment in globally renowned US stocks

- On-app INR-to-USD currency conversion for easy funding

- Transparent fee disclosures before every transaction

- Effortless onboarding tailored for Indian compliance needs

Pros

- Purpose-built for Indian residents seeking US stock access

- Reduces paperwork—no need to visit foreign banks or brokers

- Account set up and funding typically completed in under a day

Cons

- Exclusively for Indian residents—non-Indians can’t register

- Per-trade and conversion fees may be higher than those charged by US-based brokerages

Pricing

Groww does not charge for account opening or monthly maintenance. Instead, it applies clearly stated fees on each trade, particularly around currency conversion from INR to USD. For example, as of 2023, currency conversion fees could range from 0.5% to 1% per transfer, and US stock trades carry flat transaction charges.

This structure is straightforward, albeit somewhat higher than US-native platforms like Charles Schwab, which may offer zero-commission trades to Americans domestically.

User Sentiment

Feedback for Groww is strongly positive regarding ease of use and rapid onboarding. App ratings on Google Play and the App Store average above 4.4 stars, with users highlighting how they could invest in global brands like Netflix and Google within hours of signing up.

However, some experienced investors mention that the currency conversion and withdrawal fees are a drawback compared to maintaining a US brokerage account directly. The consensus suggests Groww excels for new and convenience-focused Indian investors seeking US market exposure.

Top 10 Best Groww Equity Funds to Invest in 2025

Choosing the Right App: Personalized Recommendations

Selecting the most suitable investment app depends on individual needs, trading experience, and regional access. Beginners often seek simplicity and educational resources, while experienced traders may prioritize advanced tools. Investors with a focus on global diversification or specific asset types, such as cryptocurrencies, need platforms that address these priorities.

For US Beginners

Robinhood and Stash are excellent entry points for individuals learning to invest. Robinhood’s commission-free trading and intuitive interface have attracted over 10 million users, making it a familiar first step. Its integrated educational snippets help users understand concepts like limit orders and ETFs as they trade.

Stash, on the other hand, offers fractional shares starting at just $5, coupled with automated guidance and personalized investment themes. This approach simplifies the investing experience, helping users build confidence while learning.

For Hands-On Traders

Those seeking robust charting or real-time data often gravitate to Webull and TD Ameritrade. Webull provides comprehensive technical indicators—over 50—including MACD, Bollinger Bands, and Fibonacci retracements, supporting informed decision-making for active traders.

TD Ameritrade’s thinkorswim platform offers paper trading and advanced backtesting capabilities. This allows users to refine strategies before risking real capital, exemplified by many day traders who test multiple strategies via its demo mode.

For Indian Residents

Accessing US markets from India introduces regulatory hurdles and currency conversions. Groww and Interactive Brokers streamline this process. Groww allows Indian investors to directly invest in US equities using its mobile app, supporting popular stocks such as Apple and Tesla with INR funding options.

Interactive Brokers stands out with fully compliant onboarding for Indian residents and competitive FX conversion rates, making cross-border investing smoother and more transparent.

If Research Is Key

Fidelity and Charles Schwab are industry leaders for investors who prioritize research. Fidelity’s robust stock screeners, daily market insights, and access to expert analyses empower users to make evidence-based decisions.

Charles Schwab supplements thorough research tools with curated educational articles, videos, and live webinars. Investors often cite Schwab’s quarterly outlooks as a valuable resource for navigating market volatility.

Looking for Automation or Crypto

Those interested in automated investing or crypto assets benefit from platforms like SoFi Invest. Its Automated Investing tool constructs diversified portfolios tailored to risk tolerance, while the same dashboard enables users to buy cryptocurrencies such as Bitcoin and Ethereum alongside traditional stocks.

This dual functionality appeals to investors who want exposure to both traditional and emerging asset classes without juggling multiple accounts.

Seeking Global Diversification

For international market access, Interactive Brokers is in a league of its own, providing investments across over 150 markets and supporting 24 base currencies. Institutional clients and globally-minded individuals can manage American, European, and Asian equities—all from one interface.

This capability is especially noteworthy: a US-based investor can purchase shares on the London Stock Exchange or diversify into Japanese ETFs, executing trades in local currencies for cost-effective diversification.

Frequently Asked Questions About US Stock Market Apps

1. Can I use US stock market apps if I live outside the United States?

Investors living outside of the US are often interested in accessing American stock markets to diversify portfolios and access global leaders. Not every stock trading app allows international participation, but several prominent names do.

Platforms like Interactive Brokers serve clients in over 200 countries, making US equities accessible globally. In India, Groww enables local investors to buy US stocks with INR deposits. When choosing an app, it's crucial to review fund transfer policies and ensure all regulatory requirements are met.

2. What documents do I need to open an account with these apps?

Account verification is an important compliance step for all investors. US stock market apps typically request basic identification and address proof, regardless of your country of residence.

For example, platforms such as TD Ameritrade and eToro require a government-issued ID (like a passport), recent utility bills, or bank statements for address confirmation. Investors outside the US may also need to provide additional tax identification documents, such as an ITIN for non-residents.

3. Are there tax implications when investing in US stocks from India?

Taxation is an essential aspect of international investing. Indian residents investing in US equities must declare any income, including dividends and capital gains, according to India's Income Tax laws.

For example, US-sourced dividends for Indian investors attract a 25% withholding tax as per the India-US double taxation avoidance agreement. Capital gains above Rs 2.5 lakh are also taxable in India. Seeking guidance from a cross-border tax advisor is recommended for accurate reporting.

4. How do I transfer money from my country to fund a US investing app?

Funding accounts with apps designed for international users is increasingly straightforward, thanks to localized currency options. Some Indian-friendly platforms, such as Groww and Interactive Brokers, let investors fund their accounts in Indian Rupees (INR).

Once deposited, these platforms convert the currency into US Dollars internally, eliminating the need for separate forex transactions. For instance, Interactive Brokers offers competitive currency conversion rates for global investors.

5. Can beginners practice before investing real money?

New investors often want to test strategies without risking capital. Many leading apps provide demo or paper trading accounts as a solution.

Webull offers a robust paper trading feature with real-time data, while TD Ameritrade’s paperMoney® simulator allows users to virtually trade US stocks and options. These tools let beginners simulate live market conditions and build confidence before deploying real funds.